- Who are sundry creditors?

- Sundry creditors example

- What is accounts payable?

- Why managing accounts payable is important?

- Manage payables seamlessly with TallyPrime

Who are sundry creditors?

A business runs on in flow and out flow of cash. Debtors and creditors play a crucial role in shaping a business’ hold in its line of work. In any business transaction, there is buying and selling of goods/services involved. Any individual who is responsible for the supplies of the goods or services to another business firm on credit basis, will be considered as sundry creditor by the firm who avails this facility.

The simple meaning of Sundry Creditors means that whenever we purchase any goods from our business by borrowing from a Party / Company / Firm, we know that Party / Company in the accounting language as Sundry Creditors. All such people come under Sundry Creditors, from whom we buy goods on credit in business and those who have to pay us are called Sundry Creditors

Sundry creditors are considered as liabilities to a business as they are supposed to pay outstanding amount, for a specific transaction, based on the agreed timeline by both the parties.

Sundry creditors example

Since sundry creditors are a liability to a firm, they will be shown on the right side of the balance sheet. Businesses use a separate category to track these transactions and they are called sundry creditor accounts or accounts payable.

For example: Let’s say A-One Mfg Ltd purchased a certain number of goods from Surabhi Traders, worth Rs 12,000. This purchase was made on January 31st, 2021 and the bill is to be paid before Apr 2nd, 2021. In this case, A-One Mfg Ltd will record this transaction under ‘Sundry Creditors’ ledger account and treat it as a liability as the company is to pay its party on time, to maintain its credit score at a high.

What is accounts payable?

Accounts payable is any sum of money owed by a business to its suppliers shown as a liability on a company's balance sheet. In simple words, when you buy goods or services with an arrangement to pay later, such an amount till it is paid is referred to as accounts payable.

Accounts payable is also called bills payable and the total amount that a company is liable to pay is shown as liability under the head ‘sundry creditor’ in the balance sheet.

The reason accounts payables are critical is slow or delayed payment may create ill-feeling and the supplies could be disrupted and also impacts the credibility of the business. The way you manage your accounts payable has a direct impact on cash flow and therefore it should be managed carefully to enhance the cash position.

Read more on Accounts Payable – Definition, Example and Process

Why managing outstanding payables is important for any business?

When you buy certain goods/services from your vendors or suppliers, you must ensure that you discuss and agree on a specific timeline to make your payments. Especially when you purchase goods on credit, it is important that both parties have agreed on the payment timeline, so that there isn’t any bad blood at later stages of the transaction.

Managing your outstanding payables will help you to know the time-to-time expenses, avoid overseeing the payments that you owe to the creditors, and help you manage the cash-flow in your business.

-

Record and track dues

You can get an overview of the amount and the creditors to whom you owe money and how much you owe each creditor and the duration of such pending payments. Managing your outstanding payables will help you to know the time-to-time expenses, avoid overseeing the payments that you owe to the creditors, and help you manage the cash flow in your business.

-

Use credit period

To ensure that all the payments that you owe to your suppliers are tracked systematically, it is advised to maintain your accounts by specifying the credit period or due date for the party during purchases. You can specify a credit period of say 30 days in the party ledger for the party to make the payments. This helps to avoid conflicts with your parties, systematically track your outstanding payables, and make timely payments to your parties.

-

Help maintain a good rapport with your supplier

Let’s say you made a credit purchase from your supplier on March 1st, 2021. Your agreed due date before which your supplier expects payment for the goods supplied is on April 1st, 2021. Since you have always maintained a good credit score, your supplier offers you a discount of 3% if the payment is made within 20 days, which is March 20th, 2021. Building this kind of relationship, with your sundry creditors will always be beneficial for your business, as not only will you be offered discounts on the supplies, but also maintain a good reputation among several vendors in the market.

Manage payables seamlessly with TallyPrime

When you purchase goods/services on credit, you may want to track and manage the amount that is due to your party. Once you record a purchase, TallyPrime reflects the purchase amount as Credit against the party in the corresponding report. Anytime you make the payment to your party, you can record a payment entry for that amount to clear the outstanding for that party.

You can also access Ledger Vouchers by drilling down from different statements, such as Group Summary and Monthly Summary.

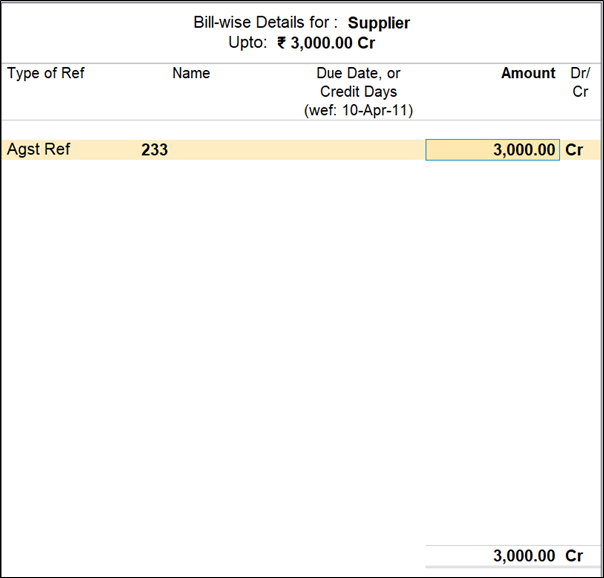

If you maintain bills with specific reference numbers for easy tracking in the future, you can use the bill-wise option in the party master. Next time you record a transaction for that party, TallyPrime will internally track the bill by using the voucher number as the reference number. You can also split purchases into multiple bills. This helps you to track the payment breakup against the bills created and manage your outstanding payables systematically.

You can also get a view of the details of the outstanding payables – Opening amount, pending amount, due date and overdue days for the selected party with TallyPrime’s ledger outstanding report. All the purchases recorded bill-wise or without any bill references and the corresponding payment entries recorded are displayed in this report. You can make the payments that are pending with your parties using the report.

Accounts payable and their management is crucial for any business. It not only takes charge of your business’ timely payments but also maintains a healthy relationship with your vendors. All the purchases need to be tracked efficiently to maintain smooth functioning of a business organisation. Give TallyPrime a free trial today and check out its amazing capabilities that help you keep your payables steady.

FAQs

What are sundry creditors in accounting?

Sundry creditors are individuals or businesses who supply goods or services to your business on credit. From your perspective, they are liabilities that must be settled within an agreed period.

Why are sundry creditors shown as liabilities?

They represent money your business owes to suppliers for past credit purchases. Until paid, this amount remains a liability in your balance sheet under “accounts payable.”

How do sundry creditors differ from accounts payable?

“Sundry creditors” typically refers to individual supplier accounts, while “accounts payable” is the total sum your business owes to all creditors at any point in time.

How can TallyPrime help manage sundry creditors?

TallyPrime helps you:

- Record and track each credit purchase

- Set due dates and credit periods

- Use bill-wise tracking to match payments to invoices

- Generate reports to view outstanding amounts, overdue days, and supplier-wise details

Why is managing outstanding payables important?

- Efficient payable management ensures:

- Timely payments

- Better cash flow

- Stronger supplier relationships

- Opportunities for early payment discounts

Learn More

Capital Lease, Life Cycle Costing, Budgeting vs. Forecasting, Royalty in Accounting, Auditing Process, External Audit