- Definition of Credit Terms

- Types of Credit Terms

- Factors Influencing Credit Terms

- Tips to Manage Credit Terms

Definition of Credit Terms

Credit terms are the payment terms mentioned on the invoice at the time of buying goods. It is an agreement between the buyer and seller about the timings and payment to be made for the goods bought on credit. It is also known as payment terms

Types of Credit Terms

- Cash on Delivery (CoD): Here the payment is due at the same time as a product or service is delivered. This also known as ‘Payable on Receipt’

- Payment in Advance: Seller demands the buyer to pay the consideration, either partial or full before the delivery of goods.

- Pre-paid: This is exactly opposite of cash on delivery(COD). Here, the buyer is required to pay the full consideration for the seller before the delivery of goods.

- Stage Payment: Payment of agreed amount upon completion of decided milestone.

- Bill of Exchange: Arrangement to pay at a later date, usually with bank support.

- N/10, N/15, etc: This is applicable in case of credit sales and it notifies the maximum credit period allowed for payment. Here, N/10 denotes the net credit period of 10 days.

- 2/10, n/30: The credit term of [ 2/10, n/30] means that you will get a discount of 2% if you clear your account within 10 days with a maximum credit period of 30 days.

- 2/10,n/30 E.O.M: Here E.O.M stands for ‘End of Month. This credit term of [ 2/10,n/30 O.M ] implies that you will get a discount of 2% if you pay your account within the first 10 days of next month with a maximum credit period of 30 days.

- 2/10 R.O.M: Here R.O.M stands for Receipt of goods dating method. A credit term of [ 2/10 O.M] means that you will get a discount of 2% if you make the payment within the first 10 days after the goods are received.

Read What is Cash Discount? Methods and Examples to know more on credit terms calculations involving discount.

How much Credit to be Extended?

If you are finding it difficult to decide as how much of credit you can extend to your customer then this decision of yours has to be based on how much risk you are willing to take or get exposed to in the event of default in payment from the borrower. We call this as Credit exposure in business language.

For example, if you have sold 4 lakhs on credit, your credit exposure in the event of default will be Rs. 4 lakhs.

Here is why a formal credit policy will help your business. Your credit policy will define the credit limits you are willing to give your customers, i.e. the maximum amount of credit you can give to your customers.

Your policy should also need to outline the maximum credit period you want to give to your customers and the process your business will follow to approve credit terms, exceptions and the process for handling violations.

Factors Influencing Credit Terms

- Time Factor

Here, the customer is allowed a time benefit and the seller expects the bill to be settled before the due date. Typically, the time limits are set before the transaction is made.

- Credibility Factor

The credit you lend to your customer depends upon the creditworthiness of your customer. This could be based on the volume of transactions, the capacity of repayment, historical performance, etc.

- Interest rate Factor

Depending on the amount and credit period, sellers do charge interest, either for the entire credit period or only for an overdue period.

Tips to Manage Credit Terms

Credit terms adopted by the businesses differ from each other and the credit you would lend to a customer could be totally different for another customer. There is no right or wrong about the type of credit terms applied by you. It’s all about what works better for your business, you and your customer.

Irrespective of the type of credit terms you choose, here are a few tips which will help you to be on top of credit sales.

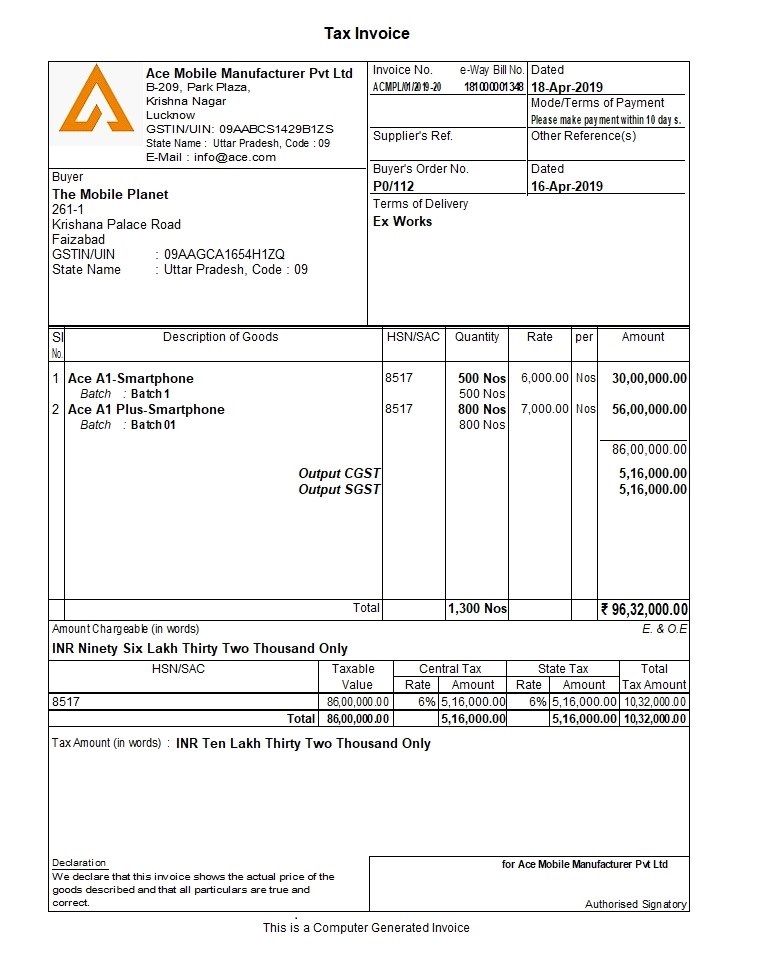

- Mention the Credit terms on the Invoice: It’s a good practice to mention the credit terms or terms of payment on the invoice to track the due date and also to notify the buyer about the same.

- Find and Set the Credit Period for each customer: It’s recommended to identify the credit period for each customer based on the factors like products, volume, frequency etc. and set it as default credit period in your accounting software.

- Credit Limit: Based on the creditworthiness and credibility of the customer, defining maximum credit limit which you can lend to a customer will help in avoiding the situation of overselling to the customer beyond the defined limit. This will be helpful especially when there are different people responsible for managing sales and accounts receivables.

- Overdue Notification: if your credit policies disallow new sales to customer’s having overdue bills, having an internal alert system to notify the overdue bills during invoicing will help the business.

Find out How TallyPrime will help you in defining and managing credit terms?

Read more on Billing and Invoicing: