The complexity of taxation in India is akin to mastering a new terrain. Among the transformative amendments in recent years stands the Goods and Services Tax (GST), a monumental stride towards simplifying indirect taxation. At its heart lies the GST Identification Number (GSTIN), a digital passport that businesses need for navigating this new tax regime. Understanding its significance opens doors to seamless compliance and operational clarity in today's dynamic business environment.

Significance of GSTIN (Goods and Services Tax Identification Number)

The GSTIN is a 15-digit alphanumeric code assigned to every registered taxpayer under GST. It serves as a vital tool for tax authorities to monitor compliance, prevent tax evasion, and ensure seamless tax administration.

What is a GST Number (GSTIN) and Its Importance?

A GSTIN is more than just a registration number; it is a gateway for businesses to collect taxes, claim input credits, file returns, and maintain compliance with GST laws. It also facilitates interstate trade by ensuring uniformity in tax procedures.

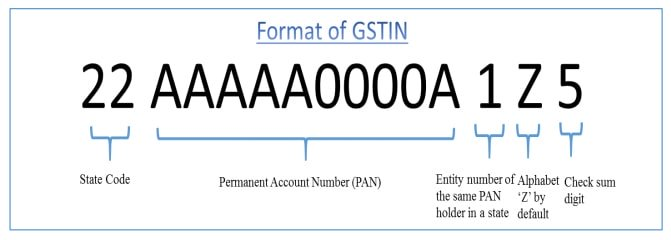

Definition and Components of GSTIN

The GSTIN comprises:

- State Code: Two-digit code representing the state of registration.

- PAN: Ten-character Permanent Account Number of the taxpayer.

- Entity Code: Based on the number of registrations within a state.

- Checksum Digit: Verifies the validity of the GSTIN.

Importance and Use of GSTIN in GST Compliance

For businesses, having a GSTIN is essential for fulfilling legal obligations, including tax collection, invoice issuance, and return filing. It promotes accountability and transparency in financial transactions while enabling seamless integration with government tax portals.

Understanding GSTIN: Format, Application, and Fees

GSTIN Format: Decoding the 15-Digit Identifier

The GST Identification Number (GSTIN) serves as a unique identifier for businesses registered under GST in India. Let's break down its format to demystify its components:

- State Code: The first two digits denote the state code based on the Indian Census 2011.

- PAN: The next ten digits represent the Permanent Account Number issued by the Income Tax Department.

- Entity Code: This is unique to each taxpayer within a state, determined based on the number of registrations.

- Checksum Digit: The final digit is a checksum calculated using a specific formula to ensure the integrity of the GSTIN.

Understanding each segment helps businesses identify and verify their GSTIN, crucial for seamless tax compliance and operational efficiency.

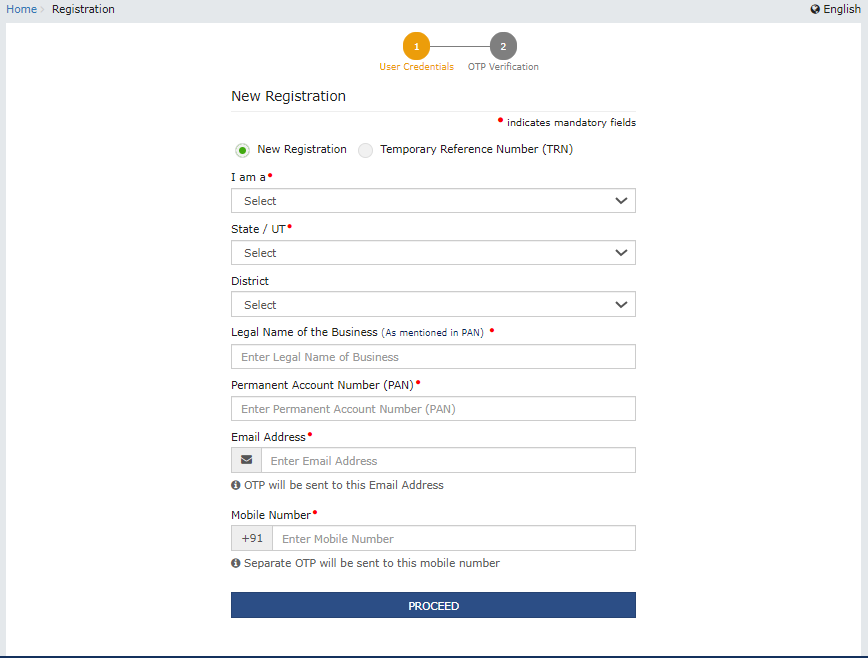

How to Get a GSTIN Number?

Obtaining a GSTIN is essential for businesses to comply with GST regulations. Here’s how you can get yours:

Step 1: Visit the GST Portal

Navigate to www.gst.gov.in, the official GST portal.

Step 2: Initiate Registration

Start the registration process by providing necessary details such as PAN, business address, and bank account details.

Step 3: Upload Documents

Upload required documents, including proof of address, identity, and business incorporation.

Step 4: Verification and Approval

Once submitted, the application undergoes verification by the GST authorities. Upon successful verification, your GSTIN is issued.

Applicable Fees

There is no fee for obtaining a GSTIN, making it accessible to businesses of all sizes. This eliminates financial barriers and encourages compliance among startups and small enterprises.

GST Number Format

As discussed above, the GSTIN is a 15 digit identification number. The following are the details of each digit, which constitutes the GSTIN format:

- 1st 2 digits: This is the state code as per the Indian Census 2011, as given below:

|

State code list |

State |

State code list |

State |

|

01 |

Jammu & Kashmir |

19 |

West Bengal |

|

02 |

Himachal Pradesh |

20 |

Jharkhand |

|

03 |

Punjab |

21 |

Orissa |

|

04 |

Chandigarh |

22 |

Chhattisgarh |

|

05 |

Uttarakhand |

23 |

Madhya Pradesh |

|

06 |

Haryana |

24 |

Gujarat |

|

07 |

Delhi |

25 |

Daman & Diu |

|

08 |

Rajasthan |

26 |

Dadra & Nagar Haveli |

|

09 |

Uttar Pradesh |

27 |

Maharashtra |

|

10 |

Bihar |

28 |

Andhra Pradesh (Old) |

|

11 |

Sikkim |

29 |

Karnataka |

|

12 |

Arunachal Pradesh |

30 |

Goa |

|

13 |

Nagaland |

31 |

Lakshadweep |

|

14 |

Manipur |

32 |

Kerala |

|

15 |

Mizoram |

33 |

Tamil Nadu |

|

16 |

Tripura |

34 |

Puducherry |

|

17 |

Meghalaya |

35 |

Andaman & Nicobar Islands |

|

18 |

Assam |

36 |

Telengana |

|

37 |

Andhra Pradesh (New) |

- Next 10 digits:This is the PAN of the business entity.

- 13th digit: This denotes the serial number of registrations the business entity has for business verticals in the state, under the same PAN. It can range from 1-9 for businesses with up to 9 business vertical registrations in the state and for more than 9 registrations, from A-Z. For example, when a business entity gets a GST no. for its 3rd business vertical in the state, this digit will be 3, whereas when a business entity gets GST registration no. for its 13th business vertical in the state, this digit will be D.

- 14th digit:This will be ‘Z’ by default.

- 15th digit: This digit denotes a ‘checksum'

Conclusion

Are you overwhelmed by the complexities of obtaining and managing a GSTIN? These challenges can indeed seem daunting, from understanding the detailed format and components of GSTIN to ensuring timely registration without incurring fees.

However, with TallyPrime, these challenges become opportunities for streamlined efficiency and compliance. TallyPrime simplifies GSTIN generation, automates return filing, and provides real-time tax calculations, empowering businesses to focus on growth.

By choosing TallyPrime, businesses not only ensure seamless GST compliance but also gain a reliable partner in navigating the intricacies of GST, fostering operational excellence and financial peace of mind. Ready to transform your GST experience? Let TallyPrime guide your way.

FAQs About GSTIN

What is GSTIN, and who needs to obtain it?

GSTIN (Goods and Services Tax Identification Number) is a unique 15-digit alphanumeric code assigned to every taxpayer registered under GST in India. Any business or individual involved in the supply of goods or services exceeding the threshold turnover limit (Rs. 20 lakhs for most states, Rs. 10 lakhs for special category states) must obtain GSTIN.

How does GSTIN benefit businesses?

GSTIN streamlines tax compliance by enabling businesses to collect taxes from customers, claim input tax credit on purchases, file GST returns, and comply with legal requirements seamlessly. It also facilitates transparency and reduces tax evasion.

Is there a fee for obtaining a GSTIN?

No, there is no fee for obtaining a GSTIN. The registration process is free of charge, ensuring accessibility for businesses of all sizes.

How can I verify the validity of a GSTIN?

You can verify the authenticity of a GSTIN using the GSTIN verification tool available on the GST portal (www.gst.gov.in). Enter the GSTIN you wish to verify, and the tool will confirm its validity.

What happens if I operate without a GSTIN?

Operating without a GSTIN when required can lead to legal consequences, including penalties and fines. It is mandatory for eligible businesses to obtain GSTIN to comply with GST laws and regulations.

Can I apply for multiple GSTINs for different business verticals or states?

Yes, businesses can apply for multiple GSTINs under different verticals or states, provided they meet the necessary criteria for registration in each case. Each GSTIN will be unique to the respective business vertical or state of operation.

How long does it take to get a GSTIN after applying?

Once you have submitted your GST registration application with all required documents, the GST authorities typically issue the GSTIN within 3-7 working days, subject to verification and approval.

Know More about GST Registration

GST Registration, GST Registration Eligibility, GST Registration Certificate, Documents Required for GST Registration, How to Check GST Registration Status

GST

GST Software, GST Calculator, GST on Freight, GST Exempted Goods & Services, Reverse Charge Mechanism in GST, GST Declaration

GST Rates & Charges

GST Rates, GST Rate Finder, HSN Codes, SAC Codes, GST State Codes

GST Returns

GST Returns, Types of GST Returns, New GST Returns & Forms, Sahaj GST Returns, Sugam GST Returns