With the e-invoice concept being introduced for notified businesses, how does the e-invoice system work is the common question that most businesses have? In this blog, let's look at how e-invoice is operates.

In simple words, e-invoicing is a system through which business-to-business (B2B) transactions are authenticated electronically by the IRP portal for further use on the common GSTN portal.

In the e-invoice system, the moment you create an invoice for your customer, it should be uploaded to IRP (Invoice Registration Portal) where the validation will be done, and a unique number called IRN (Invoice Reference Number) along with the QR code will be issued.

| Best e-Invoicing Software Solution for Businesses in India | Generate e-Invoice Instantly in TallyPrime |

An invoice remains valid only if it has IRN and QR code that is authenticated by the IRP (Invoice Registration Portal). Here, IRP is a designated portal designed to accept, validate and authenticate the invoice. Know more on IRN, Format and ways to generate it.

In contrast to the current system of GST which requires only the details of invoice to be uploaded periodically in GSTR-1, the e-invoice system requires you to upload and get the invoice authenticated by the IRP system. Without further ado, let’s understand how e-invoice system works?

How does e-invoice system work?

For us to understand the workflow of the e-invoice system, it is important to know the participants of the system. The key participants of e-invoice system are represented in the below diagram along with their interactions.

As depicted in the above diagram, the workflow of the e-invoice system can be categorized into 2 parts. First is the interaction between the business (supplier in case of invoice) and the Invoice Registration Portal (IRP). The second part is the interaction between the IRP and the GST/E-Way Bill Systems and the Buyer. Let’s now understand the e-invoice system in detail.

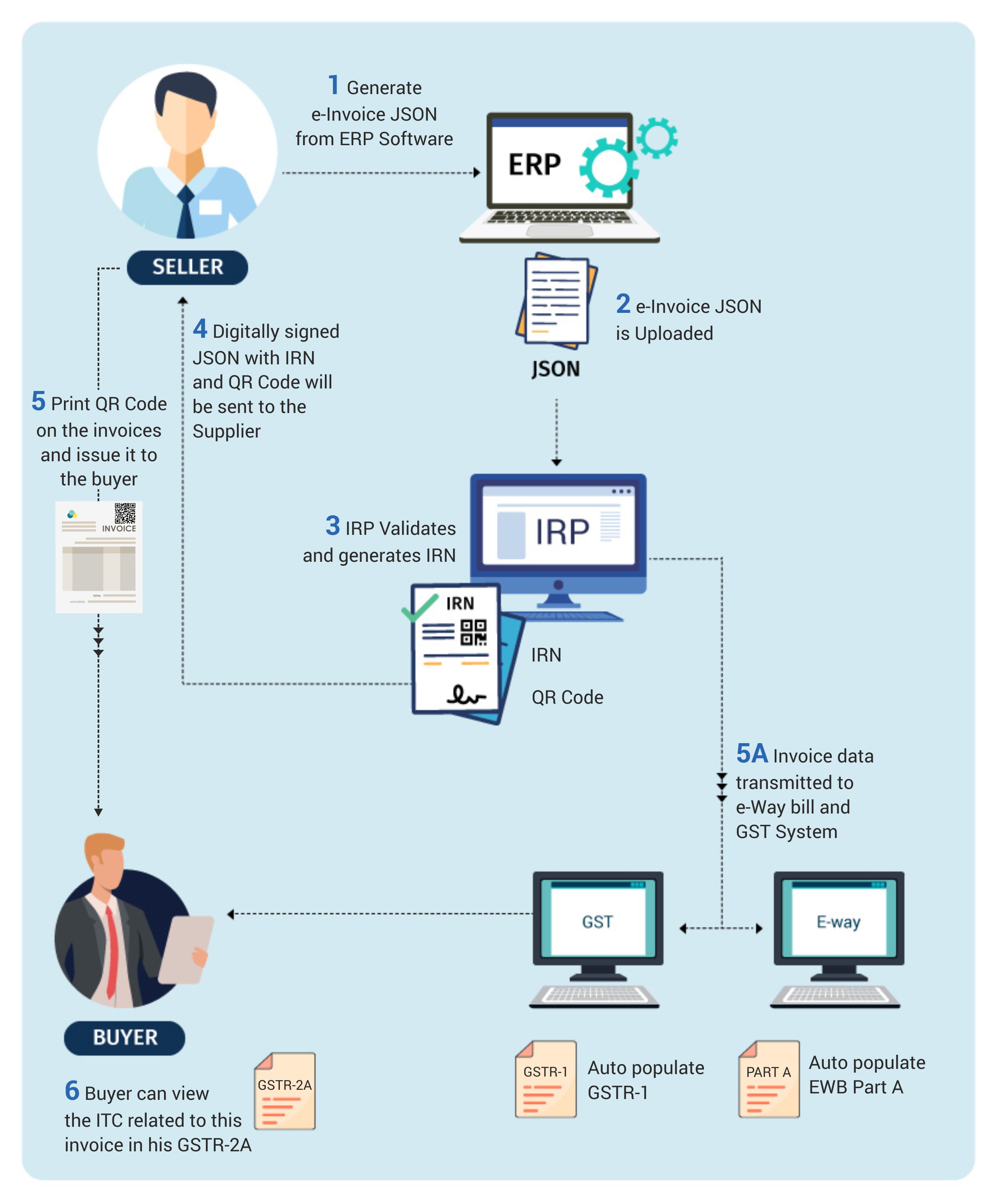

The above illustrative diagram of e-invoice system is explained below

The above illustrative diagram of e-invoice system is explained below

- The supplier generates the invoice JSON in the prescribed format. It can be either the ERP software generates the e-invoice JSON or you can use the offline utility tool do it.

- The JSON is uploaded to IRP (Invoice Register Portal) by the supplier. If the ERP software is integrated with IRP via GSP, the upload of the JSON file will be automated, meaning system sends the required details directly to the IRP portal.

- IRP validates the JSON generated by the ERP Software

- On successful validation, IRN is generated. Also, the invoice is digitally signed and a QR code is added by IRP

- The digitally signed e-invoice JSON along with QR code will be sent to the supplier who in turn will print these details on the invoice. In the case of an integrated environment of ERP and IRP via GSP, the software will automatically fetch and print such details.

- The signed e-invoice data along with IRN (same JSON data returned by the IRP to the seller) will be sent to E-Way Bill System and to the GST System

- Using the JSON data received from IRP, the e-invoice system will auto-populate the Part-A of e-way. If the complete details of e-way bill (Part -A and Part-B) are available with the seller at the time of generation of e-invoice, the e-way bill will be generated automatically, and e-invoice data will also capture the e-way bill number

- Similarly, GST system will auto-populate the details in GSTR-1 and GSTR-2A

- Buyer will get real-time visibility in GSTR-2A for confirming the ITC of the invoice uploaded by the supplier

With e-invoices already implemented for notified businesses, it is a necessity for the business to have an accounting or ERP software which will help you seamlessly generate e-invoice without impacting the way you use to operate your business. While the current applicability of the e-invoice is for the businesses with turnover exceeding 10 crores from 1st October,2022, the long-term vision of the council is to implement the new e-invoicing system for all taxpayers irrespective of the turnover threshold. In the recent update, from 1st August 2023, e-Invoicing will be essential for all the registered persons whose aggregate turnover (based on PAN) in any prior fiscal year from 2017-18 onwards exceeds 5 crores.

Video on e-invoicing in TallyPrime

Watch video on e-invoicing in TallyPrime

Frequent Ask Questions

-

How does GST e-invoicing work?

e-invoicing is a system through which B2B transactions can be authenticated electronically via the IRP portal for further use on the common GSTN portal. -

What happens if an e-invoice is not generated within 3 days?

As per directions by GST Authority, a time limit of 30 days for reporting of invoices from date of invoice is imposed on e-invoice portals, and is applicable for taxpayers with AATO greater than or equal to 100 crores from 1st November 2023

Know more about e-invoices in GST