Effortless GST Calculation at your Fingertips

INV-2024-##

Taxable Value:

₹ 0

IGST:

₹ 0

CGST:

₹ 0

SGST:

₹ 0

Your gross price will be

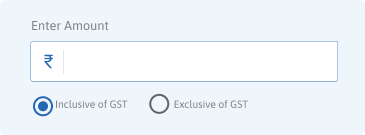

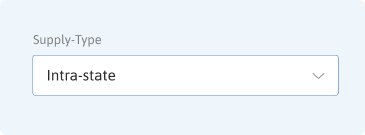

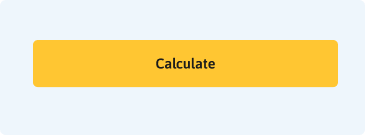

Calculating GST is a breeze with our user-friendly GST calculator. Just follow these simple steps:

Enter the price of the goods or services in the amount field and choose whether it's "Inclusive" or "Exclusive" of GST.

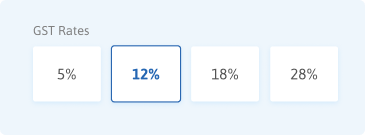

Choose the applicable GST slab based on your service provided.

Select the appropriate "Supply type" for your transaction.

Hit the "Calculate" button to instantly get your GST calculation.

GST consists of five distinct slabs: 0%, 5%, 12%, 18%, and 28%. Here's a concise summary

Levied by the central government on intrastate transactions, CGST applies to the supply of goods and services within state boundaries.

Similar to CGST but imposed by state governments on intrastate transactions. Revenue from SGST is collected by the respective states.

Applicable to transactions within union territories, UTGST is collected by the respective union territory governments, functioning similarly to SGST.

Levied on interstate transactions, IGST is collected by the central government and distributed to the states, ensuring seamless tax credit flow and preventing double taxation.

| Item | Qty. | Price |

|---|---|---|

Total Price ₹80,000

GST

CGST 2.5% ₹2,000

SGST 2.5% ₹2,000

Your gross price will be ₹84,000

A manufacturer produces electronic components (18% tax rate applicable) worth ₹2,000 and sends them to a logistics company for distribution. The logistics company adds ₹500 to the existing value for handling and distribution. Then, it is sold to a retailer who adds a marketing expense of ₹400.

Here's how the value of the goods and tax on it changes, and the final effect on the price under GST:

| Particulars | Cost | Tax @18% | Tax Liability to be deposited to the Government | Invoice Total |

|---|---|---|---|---|

| Manufacturer | ₹2,000 | ₹360 | ₹360 | ₹2,360 |

| Logistics company adds ₹500 for distribution | ₹2,500 | ₹450 | ₹90 | ₹2,950 |

| Marketing expense of ₹400 added by the retailer | ₹2,900 | ₹522 | ₹72 | ₹3,422 |

| Total | ₹2,900 | ₹1,332 | ₹522 | ₹3,422 |

This example illustrates how GST is calculated at each step of the supply chain and how the tax liability is adjusted using input tax credit, ensuring transparency and fairness in the tax system.

| Features | Free Online GST Calculator | TallyPrime for GST |

|---|---|---|

| Ease of Use |

|

|

| GST Compliance |

|

|

| Invoice Generation |

|

|

| Return Filing Assistance |

|

|

| Tax Tracking |

|

|

| Reporting and Analytics |

|

|

| Integration with Business Systems |

|

|

| Cost |

|

|

Automate your business processes with streamlined GST-Compliant accounting using TallyPrime. Accelerate payment processing, enhance cash flow, and optimize financial operations.

Inclusive of GST represents the total value of a product or service, including the Goods and Services Tax (GST). In this scenario, the tax amount is already incorporated into the original price, and it is not charged separately from the customer.

Exclusive of GST refers to the value of a product or service without the GST included. To determine this amount, the GST amount is subtracted from the product’s GST inclusive value. This allows for a clear understanding of the base price of the product before the tax is applied.

Using GST-compliant software like TallyPrime ensures accurate calculations, seamless compliance, and streamlined business operations.

GST Amount = (Value of supply x GST%)/100

Price to be charged = Value of supply + GST Amount

GST Amount = Value of supply – [Value of supply x {100/(100+GST%)}]