The Profit and Loss statement is an apt snapshot of a company's financial health during a specified time. The income statement, often known as the balance sheet, is a window into the heart of a corporation, presenting revenues, costs, and expenses in a comprehensive style. This financial roadmap provides a real-time picture of a company's income, profits, and the costs incurred to obtain those profits.

The main objective of a profit and loss statement is to identify whether a company made a profit or lost money during a specified time, usually a month, quarter, or year. The statement reveals the financial outcome of a company's operations by subtracting total expenses from total revenues.

We'll delve into the elements that make up this financial tapestry, dissecting it into parts to determine the meaning behind each figure. We will provide the tools to traverse the P&L statement's diverse landscape, from grasping the relevance of gross profit and net income margins to spotting patterns and avoiding frequent mistakes.

|

"Mastering the Profit and Loss statement unlocks the financial story of your business, and with tools like TallyPrime, you can navigate this narrative with precision and confidence." |

How to read P&L?

Navigating the intricacies of a Profit and Loss (P&L) statement might seem like deciphering a complex code, but with the right approach, anyone can master this essential financial tool. The P&L statement's structure and components provide a roadmap for understanding a company's financial performance and are key to unraveling its story.

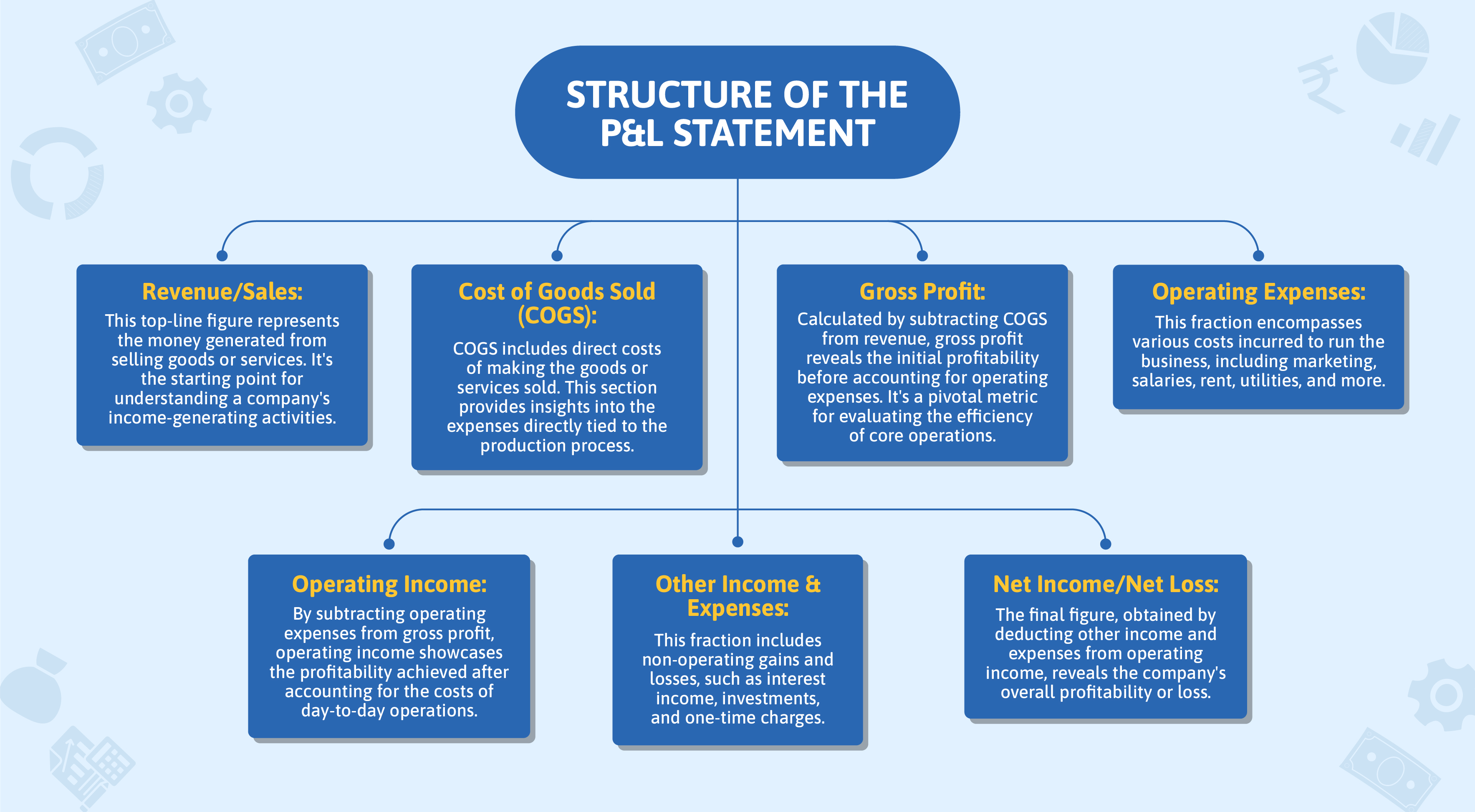

Structure of the P&L statement

The P&L statement is typically structured into several sections that offer a comprehensive overview of a company's financial activity during a specific period. These sections include:

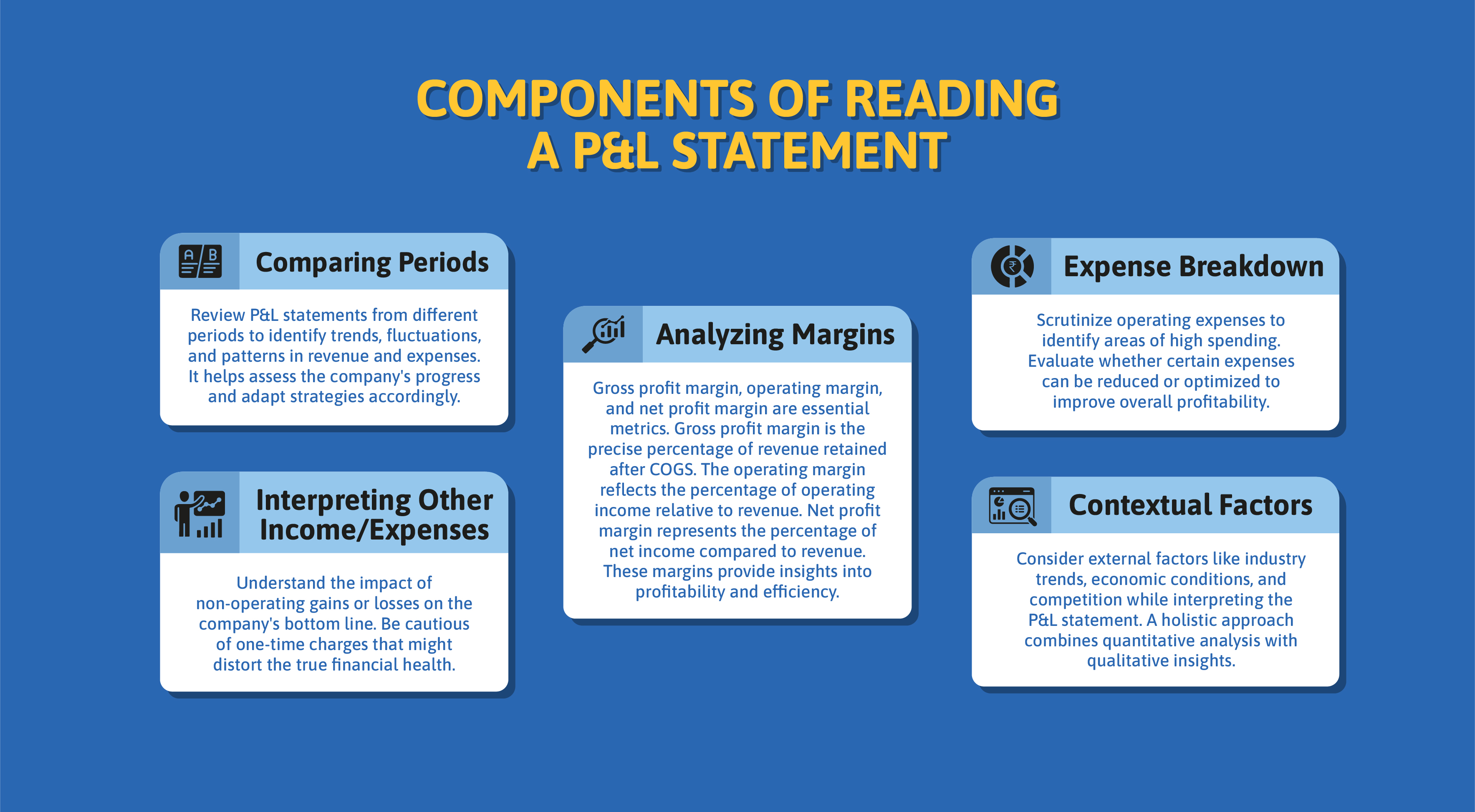

Components of reading a P&L statement

The P&L report is a defining indicator of a business's success. The report that details the company's financial position helps understand the financial health of the firm. Here are the important components for properly reading and interpreting a P&L report:

How to prepare a profit and loss statement?

Devising a Profit and Loss (P&L) statement has evolved, blending traditional accounting practices with modern tools for efficiency and accuracy. Here's a glimpse of creating a P&L statement encompassing traditional and modern-day approaches.

Traditional approach

Preparing a P&L statement traditionally involves manually entering financial data into ledgers and journals. Accountants meticulously recorded revenues and expenses, cross-referencing multiple documents to ensure accuracy. This method was time-consuming and prone to human errors. The data from various sources had to be manually collated and calculated to generate the final P&L statement.

Modern-day approach

With the advent of technology, modern accounting software has revolutionized the process. Businesses now rely on accounting software and financial management platforms to streamline P&L statement preparation. These tools automate data entry, integrate with various financial systems, and generate P&L statements in real time. Cloud-based solutions allow collaboration and accessibility from anywhere, facilitating seamless stakeholder data sharing.

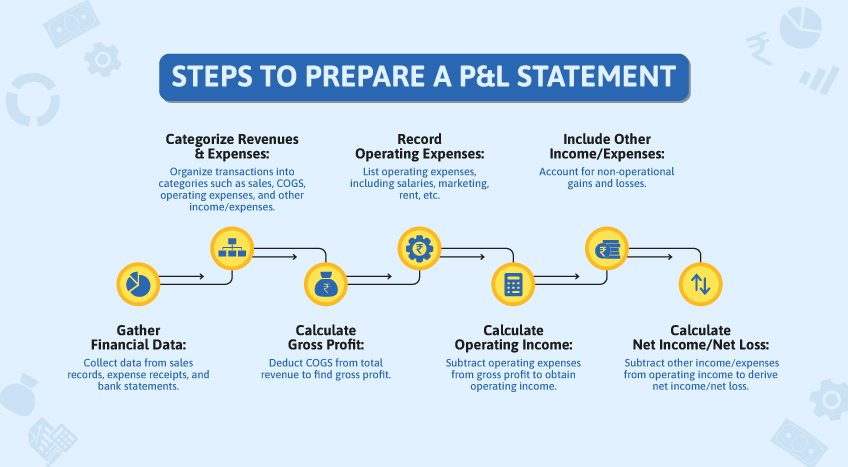

Steps to prepare a P&L statement

Preparing and analyzing P&L in TallyPrime

TallyPrime, a robust accounting software, streamlines preparing and analyzing Profit and Loss (P&L) statements, offering a comprehensive platform for businesses to gain valuable financial insights. With TallyPrime's user-friendly interface, creating a P&L statement becomes efficient and accurate.

Preparing P&L in TallyPrime

- Data input: Easily input financial transactions, including revenue and expenses, through TallyPrime's intuitive data entry system.

- Automated categorization: TallyPrime's intelligent algorithms automatically categorize transactions, reducing manual effort and ensuring accurate data organization.

- Real-time calculations: TallyPrime performs real-time calculations as transactions are recorded, instantly updating the P&L statement as data is inputted.

Analyzing P&L in TallyPrime

- Visual dashboards: TallyPrime offers visual dashboards that visually represent the P&L statement, aiding quick comprehension.

- Comparative analysis: Easily compare P&L statements across different periods to identify trends and make informed decisions.

- Instant insights: With TallyPrime's instant reporting capabilities, businesses gain quick insights into key metrics like gross profit margins and net income.

Wrapping up

Profit and Loss (P&L) statement is a financial compass essential for steering businesses toward success. In modern financial management, tools like TallyPrime are beacons of efficiency and accuracy. TallyPrime seamlessly merges traditional accounting practices with cutting-edge technology, transforming the P&L statement preparation and analysis process. Its user-friendly interface simplifies data entry, automates categorization, and provides real-time calculations. When analyzing your business's financial pulse, TallyPrime's visual dashboards and instant reporting offer invaluable clarity.

Empowered by TallyPrime, you can confidently approach your company's financial data, delve into its narratives, and make informed decisions that shape the trajectory of your business. The P&L statement isn't merely a record of transactions; it's a dynamic tool that guides strategic choices, optimizes resources, and ensures sustainable growth.