- What is a GST Registration Certificate

- Sample GST Registration Certificate

- How to get GST Registration Certificate

- How to download GST Registration Certificate

What is a GST Registration Certificate?

A GST Registration Certificate is an official document issued by the government confirming a business's registration under the Goods and Services Tax (GST) regime. It signifies compliance with tax regulations and enables businesses to collect GST from customers, claim input tax credits, and conduct inter-state transactions legally. This certificate is crucial for businesses as it grants access to various benefits, including legal recognition, simplified tax compliance, and eligibility for certain government schemes and contracts. Moreover, it enhances credibility and trust among customers and business partners.

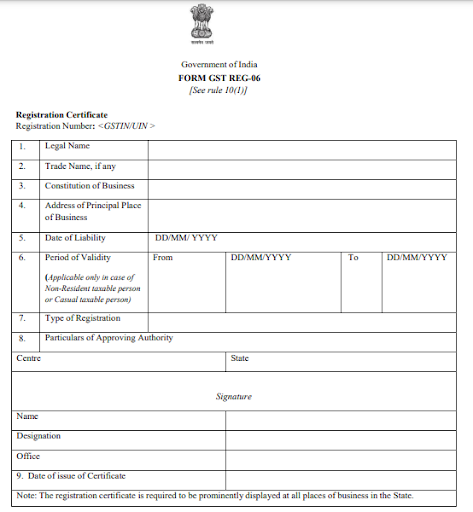

Sample GST Registration Certificate

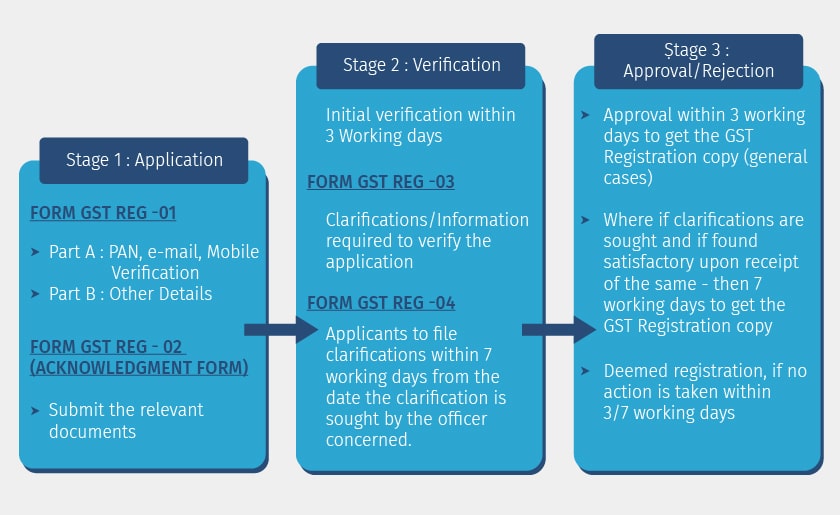

How to get GST Registration Certificate?

The registration process for obtaining GST Registration certificate can be easily understood from the three step process outlined below:

The above is applicable to inter-State suppliers, voluntary registrations, casual taxable persons and persons liable to reverse charge. The GST Registration Certificate is then issued in Form GST REG-06.

How to download GST Registration Certificate

The GST Registration certificate download could be done by visiting the GST Portal at www.gst.gov.in by following the simple steps listed below:

Step 1: Log in to the GST Portal

Step 2: Go to 'Services' > 'User Services'>'View/Download GST Registration Certificate'

Step 3: Click on 'Download' icon and a GST registration certificate download.pdf file will be downloaded

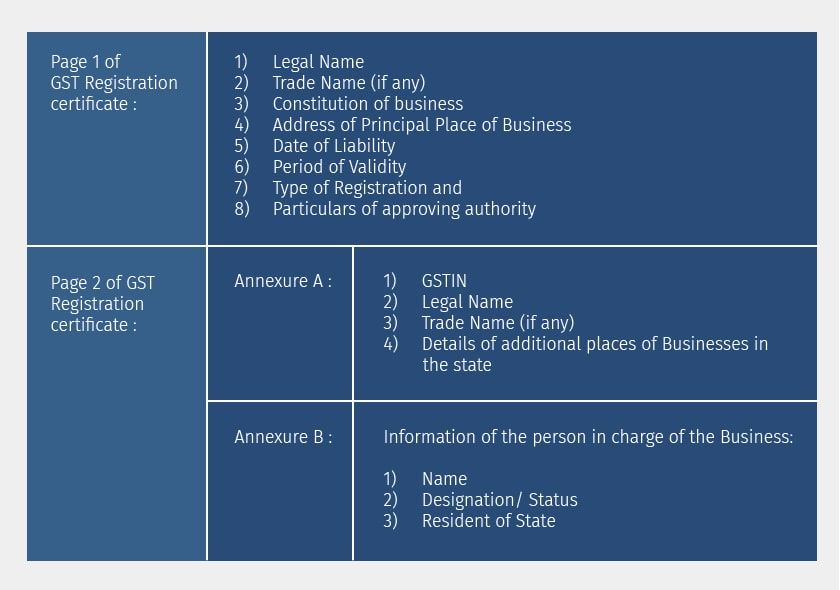

Information available in the GST Registration Certificate copy

Know More about GST Registration

GST Registration, GST Registration Eligibility, Documents Required for GST Registration, How to Check GST Registration Status, GSTIN

GST

GST Software, GST Calculator, GST on Freight, GST Exempted Goods & Services, Reverse Charge Mechanism in GST, GST Declaration

GST Rates & Charges

GST Rates, GST Rate Finder, HSN Codes, SAC Codes, GST State Codes

GST Returns

GST Returns, Types of GST Returns, New GST Returns & Forms, Sahaj GST Returns, Sugam GST Returns