- What is life cycle costing in accounting?

- How to use life cycle costing?

- Life cycle costing process

- How business software helps you stay on top of your financials?

What is life cycle costing in accounting?

Life cycle costing is a method of adding up all the costs associated with an asset starting from its initial cost to its end of life. It does not take into account the salvage value or residual value of the asset. Life cycle costing provides an estimate of the cost that an asset will incur in its lifetime. Life cycle costing calculation generally involves adding six types of costs; purchase costs, maintenance costs, operational costs, financing costs, depreciation costs, and end-of-life costs. The summation of these costs gives the life cycle costing value. In some cases, the costs won’t apply to the asset in question and so they are not part of the calculation.

| 3 Key Areas to Strengthen Working capital of your business | 6 Tips for Efficient Cash Flow Management |

Life cycle costing can be highly beneficial to businesses of all types and sizes. It gives a realistic estimation of costs over the course of a product's life. Generally, businesses have the tendency to buy products that have a lower upfront cost. However, with time, the maintenance costs, operating costs, and recurring costs can add up. When these add up, the product can be much more expensive than the one that has a higher upfront cost but a lower recurring cost. Life cycle costing is a time-consuming process but it can uncover costs that can ease the decision-making process.

How to use life cycle costing?

Life cycle costing in accounting enables you to plan efficiently and cut costs along the way. It is used by businesses that are involved in long-term planning. Life cycle costing enables businesses to make better decisions with regard to their investments. If there are two assets you are considering, calculating the life cycle costing of the two assets can unveil which asset is more profitable in the long run. In this way, you can spend your money in the right places. Life cycle costing makes budgeting easier. For example, if you do not know the expenses that will be incurred, you won’t be able to make a reliable budget. With life cycle costing budgeting is more precise.

Let us explore the use of life cycle costing in different areas. In the engineering industry, life cycle costing aids in the development and manufacturing process of the products. These products are made such that they do their job but aren’t too expensive for the customer either. That is the total lifetime cost of the product isn’t a burden to the customer. In the procurement area, businesses will consider life cycle costing to determine which products they should buy and which they should avoid. They will look for items that are cheap to maintain and operate. In capital budgeting, life cycle costing can be used to figure out the ROI which aids in the purchase decisions.

Life cycle costing is mostly used for tangible assets. However, it is applicable to intangible assets too. For example, a business patent. While the costs may be trickier to add up in the case of intangible assets, it is possible to calculate the value of life cycle costing. For example, patents cost money. They require that you hire a knowledgeable individual such as a lawyer. You need to pay for the patent maintenance and so on. When you add all of these costs up, you can come up with the life cycle costing value. In this way, life cycle costing has numerous applications in all aspects of business expenditure.

Life cycle costing process

The Life cycle costing process consists of three major stages. The first stage is developing a plan that will aid in decision-making. It involves determining the objectives such as determining what different options mean for the business. The second stage is the analysis stage which helps with cost control and management. It involves setting targets that can change later on due to precise estimation from other assets that work similarly. The third stage is the implementation and monitoring stage. In this, the performance is implemented and monitored to determine if additional cost savings are possible. This activity can be useful for future investments in assets and planning.

Purpose of life cycle cost analysis

The life cycle cost analysis has the following main purposes.

Cost identification

The purpose of life cycle cost analysis is to identify all types of costs that a business may not think of in the initial stages. Businesses might be tempted with a lucrative offer without realizing that over time the costs surpass the offer pretty quickly. Life cycle cost analysis throws light on whether profits can recover the costs incurred at different stages of a product’s life cycle. Rather than compare individual costs, a cumulative comparison of the options is possible by first identifying all the costs related to the asset or product.

Costs comparison

Another major purpose of Life cycle costing is cost comparison to make effective decisions that can prove fruitful in the long term. Businesses can choose to invest as they wish depending on how much they are willing to spend. When they have various options, it makes sense to compare the costs that will be incurred to make smarter decisions. Let us say product A has a lifetime cost of $500 while product B has a lifetime cost of $650 even though they perform the same function. Comparing costs enables businesses to decide which is the more cost-effective option from the options available. This can maximize profits.

Effective planning

Life cycle costing aids in planning. A business can effectively plan when it is aware of the various costs involved. For example, let us say a product’s initial costs are extremely high, it has a lifetime of 10 years, and the maintenance costs are low. With life cycle costing, a business is aware of all these costs and so it can plan budget allocation accordingly. Additionally, it uncovers when a product needs a higher investment in comparison. For instance, if a product needs higher investment during the operational phase, then a business is better prepared to invest and spend at that time. Without life cycle costing, expenditure planning is tougher although possible.

Life cycle costing assessment example

Let us take a simple example of equipment to explain the life cycle costing assessment and how it works.

|

Particulars |

Value |

|

Purchase cost |

10,000 |

|

Installation cost |

500 |

|

Operating cost |

3,000 |

|

Maintenance cost |

1000 |

|

Depreciation value |

500 |

|

Disposal value |

1000 |

|

Life cycle costing |

16,000 |

The initial investment to buy the equipment is 10,000 for the purchase while the life cycle cost turned out to be 16,000.

How business software helps you stay on top of your financials?

When you are running a business, tracking costs and revenue are the core functions. Without a business software such as TallyPrime in place, tracking costs can be challenging and time-consuming. Businesses should get in the habit of using accounting software from the start as it simplifies accounting tasks. TallyPrime empowers businesses to manage cash flow, perform accounting calculations, generate insightful reports, securely access data, and manage inventory effectively. All this is to efficiently organize your business financial data so you can make decisions related to investment and costs.

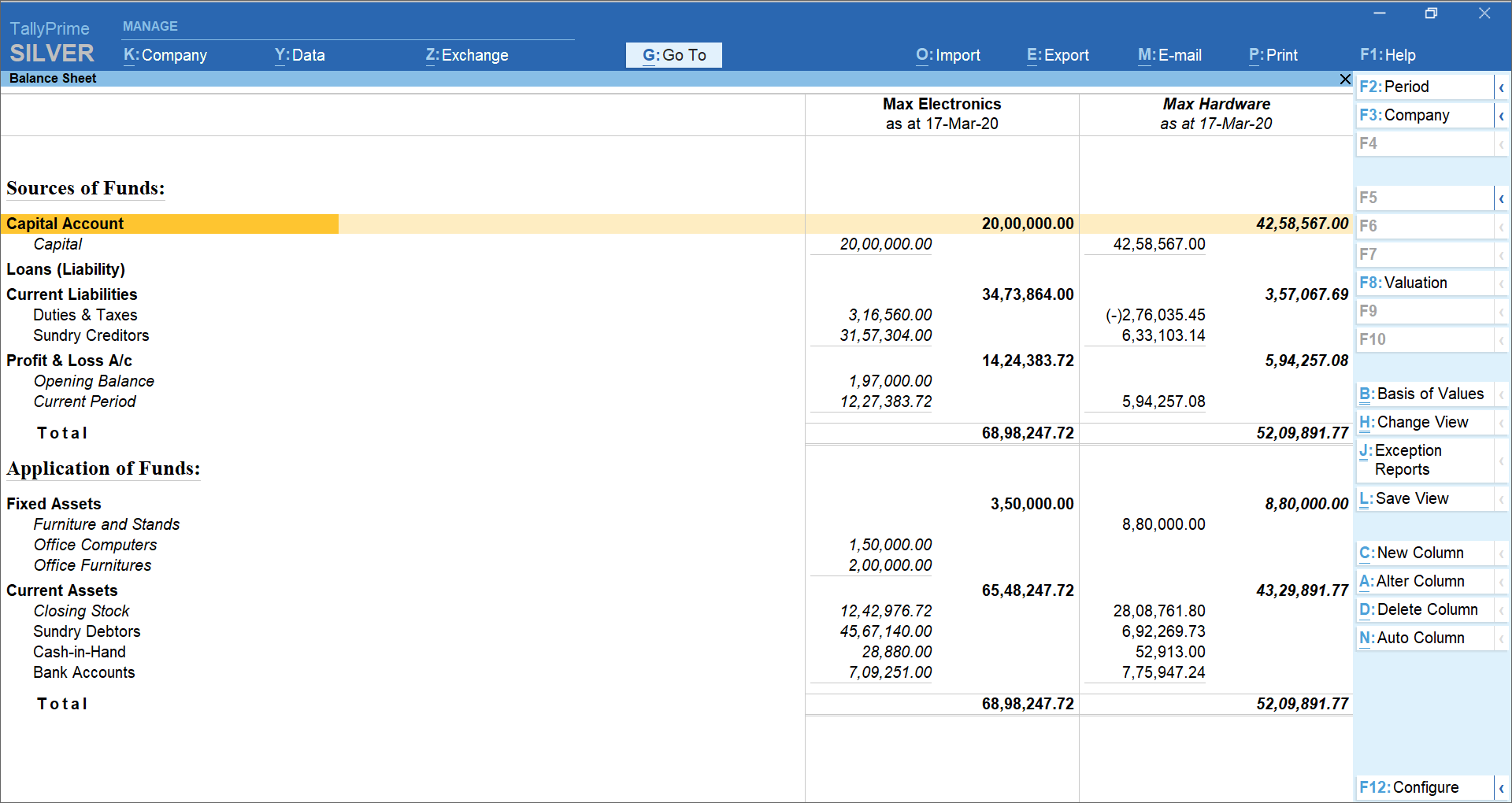

Company-wise comparative balance sheet in TallyPrime

Read more: