- What is SGST?

- What determines whether CGST, SGST or IGST is applicable for a supply

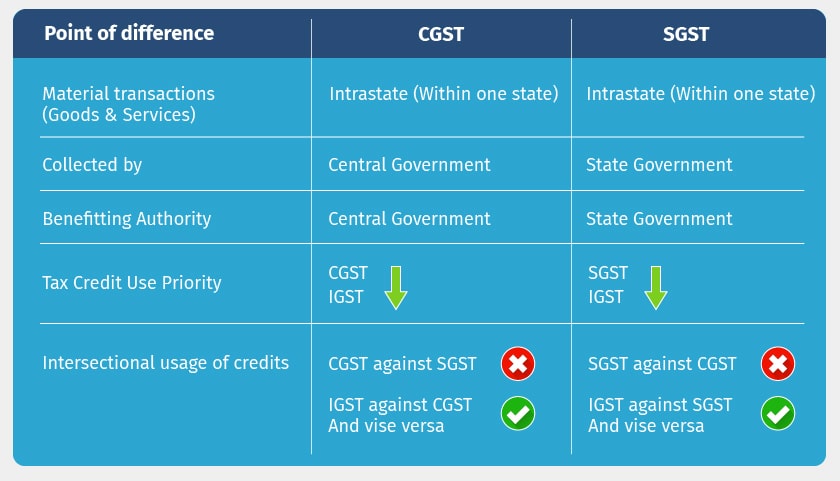

- Difference between CGST and SGST

- Case study to understand CGST, SGST and IGST

SGST, which stands for State Goods and Services Tax, is one of the tax components of GST in India. SGST Act expands to State Goods and Services Tax. It is one of the three categories under Goods and Service Tax (CGST, IGST, and SGST) with a concept of one tax, one nation. SGST falls under the State Goods and Services Tax Act 2017.

SGST Act 2017: Key highlights

The Act, an integral component of India's Goods and Services Tax (GST) system, was implemented to streamline indirect taxation. The State GST Act 2017 empowers all states to levy and collect tax on the intra-state supply of goods and services. SGST works hand-in-hand with Central GST so that governments at both the state and the center receive a fixed share of the revenue from local transactions.

The SGST Act 2017 outlines comprehensive procedures for:

- SGST registration

- Return filing

- Tax payment

- Refund claims

- Assessments, audits, and appeals.

The Act defines methods to ensure tax administration consistency across all states. It also facilitates state-level implementation, integrating the framework with the GST Network for compliance.

The primary objectives of the SGST Act include -

- Simplifying the tax structure

- Reducing the build-up effect of taxes

- Creating an integrated national market

- Ensuring the ease of doing business through a transparent and digital tax system.

What is SGST?

SGST is one of the tax components of GST in India. SGST Act expands to State Goods and Service Tax.

It is one of the three categories under Goods and Service Tax (CGST, IGST and SGST) with a concept of one tax one nation. SGST falls under State Goods and Service Tax Act 2017.

A simple understanding could be that, when SGST is being introduced, the present state taxes of State Sales Tax, VAT, Luxury Tax, Entertainment tax (unless it is levied by the local bodies), Taxes on lottery, betting and gambling, Entry tax not in lieu of Octroi, State Cesses and Surcharges in so far as they relate to supply of goods and services etc. are subsumed into one tax in GST called State GST.

All the tax proceeds collected under the head SGST is for State Government.

What determines whether CGST, SGST or IGST is applicable for a supply

To identify whether Central Goods & Services Tax (CGST), State Goods & Services Tax (SGST) or Integrated Goods & Services Tax (IGST) will be applicable in a taxable transaction, one needs to first know if the transaction is an Intra State or an Inter-State supply.

- Intra-State supply of goods or services is when the location of the supplier and the place of supply i.e., location of the buyer are in the same state. In a transaction involving supply within the state, a seller has to collect both CGST and SGST from the buyer. The Central GST gets deposited with Central Government and State GST gets deposited with State Government.

- Inter-State supply of goods or services is when the location of the supplier and the place of supply are in different states. Also, in cases of export or import of goods or services or when the supply of goods or services is made to or by a SEZ unit, the transaction is assumed to be Inter-State. In an transaction involving supply between two states or outside the state, a seller has to collect IGST from the buyer.

Difference between CGST, SGST and IGST

Case study to understand CGST, SGST and IGST

A trader in Indore is selling a Printer worth Rs. 10,000 to a trader in Bhopal. The CGST for this transaction will be 14% whereas the SGST will be 14%. The trader will have to charge Rs. 1,400 as CGST and Rs. 1400 as SGST from the trader in Bhopal and the respective amounts will be deposited in the Central and State Government accounts.

Now, the trader from Bhopal (in the given example) is supplying this printer to his shop in Bengaluru. As this is an inter-state trade, the Bhopal shop keeper will charge IGST of 28% i.e. Rs. 2800 on the basic value of the product (Rs. 10,000) from his Bengaluru shop and deposit the IGST amount into the government account.

Applicability of SGST

SGST applies when goods or services are sold within the same state or the buyer and the seller are registered in the same state. In such transactions, both SGST and CGST bearing equal rates are levied simultaneously. It is usually a 50-50 split of the total GST rate. For example, a Bangalore-based furniture shop sells a table to a customer in the same city. Since this is an intra–state transaction, SGST and CGST both apply. Similarly, when a mobile phone retailer in Ahmedabad sells a phone to a buyer in Surat, it is an intra-state transaction as both are in Gujarat. In this case, too, SGST and CGST both apply.

Tax calculation with SGST – Step-by-step process

Suppose a clothing store in Mumbai sells shirts worth ₹10,000 to a customer in the same city. The applicable GST rate is 18%.

GST Breakdown:

Total GST = 18%, where SGST = 9%, and CGST = 9%

Tax Calculation

|

Particulars |

Amount (₹) |

|

Product Value |

10,000 |

|

CGST @ 9% |

900 |

|

SGST @ 9% |

900 |

|

Total Invoice value |

11,800 |

In this scenario, the seller will collect ₹11,800 from the customer and deposit:

- ₹900 as SGST to the Maharashtra Government

- ₹900 as CGST to the Central Government

How SGST impact businesses?

State GST, levied by the state government on goods and services sold within the state, is an essential component of the dual GST framework. It has a significant influence on the commercial taxation of businesses. Compliance with SGST is mandatory for businesses in all states. Hence, business owners and their finance teams need to be updated about the different state laws, procedures, and impacts.

Key compliance requirements

- GST registration is mandatory for all businesses, especially if their turnover exceeds the prescribed threshold.

- Monthly, quarterly, and annual filing of SGST returns is mandatory, based on specified categories.

- Businesses have to maintain accurate invoices, proper books of accounts, and digital records.

- Businesses have to reconcile their input tax credit claims with the supplier’s filings. This is crucial to avoid discrepancies, demanding a strong internal compliance system.

Penalties for non-compliance

Non-compliance with SGST rules can lead to the following -

- Substantial penalties - A 10% penalty on the tax amount due (minimum ₹10,000) for genuine errors, and 100% of the tax evasion.

- Interest on delayed payments - Parties that are repeat defaulters can get their GST registration suspended or cancelled.

Other than this, legal prosecution and loss of business reputation are also possibilities.

Steps for filing SGST returns

Registered persons within a state are required to file SGST returns, as it is a crucial part of GST compliance. It involves accurate reporting of intra-state transactions and recording proper credit flow within the GST framework.

Process overview

- Registration: The first step is to register your business as per GST requirements. Every registered business is required to have a valid GSTIN.

- Invoicing maintenance: The next step is maintaining invoices regularly. Businesses need to collect and organize all sales and purchase invoices for the relevant period.

- Use portal: For SGST return filing, you need to log in to the GST Portal. Visit www.gst.gov.in, and use your valid credentials while logging in.

- Proper selection: While filing the return, first select the appropriate return form (e.g., GSTR-1, GSTR-3B) based on your filing frequency and business type.

- Recordkeeping: Enter every transaction detail and reconcile data with your books and supplier records.

- Review and submit: Verify the return summary before submitting. This helps avoid errors.

- Pay liabilities: Pay the outstanding SGST liability through the GST portal. You will have to use the payment options that are available.

- Download acknowledgement: File the return using a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC). Once completed, download the acknowledgment for records.

Documents required

The supporting documents required for the process have been listed below:

- Your GSTIN

- Sales and purchase invoices for the period that you are filing the return

- Debit and credit notes (if applicable)

- Bank statements for reconciliation

- Details of outward and inward supplies

- Input tax credit (ITC) records

- Previous return filings for reference (if any)

Recent amendments and updates

Here’s a brief about some of the recent changes to the SGST Act.

Changes to the SGST Act

Introduction of Section 74A - Section 74A has been inserted into the SGST Act, effective from November 1, 2024. The section offers a unified framework for determining tax not paid, short paid, or erroneously refunded, irrespective of whether the case involves fraud.

Changes to input service distributor (ISD) provisions - The Finance Act, 2024, made notable amendments to the provisions related to ISDs. Section 12 has been replaced to detail the manner of credit distribution by ISDs, including requirements for registration and the distribution method of central and integrated taxes. These changes are effective from October 1, 2024

Penalty for non-registration of machines - 122A is a new Section that has been introduced. A penalty of ₹1 lakh per machine will be levied on manufacturers who fail to register certain machines under a special procedure. This penalty is in addition to any other penalties under the Act and is effective from August 6, 2024.

Important deadlines

- Starting November 1, 2024, GSTR-7 filing must be on or before the 10th day of the month succeeding the calendar month.

- Starting October 8, 2024, businesses can apply for rectification of an order online within 6 months.

- Effective November 1, 2024, for nil total CGST deduction at source in a month, there is no late fee for delayed filing of GSTR-7.

FAQs

What is the full form of SGST?

The full form of SGST is State Goods and Services Tax. The state government levies the tax on supplies within the state and is an essential part of the dual GST system in the country.

How does SGST differ from CGST and IGST?

SGST is collected by the state government and is applicable only for intra-state transactions. CGST is collected by the central government and applies to the same transaction. IGST or Integrated GST is charged on inter-state transactions. It is collected by the central government and is later distributed to the relevant states.

Who is liable to pay SGST?

The liability to pay SGST lies on any registered person involved in supplying goods or services within a state. The person is also liable to pay CGST. In certain cases, registered persons include businesses, professionals, and even government bodies.

What are the key provisions of the SGST Act 2017?

The key provisions of the Act include -

- Taxable persons & events

- Registration requirements

- Tax rates and exemptions

- Input tax credit mechanisms

- Filing procedures and compliance norms

- Audit, assessment, penalties, and appeals process

Can SGST be claimed as input tax credit?

Surely. SGST that is paid on business-related purchases can be claimed as Input Tax Credit (ITC). ITC can be used to offset SGST and IGST but not GST liabilities.

What happens if SGST is not paid on time?

In case SGST is not paid or paid after the deadline, businesses can incur monetary penalties, interest on the outstanding amount, and the possibility of legal action against the business.

Know Other Types of GST

CGST, IGST, UTGST, Difference between CGST, SGST & IGST

GST

GST Software, GST Calculator, GST on Freight, GST on Ecommerce, GST Impact on TCS, GST Impact on TDS, GST Exempted Goods & Services, Reverse Charge Mechanism in GST, GST Declaration

GST Rates & Charges

GST Rates, GST Rate Finder, GST Rate on Labour Charges, HSN Codes, SAC Codes, GST State Codes

GST Returns

GST Returns, Types of GST Returns, New GST Returns & Forms, Sahaj GST Returns, Sugam GST Returns, GSTR 1, GSTR 2, GSTR 3B, GSTR 4, GSTR 5, GSTR 5A, GSTR 6, GSTR 7, GSTR 8, GSTR 9, GSTR 10, GSTR 11