The complexity of taxation in India is akin to mastering a new terrain. Among the transformative amendments in recent years stands the Goods and Services Tax (GST), a monumental stride towards simplifying indirect taxation. At its heart lies the GST Identification Number (GSTIN), a digital passport that businesses need for navigating this new tax regime. Understanding its significance opens doors to seamless compliance and operational clarity in today's dynamic business environment.

Significance of GSTIN

The GSTIN is a 15-digit alphanumeric code assigned to every registered taxpayer under GST. It serves as a vital tool for tax authorities to monitor compliance, prevent tax evasion, and ensure seamless tax administration.

Importance of GSTIN in GST Compliance

For businesses, having a GSTIN number is essential for fulfilling legal obligations, including tax collection, invoice issuance, and return filing. It promotes accountability and transparency in financial transactions while enabling seamless integration with government tax portals.

Who needs GSTIN?

A GSTIN is needed by most businesses that are registered under GST in India. In practice, the requirement comes from turnover limits and certain compulsory categories.

Basic turnover rule

- Any business supplying taxable goods must register for GST and get a GSTIN if its aggregate annual turnover exceeds around ₹40 lakh in most states (lower in some special category/North‑Eastern states).

- Any business supplying taxable services must register for GST and get a GSTIN if its aggregate annual turnover exceeds around ₹20 lakh in most states (around ₹10 lakh in special category states).

Mandatory cases even below threshold

Even if turnover is below the basic limits, GSTIN is compulsory for:

- Inter‑state suppliers of goods or services.

- E‑commerce operators and people selling through e‑commerce platforms.

- Input Service Distributors (ISD).

- Casual taxable persons (e.g., temporary exhibitions, fairs).

- Non‑resident taxable persons supplying in India.

- Persons liable to deduct or collect tax at source (TDS/TCS) under GST.

If you are below the threshold and not in any compulsory category, you can still opt for voluntary registration to claim input tax credit and appear as a GST‑registered supplier in B2B chains.

Understanding GSTIN: Format, Application, and Fees

Understanding each segment helps businesses identify and verify their GSTIN, crucial for seamless tax compliance and operational efficiency.

How to Get a GSTIN Number?

Obtaining a GSTIN is essential for businesses to comply with GST regulations. Here’s how you can get yours:

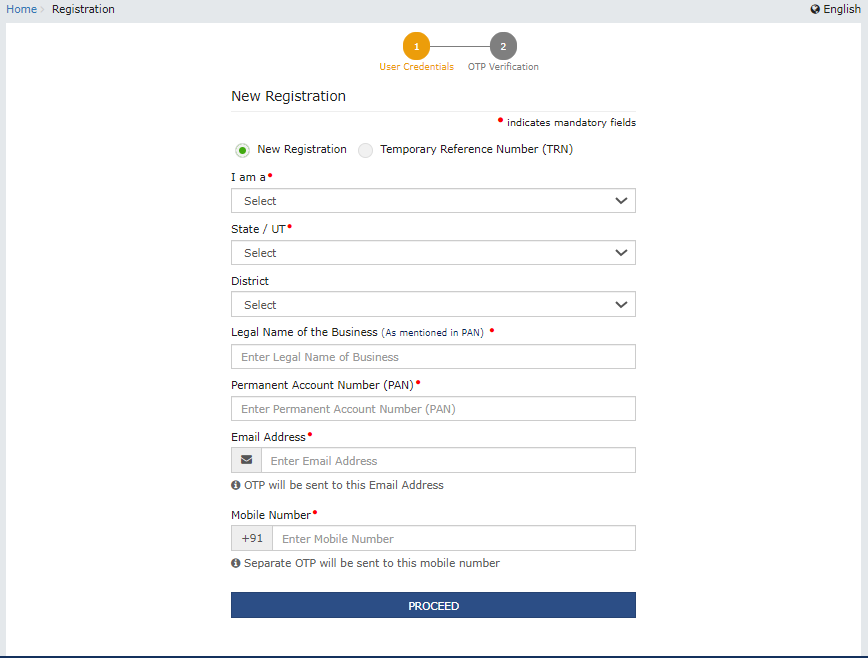

Step 1: Visit the GST Portal

Navigate to www.gst.gov.in, the official GST portal.

Step 2: Initiate Registration

Start the registration process by providing necessary details such as PAN, business address, and bank account details.

Step 3: Upload Documents

Upload required documents, including proof of address, identity, and business incorporation.

Step 4: Verification and Approval

Once submitted, the application undergoes verification by the GST authorities. Upon successful verification, your GSTIN is issued.

Applicable Fees

There is no fee for obtaining a GSTIN, making it accessible to businesses of all sizes. This eliminates financial barriers and encourages compliance among startups and small enterprises.

Types of GSTIN Status

|

Status |

Meaning |

|

Active |

GSTIN is valid and business can conduct GST transactions |

|

Inactive |

GSTIN is temporarily not operational |

|

Cancelled |

GSTIN has been permanently cancelled |

|

Suspended |

GSTIN is temporarily suspended by authorities |

|

Provisional |

Temporary GSTIN during migration period |

Benefits of Getting the GSTIN

Businesses gain several practical advantages from obtaining a GSTIN through registration, beyond just meeting legal requirements. These benefits help improve cash flow, credibility, and operational efficiency.

Legal compliance and input tax credit

GSTIN registration ensures full compliance with India's GST laws, avoiding penalties for unregistered operations above thresholds. The biggest financial gain is claiming Input Tax Credit (ITC) on purchases—offsetting GST paid on inputs against output liability, which directly boosts profitability by 5-18% depending on your sector.

Enhanced business credibility

A GSTIN makes your business appear professional and trustworthy to customers, suppliers, and platforms like Amazon or Flipkart, which often require it for sellers. Registered suppliers can issue GST-compliant invoices, enabling B2B buyers to claim ITC, which strengthens supplier relationships and opens doors to larger contracts.

Interstate and e-commerce expansion

With GSTIN, businesses can legally supply goods or services across state borders without restrictions, expanding market reach seamlessly. E-commerce sellers need it mandatorily to list on major platforms, collect TCS, and handle interstate deliveries.

Simplified operations and growth support

Registration provides access to GST portals for easy returns, refunds, and reconciliations, plus eligibility for government schemes, loans, and tenders that favor compliant entities. Tools like TallyPrime integrate GSTIN details for automated invoicing, ITC tracking, and compliance, reducing manual errors and saving time

Reasons for GSTIN Cancellation

- Non-filing of GST returns for 6+ consecutive months

- Obtained registration by fraud or misrepresentation

- Business discontinued or closed

- Violation of GST provisions

- Voluntary cancellation by taxpayer

- Death of proprietor (in case of sole proprietorship)

- Business transferred or amalgamated

Reasons for GSTIN Suspension

- Significant difference in GSTR-1 and GSTR-3B

- Non-filing of returns beyond prescribed period

- Suspected fraud or tax evasion

- Mismatch in e-way bill and return data

- Notice issued for show cause

How to Reactivate Cancelled GSTIN

|

Step |

Action |

|

Step 1 |

File application for revocation in Form GST REG-21 |

|

Step 2 |

File all pending GST returns with late fees |

|

Step 3 |

Pay all outstanding tax dues |

|

Step 4 |

Submit within 30 days of cancellation order |

|

Step 5 |

Wait for officer approval |

How to Amend/Update GSTIN Details

|

What Can Be Amended |

Form to Use |

|

Business name (non-core) |

Form GST REG-14 |

|

Principal place of business |

Form GST REG-14 |

|

Additional place of business |

Form GST REG-14 |

|

Contact details (email, phone) |

Form GST REG-14 |

|

Bank account details |

Form GST REG-14 |

|

Authorized signatory |

Form GST REG-14 |

Conclusion

Are you overwhelmed by the complexities of obtaining and managing a GSTIN? These challenges can indeed seem daunting, from understanding the detailed format and components of GSTIN to ensuring timely registration without incurring fees.

However, with TallyPrime, these challenges become opportunities for streamlined efficiency and compliance. TallyPrime simplifies GSTIN generation, automates return filing, and provides real-time tax calculations, empowering businesses to focus on growth.

By choosing TallyPrime, businesses not only ensure seamless GST compliance but also gain a reliable partner in navigating the intricacies of GST, fostering operational excellence and financial peace of mind. Ready to transform your GST experience? Let TallyPrime guide your way.

Check GST Number with our tool

Know More about GST Registration

GST Registration, GST Registration Eligibility, GST Registration Certificate, Documents Required for GST Registration, How to Check GST Registration Status

GST

GST Software, GST Calculator, GST on Freight, GST Exempted Goods & Services, Reverse Charge Mechanism in GST, GST Declaration

GST Rates & Charges

GST Rates, GST Rate Finder, HSN Codes, SAC Codes, GST State Codes

GST Returns

GST Returns, Types of GST Returns, New GST Returns & Forms, Sahaj GST Returns, Sugam GST Returns