In business, current assets are like the cash you keep in your wallet or the money you have in your checking account – they're the immediate resources that you can readily use to keep your operations running smoothly. Think of them as your financial safety net, ensuring you can cover day-to-day expenses and handle any unexpected costs that pop up.

These assets include things like cash in the bank, money owed to you by customers who still need to pay, and even inventory that you plan to sell soon. They're all about keeping your business flexible and agile, ready to seize opportunities or weather any storms that come your way.

For example, if you suddenly need to repair a piece of equipment or pay a supplier upfront for a bulk order of materials, your current assets are there to back you up. They're the lifeblood of your business, ensuring you can keep the wheels turning without missing a beat.

So, it's crucial to keep a close eye on your current assets. They're not just numbers on a balance sheet – they're the heartbeat of your business, keeping you in the game and ready for whatever comes next.

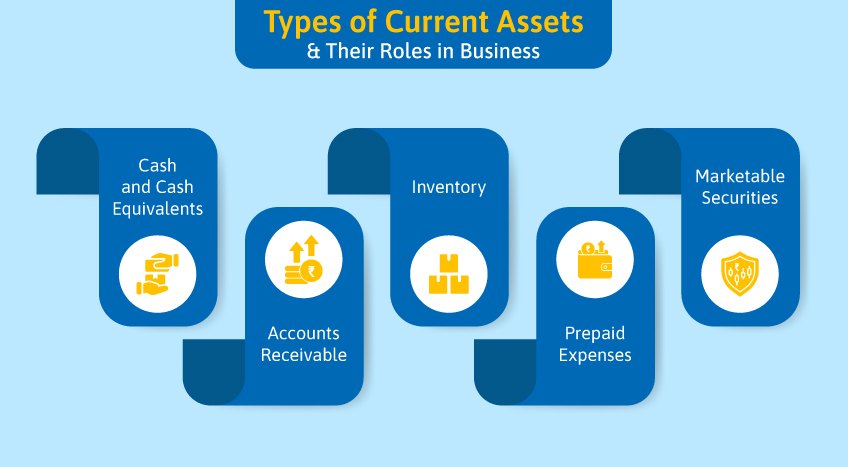

Types of current assets and their role in business

In every business, assets are the resources that a business needs to run and develop its operations. These resources can be current and noncurrent assets. However, different types of accounting assets serve different purposes.

Below are the different types of current assets and their examples:

Cash and cash equivalents

These current assets showcase the high liquidity that can be used right away or converted into cash quickly. Companies or businesses use these assets to meet their short-term financial obligations and are characterized by their high liquidity nature. These assets lie in the minimal risk of value fluctuations.

- Cash is an essential current asset that can be present as coins or banknotes, which companies need for everyday transactions.

- Current and savings accounts with financial institutions or banks represent current assets. These accounts are liable for facilitating efficient management of daily operational expenses and receipts.

- Short-term investments have a maturity period of less than 3 months, including money market funds and treasury bills. These instruments provide a higher return than traditional bank accounts with a high level of liquidity.

Accounts receivable

These current assets highlight the amount owed to a business by its customers or clients for goods and services on credit. It represents all the outstanding payments that need to be collected quickly. Moreover, accounts receivable are crucial for businesses and companies because they showcase the expected cash inflow shortly. Examples of Accounts Receivable are:

- Trade receivables are amounts customers owe for the sale of goods.

- Outstanding invoices represent the money due for services rendered.

Monitoring and managing accounts receivable is essential for balancing and maintaining a healthy cash flow and financial stability.

Inventory

Inventory is the company's goods and materials for production, resale, or operations. This current asset is essential for businesses working in manufacturing or retail industries. The current assets showcase the value of products ready for sale or in different production stages. Examples of Inventory include:

- Raw materials for production

- Work-in-progress, representing goods in the process of being manufactured

- Finished goods are final products ready for sale

Effective inventory management balances production needs with customer demand and avoids overstock or stockouts.

Prepaid expenses

These current assets are the payments made in advance for goods and services to the client. However, the services are to be received in the future. These current assets are considered prepaid because they highlight the economic benefits for the company. Examples of Prepaid Expenses are:

- Prepaid rent - a company pays rent in advance for the use of a property

- Prepaid insurance, where insurance premiums are paid ahead of the coverage period.

These assets are gradually expensed over time when the benefits are realized. Therefore, it helps in accurate financial reporting.

Marketable securities

Marketable Securities are current assets that companies or investors can quickly buy or sell. These assets can be converted into cash whenever needed almost immediately. Marketable securities are called current assets because of their highly liquid nature. Examples of Marketable Securities include:

- Stocks that represent ownership in a company

- Bonds which are debt securities issued by governments or corporations

These assets provide companies with flexibility and a source of liquidity. It also yields high returns while earning through interest or capital appreciation. Managing marketable securities involves balancing risk and return to optimize the company's financial position.

Importance of managing current assets for businesses

Financial companies or businesses need to manage their current assets effectively. It maintains the financial health and stability of a business. Moreover, current assets can be easily converted into cash quickly and play an essential role in sustaining day-to-day operations. Two primary aspects highlight the importance of managing current assets:

Liquidity management

- Managing current assets ensures there's enough cash flow in the company's financial bank to cover daily expenses, seize investment opportunities, and tackle unexpected financial challenges. Without sufficient liquidity, businesses risk missing out on opportunities and disrupting operations.

- Additionally, current assets are vital for meeting short-term obligations like paying suppliers, servicing short-term debt, and handling unforeseen financial emergencies. Maintaining liquid assets such as cash and marketable securities is crucial to fulfill these demands promptly.

Working capital management

- Managing working capital optimizes cash flow. It's about efficiently turning raw materials into finished products, selling them, and collecting cash from customers. Efficient management ensures smooth operations and minimizes unnecessary investment in inventory.

- Balancing current assets and liabilities is crucial. There should be enough assets to cover short-term obligations without holding excess cash, maximizing profitability, reducing financing costs, and enhancing efficiency.

Wrapping up

The strategic management of current assets is essential for accounting fundamentals and the company's financial well-being. This liquidity management results in a steady cash flow, which fulfills short-term obligations. On the other hand, working capital management optimizes the cash conversion cycle and maintains a balanced relationship between assets and liabilities.

This necessitates a holistic approach to current asset management for businesses aiming for long-term success and financial resilience. Tally Solutions offers the best accounting software to business owners for efficiently managing their SMBs. The software offers greater flexibility and efficiency while easily adapting to your business and your way of working.