- What is a balance sheet?

- What is the purpose of a balance sheet?

- How to read a balance sheet with example

- How the balance sheet works with the other financial statements

- Stay ahead with business management software

What is a balance sheet?

A balance sheet is also called the statement of financial position. It is amongst the three financial statements that are important, with the other two being the income statement and cash flow statement. It is important that you learn how to read a balance sheet because it shows the health of your business at a particular time which is the end of the reporting period such as the end of the month, quarter, or year. The balance sheet is divided into three major sections as follows.

Assets

Assets are the things or resources owned by a business. They are the first portion in the balance sheet and the amount is the one that was paid to acquire the resource. Note that if you installed a new machine in the business then the installation cost and operation cost will also be part of this amount. Examples of assets include vehicles, prepaid expenses, accounts receivable, equipment, and cash. Assets have current assets that can be converted to cash within a year and they include short-term investments, inventory, supplies, and cash equivalents. Assets also include long-term assets which require a longer time to be converted to cash such as intangible assets, property, and investments.

Liabilities

Liabilities are the amounts that the company owes other people and entities. Examples of what is included in the liabilities section in the balance sheet are bonds payable, short-term loans payable, accounts payable, and accrued liabilities. The liabilities are categorized into two sub-sections; current liabilities and long-term liabilities. Current liabilities are what the company must pay within a year. They include income taxes payable, accounts payable, deferred revenues, and accrued compensation and benefits. Long-term liabilities or noncurrent liabilities are those which can be paid a year later and include bonds payable, notes payable, and deferred income taxes.

Equity

This is the last section of the balance sheet. If a business is a corporation, then the section is titled shareholder’s equity or stockholder’s equity. However, if a business is not a corporation and instead has a sole proprietorship, then the title will be owner’s equity. In the case of stockholder’s equity, there are separate amounts specified for retained earnings, treasury stock, common stock, and accumulated other comprehensive income. Equity is found by subtracting liabilities from the assets of a business. They are also called sources of assets because they can be used by the business in certain cases to pay off debts.

What is the purpose of a balance sheet?

What is the purpose of understanding how to read a balance sheet? A balance sheet enables you to get a glimpse of the financial health of your business at a point in time. It gives you details about how much you have accumulated over a course of time and how much you have borrowed from other entities. You can compare the balance sheet generated to the previous ones you have. This can show you how your company’s finances and the situation have changed over the course of years. It can show you how far you have come along since you started your business. That is, you can see how much your business has grown over the years.

The balance sheet can throw light on whether you can make payments that are due within a span of one year. This is done by comparing your current assets to your current liabilities. Let us say you have to pay employee salaries. Do you have cash in hand to pay the employee salaries on time? This is shown on the balance sheet. If your current liabilities exceed your current assets, it means you will have trouble paying for your upcoming payments. If current assets exceed current liabilities in the balance sheet, then it means you can cover the upcoming expenses. Equity is also considered because if you have equity, you can still pay using equity.

You can find out liquidity with the help of the balance sheet. High liquidity means you have enough cash on hand to handle your obligations. Do you have enough in your bank account? Do you have enough equity? How easily can you get cash in hand if sufficient cash isn’t available in your bank account? All of these questions can be answered with the help of the balance sheet. The balance sheet can let you know if you are eligible for long-term loans. Your company is highly leveraged if your current and long-term liabilities outweigh current equity. Lenders will think twice before lending as you will be deemed high-risk. The balance sheet can shine the spotlight on vital areas in your business.

How to read a balance sheet with example

It will become clear how to read a balance sheet with an example.

|

Future Arc Balance Sheet Dec 31, 2020 |

||

|

ASSETS |

|

|

|

Current Assets |

|

|

|

|

Bank Accounts |

|

|

|

Checking Account |

$50,000 |

|

|

Total Bank Accounts |

$50,000 |

|

Other Current Assets |

|

|

|

|

Accounts Receivables |

$200 |

|

|

Prepaid Expenses |

$300 |

|

|

Total Other Current Assets |

$500 |

|

|

Total Current Assets |

$50,500 |

|

Fixed Assets |

|

|

|

|

Office Equipment |

$4,000 |

|

|

Accumulated Depreciation Office Equipment |

$1,000 |

|

|

Total Office Equipment |

$3,000 |

|

|

Total Fixed Assets |

$3,000 |

|

Other Assets |

|

|

|

|

Company Expense |

$2,500 |

|

|

Rent Deposits |

$5,000 |

|

|

Total Other Assets |

$7,500 |

|

Total Assets |

|

$61,000 |

|

|

|

|

|

LIABILITIES |

|

|

|

Current Liabilities |

|

|

|

|

Credit Cards |

|

|

|

American Express CC |

$8,000 |

|

|

Total Credit Cards |

$8,000 |

|

Other Current Liabilities |

|

|

|

|

Payroll Liability |

|

|

|

CA Income Taxes Payable |

$500 |

|

|

Total Other Current Liabilities |

$500 |

|

Total Current Liabilities |

|

$8,500 |

|

|

|

|

|

EQUITY |

|

|

|

|

Opening Balance Enquiry |

$9,500 |

|

|

Retained Earnings |

$30,000 |

|

|

Net income |

$13,000 |

|

Total Equity |

|

$52,500 |

|

|

|

|

|

Total Liabilities & Equity |

|

$61,000 |

Let us understand each of the three sections contained in the balance sheet so you can better comprehend how to read a balance sheet easily.

Assets

The Future Arc corporation’s assets are what it owns. The current assets are those which Future Arc is going to convert to cash within a period of one year. Current assets are also called cash in hand because they are easily convertible to cash when required. According to the balance sheet, the largest asset of the corporation is the cash it has deposited in its cash account which amounts to $50,000. The accounts receivables and expenses are other current assets. The account receivables is the amount that Future Arc is yet to receive (which is $200) but will receive shortly. The expense part shows Future Arc’s prepayment for goods or services it hasn’t received yet.

The assets section of Future Arc corporation also has a sub-section titled fixed assets. This section contains details of assets that Future Arc uses to operate its business. In this hypothetical scenario, Future Arc uses office equipment such as machinery and other equipment that amount to $4,000 in value. The balance sheet also factors in the depreciation value of the fixed assets and so in this case the depreciation value is $1,000. This means the value of office equipment will decrease by $1,000 over a period of time. The total value of the office equipment is going to be $3000 after the depreciation value has been factored in.

Liabilities

The liabilities are what Future Arc owes other entities such as vendors, banks, and service providers. In the example balance sheet, you can see the section called current liabilities which are liabilities that Future Arc must pay back within a year. As Future Arc hasn’t paid credit card charges of $8,000, these come under the current liabilities section. Future Arc owes American Express $8,000. Future Arc also owes $500 in income taxes which is reflected in the balance sheet. Note that if Future Arc pays the whole credit card amount it owes, then the balance sheet will change because the credit card charges will be nil. Any changes to what it owes will reflect changes in the balance sheet.

Equity

The equity section may also be written as stockholder’s equity or owner’s equity in some balance sheets. The equity is the amount that will be left when the liabilities are paid off completely and the assets are sold. According to the balance sheet equation, the total assets should equal total liabilities plus total equity. To compute the equity, we need the total assets and subtract that by total liabilities. In this balance sheet, the total assets are worth $61,000 and the total liabilities are $8,500. Hence, the equity amount is equal to $61,000 - $8,500 which is equal to $52,500. If Future Arc would get liquidated at this point, it would have $52,500 cash in hand.

How the balance sheet works with the other financial statements

It is vital you know how to read a balance sheet and although a balance sheet is a great tool to figure out the performance of your business, the other two financial statements are important to look into as well. The three statements together give you a more clear and detailed idea about your business. The first is the income statement which is also known as the profit & loss statement or P&L statement for short. It shows how much money is coming into your business and how much is going out. It shows the revenue your business is generating and the expenses incurred. The other statement is the statement of cash flows.

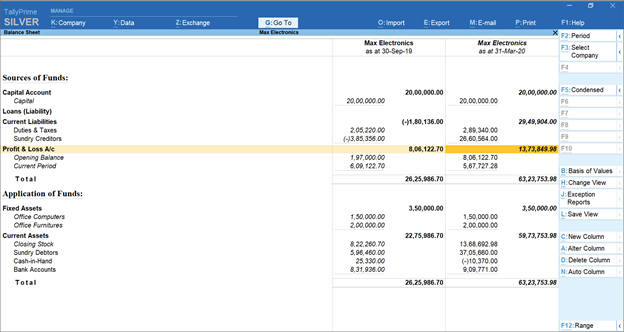

Half-yearly Comparative balance sheet in TallyPrime

The statement of cash flows shows you how much actual cash there is in your business. Businesses using accrual accounting include amounts that have not yet been received by your business such as money that your customer is supposed to send. These are already included as income in the income statement and balance sheet. As you don’t have the money yet in your business, it shouldn’t be counted as cash that you have at hand. The statement of cash flows shows how much you have actually received and you actually have. When all three statements are analyzed together, they can paint a better picture of your business and its current status.

Stay ahead with business management software

You must use business management software if you want accurate transactions to be recorded and tracked. TallyPrime is a business software that offers a wide range of features so you are aware of your current performance. It provides insights that you can use to make key decisions so you can improve your business in the long run. TallyPrime generates over 400 reports that empower you to make smart decisions for the better health of your business and long-term gains. The software gives you control so you can manage your business easily and keeps you up to speed about things that need your immediate attention. It is a complete business accounting and management software.