Financial record-keeping underpins any successful business. Accurate financial records of revenues, costs, assets, and liabilities are crucial for businesses and business people alike. The timely and systematic documentation of daily transactions is critical to producing essential financial statements that offer an instant evaluation of the company's financial well-being.

The general ledger serves as the primary ledger, documenting all financial transactions of an organization methodically and understandably. The general ledger provides a comprehensive record of all debit and credit transactions, individually recorded in separate accounts. It serves as the primary information source utilized to prepare critical financial statements. Today, we will explore the general ledger’s importance and benefits.

Significance of general ledger in business accounting

In business accounting, a general ledger is a record of a company's past transactions grouped by account, both debit and credit transactions. A general ledger carries extensive information about each transaction, such as the date, description, and amount, as well as some descriptive information about the transaction itself. It helps business owners organize the transactional data into assets, liabilities, revenues, and expenses that promote efficient accounting.

The general ledger consolidates transaction information from subsidiary ledgers, such as the cash book, sales ledger, and purchase ledger, into separate accounts in the ledger in order to present an all-encompassing financial overview of the company. It records the double-entry impact of transactions and helps in the establishment of an audit trail for all financial transactions.

Business owners can obtain significant insights into the financial performance of their companies by ensuring that the general ledger is precise and consistently updated. They are able to monitor sales and expenses, trace financial inflows and outflows, and assess the overall profitability of business operations through periodic monitoring of sales and expenses. Additionally, compliance with tax regulations is ensured, and the preparation of financial statements such as income statements and balance sheets is facilitated by a well-organized general ledger.

Format of general ledger: a must-know for every entrepreneur

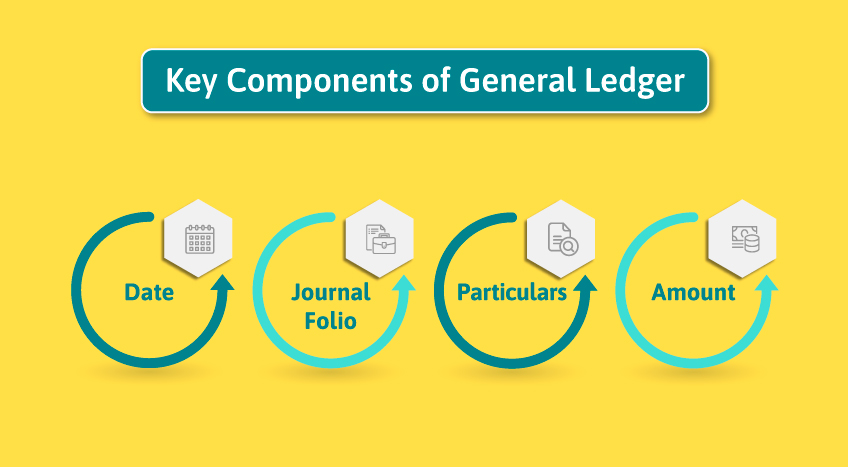

The general ledger format ensures that accounting transactions are recorded in a consistent and structured manner. Ensuring conformance to a standardized format facilitates the process of recording entries and monitoring the evolution of ledger balances. The following are essential elements of a general ledger format:

- Date: Represents the date of the financial transaction.

- Particulars: Describes the nature of the transaction, whether it's a sale, purchase, salary payment, etc.

- Journal Folio: Refers to the reference number or page number in the journal from where the entry is taken for posting in the ledger.

- Amount: Indicates the monetary value of the transaction, with positive values for credits and negative values for debits.

Below is an example of a general ledger format comprising the above components:

|

Date |

Particulars |

Journal Folio |

Amount |

Date |

Particulars |

Journal Folio |

Amount |

General ledger process: key insights for successful business accounting

A general ledger follows a standard format to record accounting transactions systematically. The key components include:

- Date

- Particulars

- Journal Folio

- Amount

Business owners can maintain organized financial records by methodically recording transactions in the ledger. It also permits the longitudinal monitoring of the effect that business activities have on account balances. Therefore, it is critical for companies to stick to a standardized general ledger format in order to facilitate compliance and serve as a point of reference for auditing and accounting objectives.

A simple example of a general ledger with the above format is shown below:

|

Date |

Particulars |

Journal Folio |

Amount (INR) |

|

2023-01-01 |

Opening Balance |

|

0.00 |

|

2023-01-05 |

Sales |

J1 |

50,000.00 |

|

2023-01-10 |

Purchase |

J2 |

-20,000.00 |

|

2023-01-15 |

Salary Payment |

J3 |

-10,000.00 |

|

2023-01-20 |

Loan Repayment |

J4 |

-5,000.00 |

|

2023-01-25 |

Revenue from Services |

J5 |

30,000.00 |

|

2023-01-31 |

Closing Balance |

|

45,000.00 |

Example explanation:

- Opening balance: The initial entry in the ledger serves as a representation of the financial status at the start of the specified period.

- Sales: A financial transaction that signifies revenue and positively impacts the overall state of affairs.

- Purchase: A negative value is assigned to an expense transaction, which signifies a withdrawal of funds.

- Salary payment: An additional entry for expenses that details the withdrawal of funds intended for employee compensation.

- Loan repayment: An example of liability reduction indicated by a negative value.

- Revenue from services: A positive value that signifies the revenue generated through the provision of services.

- Closing balance: A summary of the financial position at the conclusion of the period is included in the ledger.

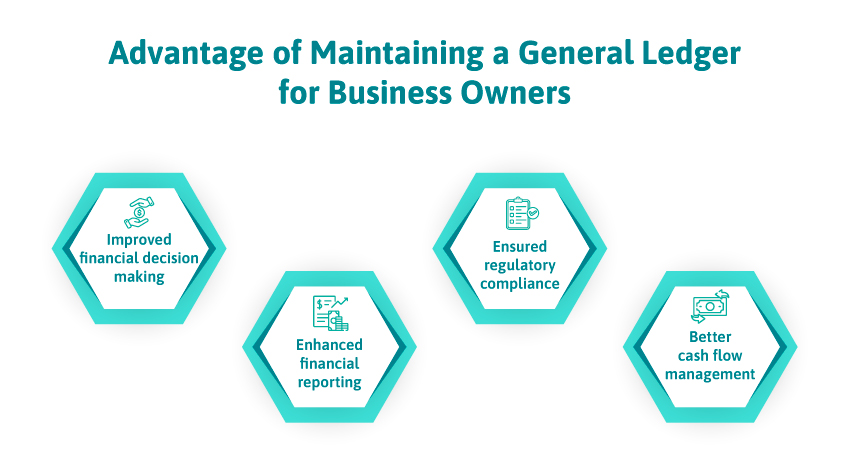

Advantage of maintaining a general ledger for business owners

A business owner needs to maintain accurate and current financial records. Maintaining an organized general ledger provides numerous significant benefits:

Improved financial decision making

A general ledger that is adequately maintained enables entrepreneurs to conduct an analysis of the financial performance pertaining to various departments, products, or services. This facilitates data-driven decision-making regarding the expansion or discontinuation of specific offerings. Additionally, business owners can effectively monitor financial flows, debts, and budgets.

Enhanced financial reporting

Businesses can effortlessly produce financial statements such as income statements and balance sheets on a recurring basis by utilizing a systematic general ledger. This provides visibility into the financial position and profitability. It also facilitates the preparation of investor, tax authority, and other stakeholder reports.

Ensured regulatory compliance

Legal requirements specify that journals of accounts must be maintained. Maintaining a systematic general ledger streamlines the audit procedure and ensures conformance to tax and statutory requirements. Moreover, penalties for inconsistencies or late filings are avoided.

Better cash flow management

A general ledger provides entrepreneurs with a comprehensive record of their financial inflows and outflows. This facilitates working capital management, timely creditor payments, and the avoidance of cash crisis situations.

In general, a well-organized general ledger provides businesses with indispensable oversight of their finances and facilitates strategic decision-making based on data. It enables business owners to concentrate on expansion while making informed decisions.

Final takeaways, accelerate your business growth with TallyPrime!

Ensuring the precision and structure of the general ledger is vital for the financial well-being of any business. It serves as the fundamental basis for all business accounting operations and enables business owners to monitor business performance, track cash flows, and ensure regulatory compliance. Automation of general ledger administration can be achieved with Tally's assistance.

By outsourcing labor-intensive accounting processes, Tally enables companies to reduce expenses and concentrate on expansion. It guarantees precise, structured, and backed-up financial records in order to streamline audits and fulfill legal responsibilities. In general, Tally is an invaluable tool that can assist business owners in managing their general ledgers efficiently and making decisions based on data.