- Bills Vs Invoices

- Difference between Billing and Invoicing

- Bill Generator Software

- Invoice Generator Software

- Few more invoicing and accounting features in TallyPrime

Bills Vs Invoices

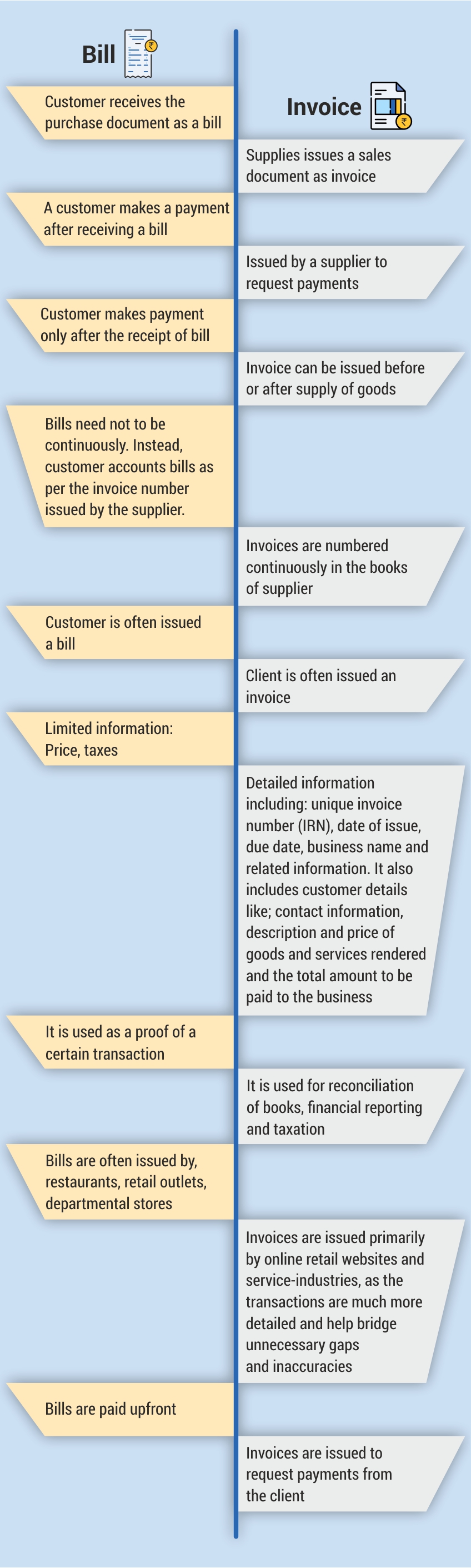

Bills or invoices are often used interchangeably in the business sector. While both of them are more or less on similar lines, there are some key characteristics that differentiate one from the other. Let’s take a look at each of these in detail!

Bills – Definition

A bill is nothing, but the money owed by a customer to a business for a purchase transaction. It could be both physical or digital in nature, depending on the requirement. Some of the key characteristics of a bill are:

- It is issued to the customer before the payment

- It records the transaction between both the parties for the product/services rendered

- When a bill is issued by a party, it must be paid by the customer.

Invoice – Definition

Invoice is a detailed document of a particular goods/service transaction. It is issued to a client by a supplier, detailing the respective transaction along with the details of money that is owed for the said work. Some of the key characteristics of an invoice are:

- It is issued requesting payment before a particular deadline

- It is a business transaction requiring payments from a client for services rendered

- It serves as a record for businesses to track their payments

What are the differences between billing and invoicing?

Create/issue bills in TallyPrime: Bill generator software

Every business involves the sales of goods or services. The sales transactions in your business may be simple cash sales or even sales on credit. For each sales transaction, you will need to keep a record of the items that you sold, the payment that you received, goods returned, and so on. The bill also serves as proof of the purchase made by the buyer. Using TallyPrime, you can do all of these and more. Moreover, you can view reports any time you need to understand the sales performance of your business. Generally, a bill of sale includes the following information:

- Date of purchase

- Name and address of the seller and of buyer

- Amount paid for the transfer of ownership

- Description of the assets/products being transferred

- Guarantee that the item is free from all claims and offsets

- Representations or warranties

- Signatures of the seller, of the buyer, and of a notary public

Every business is different and so is their process. TallyPrime’s billing and invoicing capability allow you to customise your purchase and sales management based on your business needs. You can also choose a suitable invoice/billing format according to the products/services your business deals with for a faster generation.

Read more on: What is the Bill of Sale? Format and examples

Create/issue invoices in TallyPrime: Invoice generator software

Since invoices are much more detailed and also help in managing inventory levels, updated charts of accounts, and taxation, it is imperative that your business management software gives you all the necessary information, automatically.

Optimised invoice components, host of configurations, multiple billing modes, and so on.. makes TallyPrime mold itself to your business. With e-invoicing being introduced by the government, which mandates businesses to authenticate all B2B invoices with IRN and QR code generated by the invoice registration portal (IRP), the invoicing generation process has become all the more crucial.

To support the new norm of invoicing, TallyPrime, the all-new powerful business management software is enhanced with an e-invoice solution that will help you generate e-invoices instantly in the flow of recording the transaction. Read ‘Generate e-invoices instantly in TallyPrime’ to know more about how to generate e-invoices.

Watch: How to Generate E-invoices Instantly in TallyPrime

Read more on TallyPrime’s invoicing capabilities

Few more invoicing and accounting features in TallyPrime

- Your bills receivables and payables are managed automatically while you save your invoice

- You can pre-set the details such as duty ledgers, additional ledgers, etc. to reduce the repetitive data entry in the invoice

- You can easily record post-dated transactions supported with a post-dated register

- You receive support for promotional transactions such as free schemes, samples through different actual and billed quantities, and zero-valued transactions.

Know more about Billing Software & its Benefits

While the government has offered free billing software for MSMEs, with TallyPrime’s pre-built capabilities not only do you get a whole lot of experience to record, evaluate, validate and print invoices, but also explore much more various crucial features for better business management. Give us a free trial today and stay on top of your business.

Know more on billing & invoicing:

Credit Terms, Credit Sales, Credit Memo, What is Cash Discount?, Bill of Sale & Purchase Bill, Tips for Choosing the Best Billing and Invoice Software, What are the Different Types of Invoices for Small Business?

E-Invoicing

e-invoicing Software, What is e-Invoice, Generate e-Invoice Instantly in TallyPrime, How to Generate e-Invoice in GST, How does e-Invoice System Work, Billing Software, Business Impact of e-Invoice, How to Generate Bulk e-Invoice in TallyPrime, Tally’s Approach & Recommendation for e-Invoice