- Why is accounting important?

- What is the purpose of accounting?

- Why is accounting useful for small business owners?

- How accounting software helps business owners?

Accounting is an essential part of running a business, whether big or small. It is the process and method of recording, analysing, summarising, and extracting reports about the transactions of an organization or company. Accounting the company’s transactions makes the financial dealings easy and transparent to track and understand. It helps all the stakeholders easily understand the transactions, cash flows and financial performance of the company.

| Key Financial Statements to Manage Your Finance Better | 5 Tips to Keep your Business Accounting Organized |

Why is accounting important?

Accounting records the details of the business transactions of the company in the books of accounts. These records are essential for the owners, investors, managers and other stakeholders in a company to have the ability to view and evaluate the financial details of the business. It is only when there is a precise and accurate record of every transaction that the overall financial performance of the business can be studied. The books of accounts can be summarised into reports that tell the stakeholders about:

- Profit and loss

- Cost and earnings

- Liabilities and assets

The ability to measure these aspects of a business is essential for planning and decision making in the company. Financial records are also required to be in compliance with the tax reporting and other requirements of government agencies. Financial records are required at various levels of management to manage and control the operations of the company.

What is the purpose of accounting?

Accounting is the means of recording, studying and communicating financial information within and about a business. It is referred to as the “language of business” for this reason. Financial information about a business drives decision making. The main purposes of accounting are:

Recording transactions

At the simplest level, financial accounting is the recording of the transactions of a business. This day-to-day recording process is the basis of the entire financial accounting system. When transactions are recorded, you are able to look up and retrieve details about a specific transaction whenever you need to. You can also easily compare current data to historic data to see trends. Financial accounting enables us to study and measure the performance of a business over a period of time.

Budgeting and planning

Most small businesses work with a fixed amount of resources to fund their operations. It takes planning and budgeting to properly forecast the resources that the business would require. Budgeting and planning are guided by past records of financial transactions that can be used to project and anticipate future trends. Financial accounting helps the management plan ahead and allocate resources appropriately for the near and distant future.

Decision making

Financial accounting records help drive decision making at all levels of the organization. Every level of management uses the financial data pertaining to their scope of operations in order to make decisions. These decisions could be as simple as determining which supplier is more cost-effective. Managers use these reports to make the operations more efficient and profitable. Financial accounting reports could also be used to make major decisions such as extending the operations of the company to another location. Accurate reporting also makes it easier for the management to avoid losses and mismanagement.

Business performance

Financial accounting reports quantify and measure the success and failure of a company in monetary terms. Business owners can ascertain exactly how much profit or loss the business has made over a period of time. Key performance indicators (KPIs) can measure different aspects of business performance. These KPIs can be studied over a period of time to study the past performance of the business. It can also be used to compare companies with each other. Regular monitoring of reports helps the business owner identify bottlenecks and potential problems and address them before they become a bigger problem.

Financial position

The financial position of a company is of interest to the owners, shareholders, investors and lenders. The precise financial position of a company is seen in the financial accounting reports. These reports tell the business owner or stakeholder exactly how much is invested in the business, its assets and liabilities, profit and loss and cash flows. It also facilitates accurate reporting of the financial information about a company to the government, tax and other regulatory authorities.

Liquidity

Many small businesses fail due to the mismanagement of cash. When you are involved in the daily operations of your business, it may be easy to lose sight of the bigger picture. Studying the financial accounting reports will tell you exactly how much liquidity you have. It will also tell you about how much money is owed to you and how much you owe to others. Using this information to manage your commitments reduces the risk of bankruptcy or financial crisis.

Financing

A company that approaches lenders or investors will have to present accurate financial records and projections. Lenders use this information to study the health of the business and decide if it is worth the risk of lending money. Investors can also determine if it is worth investing and also evaluate how well their investment is performing. A company communicates its financial health and builds credibility by presenting accurate and reliable financial accounting reports.

Why is accounting useful for small business owners?

One of the deciding factors between a successful and a failed business venture is proper financial management. Many small businesses fail, especially in the first year on account of poor financial management. When you are a small business owner, you have limited resources and money to work with. Financial accounting helps you for many reasons such as:

- Manage cash flow: To manage your cash you need to keep track of your money, incoming and outgoing. It is only when you have a grasp of the cash flow in your business that you can plan and strategize well. If you do not record your transactions, you could easily forget what you have paid and what you are owed. You may not have an accurate record of how much profit or loss you made over time.

- Manage costs: Every business has fixed and variable costs. Cost accounting is essential for you to cost your project and know exactly where your money is going.

- Health status: Accounting reports give you a clear report on the different aspects of the health of your business.

- Red flags: Accounting reports make it easier to detect any fraud, embezzlement, or theft within the company. An accounting system’s inbuilt checks and balances make it easy for you to detect any wrongdoing within the company or by suppliers and customers.

- Empowers you: When you have your financial reports in hand, you can face investors, bankers and lenders with the confidence of being backed up by actual facts and figures. This demonstrates that you as the owner of a business have a complete grasp, control and understanding of your business’ finances. It makes your business more attractive to lenders and investors and good accounting important to your company’s image.

- Evolve and improve: Time spent poring over your financial records will show you where your business is doing well and also where there is room for improvement. When you are able to tackle bottlenecks and reduce unnecessary expenditure, it improves the efficiency and profitability of the company. Financial reports also give you information to assess if any changes you have made are yielding positive or negative results.

How TallyPrime as an accounting software helps business owners?

You will find accounting software important for a small and medium business owner for the following reasons:

- Timesaving: TallyPrime is simple and easy to use, so you save a lot of time that would otherwise be spent manually calculating and extracting reports

- Instant: You can generate reports easily and quickly to analyse your business

- Multi-purpose: TallyPrime being an integrated business solution , you manage different

functions of a business such as accounting, inventory, banking, payroll and much more in one place

- Productivity: With the flexibility and the multi-tasking capabilities, TallyPrime greatly enhances the productivity and efficiency of accounting personnel.

- Informed decision making: The automated reports in TallyPrime give your visibility into your business transactions. You can drill down and get to the bottom of any aspect that you need to investigate further. When you rely on accounting to guide your decisions, you can be surer and more confident about them. The best part is, you can personalise the reports the way it works you.

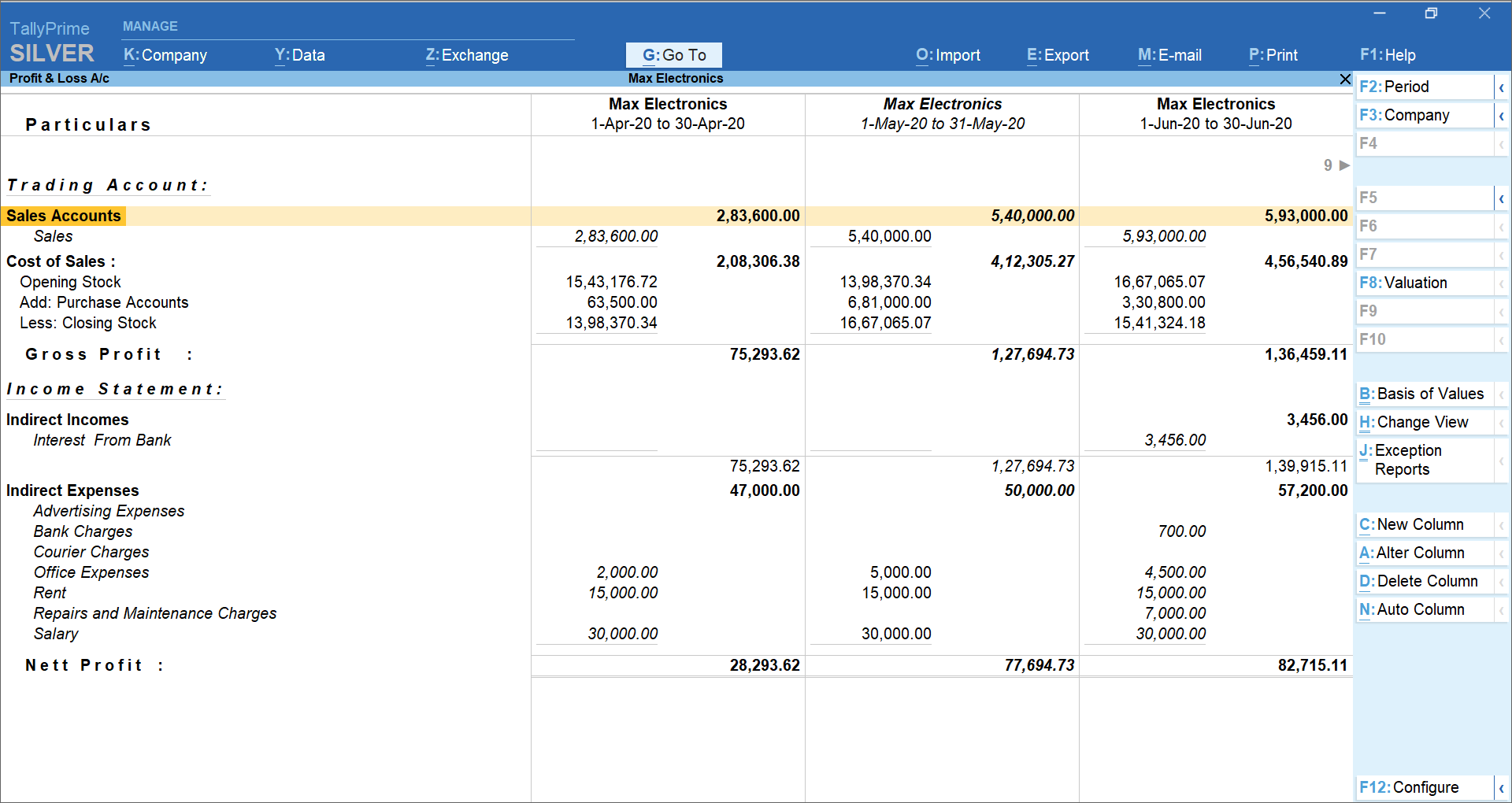

Monthly comparative Profit and loss account in TallyPrime

Read more: