- What is budgeting?

- What are the different types of budgets?

- What is forecasting?

- What are the types of forecasting?

- What are the key differences between budgeting and forecasting?

- Should you create a budget or a forecast for your business?

What is budgeting?

A budget is how you want your business to be in the next financial year. You can say that budgeting refers to the positive expectations of the next financial year. A budget is generally made for one year. Creating a budget includes writing a summary of all your business goals and thinking of where you want to see your company in the coming year. It also includes the date by which you think you will achieve the said goals. For example, budgeting includes how much expenses the business should incur and how much revenue your business should earn in the given period. Budgeting also includes how much cash flow you are expecting.

|

A Penny Saved is a Penny Earned! How can small businesses achieve it? |

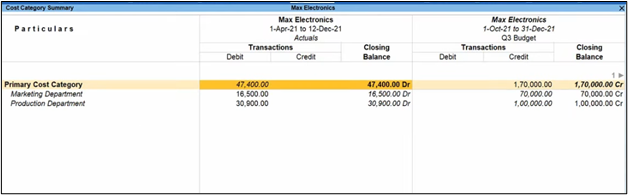

Budgeting is not as close to reality because you are essentially putting down goals and where you see your business at a particular time. Budgeting includes comparing the budget set by your business with the actual results. The difference shows how close or how far you are from your goals. If the difference is too wide, you are not close to achieving your goals at all. Budgeting can enable you to make changes to your business strategy because you are comparing budgets which allow you to understand the current and expected business performance.

TallyPrime enables comparison of budget and actual expenditure

What are the different types of budgets?

Some of the popular types of budgets are as follows.

Incremental budgeting

This type of budgeting involves adjusting the current budget that you have for your business. All you need to do is think of what you want and then set your budget according to that value. For example, if you want your business to grow by 5% in the next year then you will increase your budget by 5% to justify your spending.

Value-proposition budgeting

In this type of budgeting, you have to look at the value of the factor at hand. This type of budgeting is often saved when creating large budgets that create value in some form for your business. That is, you will think of where you will allocate your budget depending on the value it provides. The higher the value it provides the higher you can set the budget.

Activity-based budgeting

This involves working backwards. For example, if you want growth of a certain percentage, then you will think of what activities will get you that growth. Is it spending more on marketing? Is it reducing expenses? The main aim is to find the activities that will enable you to achieve the goal through budgeting.

Zero-based budgeting

In this type of budgeting, you start afresh every year. That is, you look at your business with a fresh perspective and therefore start from zero. You don’t account for your previous budgets and instead, you start from scratch. Zero-based budgeting is often helpful for businesses that want to curb their extra spending.

What is forecasting?

A forecast is an estimation of what your business performance is going to be based on past performance and various business drivers. A forecast period is generally shorter than that of a budget because forecasts are made frequently by businesses. For instance, some businesses forecast every quarter while others forecast monthly. The forecast period differs from business to business. Forecasts take into account the numerous market conditions, which are why they are closer to reality. Forecasts enable you to tweak your business strategy based on how your business did earlier. Forecasts can be for the next few months and in some cases, they can predict the long-term growth of your business.

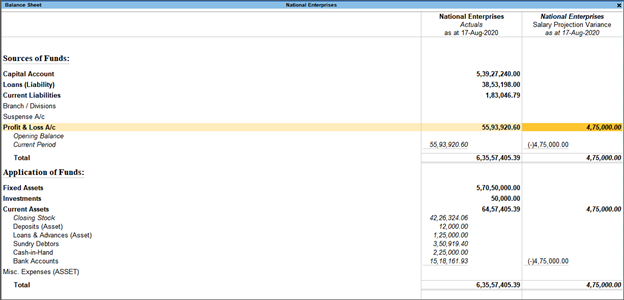

Experts say that all business owners should create different forecasts depending on the scenarios. That is, you shouldn’t create only one forecast but instead opt for a variety of them along with their outcomes. This is because it will ensure you are better prepared for the future. Let us say that certain economic conditions remain the same, and you have created numerous forecasts depending on those conditions. That is, you have created forecasts if those economic conditions remain the same and forecasts for the time when those conditions change. You will be in a better position to make changes to your business strategies.

An example of forecast variance in TallyPrime

What are the types of forecasting?

The following are some types of forecasting that businesses can use.

In-house expertise

In this type of forecasting, the person with the most expertise and experience is given the task to make accurate predictions. The person with the most knowledge is chosen for this task for higher precision. For example, your sales team is aware of your customers. They are the ones who can most accurately predict future sales and what they might look like for your business.

The Delphi method

This method of forecasting is generally used to make long-term forecasts about the business. It also requires you to spend a lot of time and energy. Rather than use only the prediction of one expert, this method utilizes the expertise of many experts. For instance, you might ask a group of experts to answer a questionnaire and, based on that, conclude what might happen in the future.

Time series analysis

This is a quantitative method of forecasting. If you want to forecast using this method, then you need years of valuable data. For example, if you want to forecast a particular product line in your business, then you need a few years of data about that product line. Then based on that analysis, you can understand what can happen in the future.

Causal method

This is a combination of two methods. In the causal methods, you perform a time series analysis along with market research. There are numerous types of causal methods that can be used for business forecasting. One of these types is regression analysis. This relates to the particular factor that you want to forecast with several variables.

What are the key differences between budgeting and forecasting?

The major difference between budget and forecast are highlighted below.

|

Budgeting |

Forecasting |

|

Budgeting involves being clear about what your business wants to achieve, such as the goals. It includes creating an outline that determines the direction in which the business should go. |

Forecasting is about predicting how the business will perform and the path that it will go in. Forecasting includes determining whether a business will achieve its budget targets or not. |

|

Business owners tend to budget only once or twice a year. This is why budgeting is often said to be static because it doesn’t take place too often, as is the case with forecasting. |

Forecasting takes place more regularly than budgeting. Forecasts are updated every month or every quarter. |

|

Budgets can be made for anything from cash flows to the expected reduction in debt. In this sense, budgets are broader and can include a variety of factors such as expenses and revenues too. |

Forecasts are more limited in nature because they are mainly used for forecasting revenues and expenses. They are also not as detailed in comparison to budgets. |

|

Budgets take into account the vision of the business and where the business wants to see itself in the following year. |

Forecasts are focused on the business plans in the short term. In certain cases, long-term planning can also be a part of forecasting. |

|

The budget is compared to the actual results of the business after the period is over. This analysis is a crucial part of budgeting. |

The difference between budget and forecast is that in the latter there is no comparison of the forecast compared to how the results turned out to be. |

|

Budgets can be used to take steps towards changing the strategy so that the business can achieve the budget goals it set. |

Forecasts enable you to take immediate action and make changes. Forecasts also influence building strategy. |

|

Budgeting doesn’t take into account the actual market conditions, which is why not every business needs to have a budget. |

Forecasting takes actual market conditions into account. Every business should forecast because it is closer to reality, and it can serve as a roadmap for your business. |

|

Budgets can include many aspects, which is why they can be highly detailed for businesses. For example, businesses can set particular budgets for expenses. |

Forecasts are not as broad as budgets, and so they are not as detailed. Forecasts are more like general overviews in comparison. |

Should you create a budget or a forecast for your business?

Both budgeting and forecasting are important financial tools that businesses should use. Both of them take you closer to growth because they show you how to achieve your goals. While budgeting shows you the gap between your current performance and expected performance, forecasting shows you what you can expect. Budgeting and forecasting are equally important, and you should focus on both. Using accounting software that helps you forecast, and budget is the easiest way to ensure you are on the right track. TallyPrime is a robust business accounting software that enables you to budget and forecast so you are always in control of your business finances.

Read more :