What is GSTR-1?

Form GSTR-1 is a return statement in which a regular dealer needs to capture all the outward supplies made during the month or a quarter. In simple words, GSTR-1 is a return in which details of sales and other outward supplies needs to be captured.

While GSTR-3B is a monthly self-assessed return, you need to file GSTR-1 with outward supplies details that substantiate the liability declared in GSTR-3B.

Understanding the GSTR-1 form

GSTR-1 form is a statement in which a regular dealer needs to capture all the outward supplies made during the month. Broadly, the GSTR 1 format requires - all the outward supplies made to registered businesses (B2B) to be captured at the invoice level, and supplies made to unregistered businesses or end consumers to be captured at a rate-wise level. However, in certain exceptional scenarios, even B2C transactions are required to be captured at the invoice level.

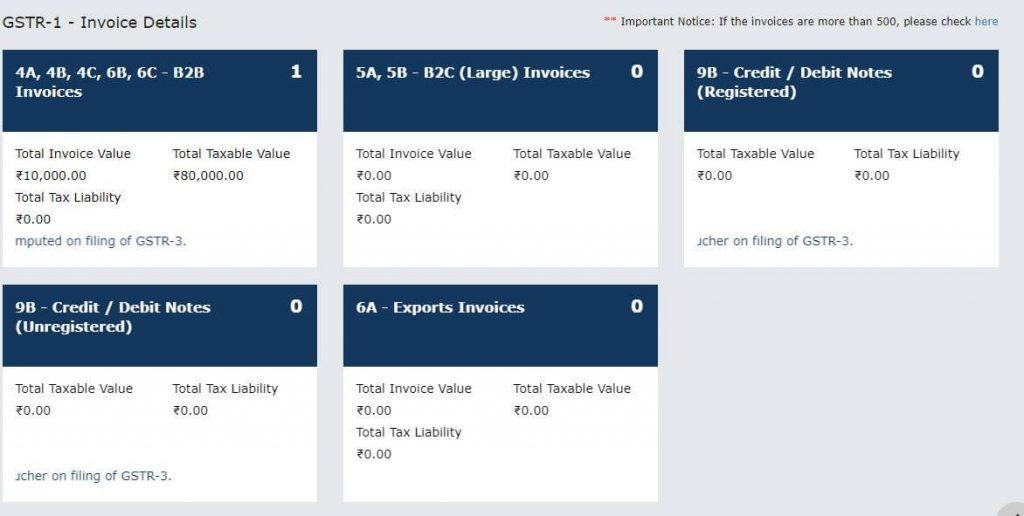

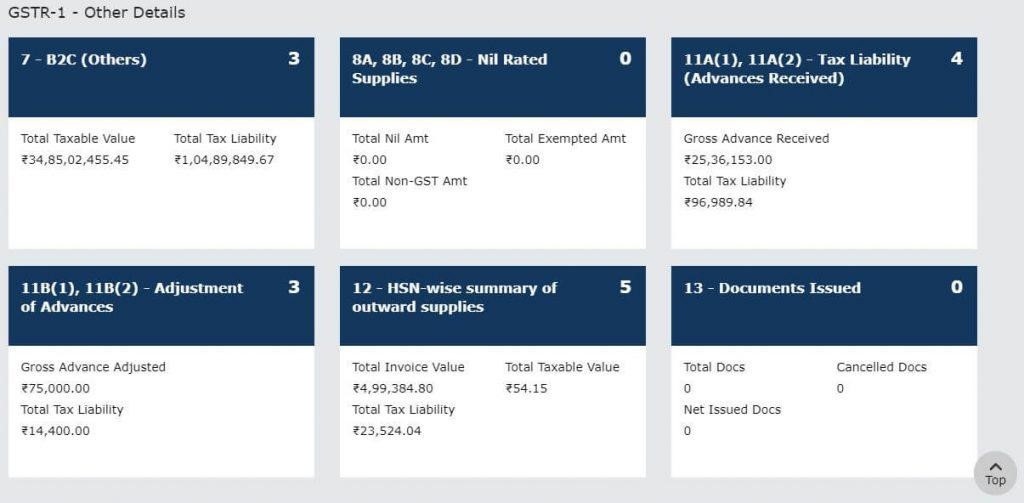

Form GSTR-1 contains 13 tables in which the outward supply details need to be captured. Based on the nature of business and the nature of supplies affected during the month, only the relevant tables are applicable, not all. The GSTR-1 format in the GST portal is as follows:

Components of the form

Registered taxpayers use the GSTR-1 form to submit outward supplies of goods and services under the GST regime. The following is a comprehensive outline of its main elements:

- Basic details - GSTIN, legal name, trade name (if any), and tax period (month and year).

- B2B invoices -Invoice-wise details of supplies to registered persons (inter-state and intra-state).

- B2C (Large) - Inter-state supplies to unregistered individuals where invoice value > ₹2.5 lakh; invoice-level reporting is mandatory.

- B2C (Others) - Consolidated information of supplies to unregistered individuals less than ₹2.5 lakh.

- Credit/Debit notes- Information on credit/debit notes issued against B2B and B2C invoices.

- Exports- Zero-rated supply information (with or without IGST); includes shipping bill information.

- Reverse charge- Information on supplies subject to reverse charge to unregistered individuals.

- Nil/exempt/non-GST supplies- Consolidated information for nil-rated, exempt, and non-GST outward supplies.

- Amendments -Revisions in details provided in previous tax periods.

- HSN-wise summary - Goods/services supplied by HSN code, quantity, and tax value.

- Documents issued- Information about invoices, amended invoices, debit/credit notes, vouchers, delivery challans, etc.

Key details required for filing

All registered taxpayers under GST (excluding composition scheme dealers, input service distributors, and others) must file GSTR-1.

- Filing period: Monthly (if turnover > ₹5 crore) or Quarterly under the QRMP scheme (if turnover ≤ ₹5 crore).

- Due date: 11th of the next month for monthly filers; 13th of the following month for QRMP scheme filers.

- Mode of filing: Online on the GST portal or through GST software/API integration.

- Late filing penalty: ₹50 per day (₹25 CGST + ₹25 SGST) and ₹20 per day (nil return).

GSTR-1 is compulsory even if there is no outward supply (i.e., NIL return has to be filed). The filed GSTR-1 cannot be amended. Corrections should be done using the amendment section in the next period's return.

GSTR-1 due date

The due dates for GSTR-1 are based on the turnover. Basis the business turnover, GSTR-1 returns needs to be filed either on the monthly or quarterly basis.

Businesses with turnover of up to INR 1.5 crore will be allowed to file quarterly returns, other businesses with a turnover of above INR 1.5 crore must file monthly returns.

Here are the due dates to file GSTR-1

|

GSTR-1 Due Date |

|

|

GSTR-1 return filing frequency |

Due date |

|

Monthly GSTR-1 |

11th of Subsequent month |

|

Quarterly GSTR-1 |

Last of the date of the month following the end of the quarter |

GSTR-1 Form and Format

The filing format consists of multiple tables that require separate sets of information. Let us explore the tables briefly:

- Tables 1 and 2 - These are auto-filled with the registered person's GSTIN and legal/trade name. These fields identify the taxpayer and are directly fetched from the GST portal.

- Table 3 - It records the taxpayer's total turnover in the last financial year. This is a one-time requirement that can be updated if necessary. It determines filing eligibility and thresholds for quarterly or monthly returns.

- Table 4 - It is used to report all outward B2B (Business-to-Business) supplies. These are taxable outward supplies to registered persons, including the usual taxable supplies, reverse charge mechanism supplies, and e-commerce operator supplies. An invoice-wise break-up is necessary here.

- Table 5 - It consists of B2C interstate outward supplies wherein the invoice value exceeds ₹2.5 lakhs. These are high-value transactions to unregistered recipients in another state and are subject to invoice-level reporting.

- Table 6 - It pertains to exports and supplies to SEZ units or developers, either with or without payment of IGST. It also includes deemed exports. Shipping bill and export invoice details have to be reported in this section.

- Table 7 - It relates to B2C supplies other than those reported in Table 5. These include intra-state and inter-state supplies with invoice values up to ₹2.5 lakhs. They are reported consolidated and typically summarised by tax rate and place of supply.

- Table 8 - It records information on nil-rated, exempt, and non-GST outward supplies. It compiles such transactions by nature and place of supply and helps distinguish them from taxable outward supplies.

- Table 9 - It needs updates to taxable outward supply invoices submitted in earlier tax periods. It entails B2B, B2C (large) changes, export invoices, credit/debit notes, or shipping bill numbers.

- Table 10 - It records adjustments to B2C (small) outward supplies. If a taxpayer is required to adjust values reported in previous returns for small-value B2C supplies, this table is applied.

- Table 11 - It reports advances received for invoices that have not yet been issued and adjusts them against invoices in current or future periods. It is mainly used for services where advances are prevalent.

- Table 12 - It captures an HSN-wise summary of outward supplies. It contains the HSN code, total quantity, taxable value, and tax applicable. It is required based on the taxpayer's turnover and helps determine the nature of goods/services supplied.

- Table 13 - It gives information about documents released within the tax period, including invoices, amended invoices, debit/credit notes, receipt vouchers, and delivery challans. It assists the tax department in reconciling the documentation flow with reported supply data.

Form GSTR-1 contains 13 tables in which the outward supplies details needs to be captured. Based on the nature of business and the nature of supplies effected during the month, only the relevant tables are applicable, not all. The GSTR-1 format in GST portal is as follows:

How to file GSTR-1 form?

The GSTR-1 form consists of the following tables in which the details of outward supplies need to be furnished by the registered businesses.

- Table 1, 2 & 3: Details of GSTIN and aggregate turnover in the preceding year.

- Table 4: Taxable outward supplies made to registered persons (including UIN-holders) other than zero-rated supplies and deemed exports.

- Table 5: Taxable outward inter-State supplies to un-registered persons where the invoice value is more than INR 2.5 Lakh.

- Table 6: Details of zero rate supplies and deemed exports.

- Table 7: Details of taxable supplies (net of debit notes and credit notes) to unregistered persons other than the supplies covered in table 5.

- Table 8: Details of nil rated, exempted and non-GST outward supplies.

- Table 9: Details of debit notes, credit notes, refund vouchers issued during the current period and any amendments to taxable outward supply details furnished in the GSTR-1 returns for earlier tax periods in table 4, 5 & 6.

- Table 10: Details of debit note and credit note issued to unregistered person.

- Table 11: Details of advances received/advance adjusted in the current tax period or amendments of information furnished in the earlier tax period.

- Table 12: HSN-wise summary of outward supplies.

- Table 13: Documents issued during the tax period.

Know more on how to file GSTR-1.

Filing through TallyPrime

To prepare GSTR-1 in TallyPrime, ensure your company is GST-enabled and all outward supplies are correctly recorded.

- Navigate to Gateway of Tally > Display More Reports > Statutory Reports > GST > GSTR-1.

- TallyPrime automatically populates invoice information into the GSTR-1 format.

- Check and rectify any discrepancies displayed under Incomplete/Mismatch in Information.

- After verification, export the data in JSON format.

- Log in to the GST portal, go to Returns Dashboard > GSTR-1, and upload the JSON file.

TallyPrime also facilitates direct online filing through its GST Suvidha Provider (GSP) integration. Always check the uploaded data before final submission.

FAQs

What is GSTR-1, and why is it significant?

GSTR-1 is a quarterly or monthly return that consolidates a registered taxpayer's outward supplies (sales). It facilitates passing on input tax credits to customers and provides tax transparency.

Who has to file GSTR-1?

All registered GST taxpayers, barring composition dealers and some exempted classes, must file GSTR-1.

What details are required to be filed in GSTR-1?

The details are invoice-wise sales, debit/credit notes, an HSN-wise summary of goods, and a summary of outward supplies.

How do I file GSTR-1 using TallyPrime?

Prepare GSTR-1 in TallyPrime, export in JSON format, and upload on the GST portal or file with the help of the GST Offline Tool.

What is the deadline to file GSTR-1?

Monthly filers: 11th of the succeeding month

Quarterly filers: 13th of the month after the quarter under the QRMP scheme

What if I default in filing GSTR-1?

Late filing invites charges: ₹50/day (₹25 CGST + ₹25 SGST) or ₹20/day for zero returns, in addition to delayed input credit for buyers.

How is GSTR-1 different from GSTR-3B?

GSTR-1 reports detailed outward supply data, whereas GSTR-3B is a summarized return on which tax is paid and consolidated amounts are reported.

Is GSTR-1 allowed to be amended after it has been submitted?

No, once GSTR-1 has been submitted, it cannot be amended. Yet, mistakes and oversights may be corrected by amending the next GSTR-1.

Watch the Video on How to Export GSTR-1 Section-wise using TallyPrime

Read More on GST Returns

GST Returns, Types of GST Returns, New GST Returns & Forms, Sahaj GST Returns, Sugam GST Returns, GSTR 2, GSTR 3B, GSTR 4, GSTR 5, GSTR 5A, GSTR 6, GSTR 7, GSTR 8, GSTR 9, GSTR 10, GSTR 11

GST

GST Software, GST Calculator, GST on Freight, GST on Ecommerce, GST Impact on TCS, GST Impact on TDS, GST Exempted Goods & Services, Reverse Charge Mechanism in GST, GST Declaration

Types of GST

CGST, SGST, IGST, UTGST, Difference between CGST, SGST & IGST

GST Rates & Charges

GST Rates, GST Rate Finder, GST Rate on Labour Charges, HSN Codes, SAC Codes, GST State Codes