- Definition of accounts receivables

- Accounts receivables examples

- Accounting receivables in books of account

- Accounts receivables in financial statement

- Accounts receivables process

- Importance of accounts receivables

Definition of accounts receivables

Accounts receivable refers to the amount that a company is entitled to receive from its customers for goods or services sold on credit. In other words, it is the amount that your customer owes you in respect of contractual obligations.

Accounts receivables are also known as debtor, trade debtors, bills receivable or trade receivables.

Accounts receivables examples

On 1st June, 2020, Max Enterprises sold goods worth 75,000 to National Traders with a credit period of 15 days. From 1st June to the date the bill is paid, 75,000 will be treated as accounts receivables against National Traders account.

Let’s say, on 10th National Traders paid 50,000 to Max Enterprises. This will be reduced from National trader’s account. Post adjustment, the overall accounts receivable will be 25,000.

Likewise, when you sell on credit to different customers, it will be added to the overall accounts receivable and when you receive from the customers, it will be reduced.

How to record accounts receivables in the books of account?

The following are journal entry to account and adjust the accounts receivables in the books of account

When a sale is made on credit

Dr National Traders a/c (Customer) 75,000

Cr Sales a/c 75,000

When a sale bill is paid

Dr Bank/Cash a/c 75,000

Cr National Traders a/c 75,000

Treatment of accounts receivables in financial statement

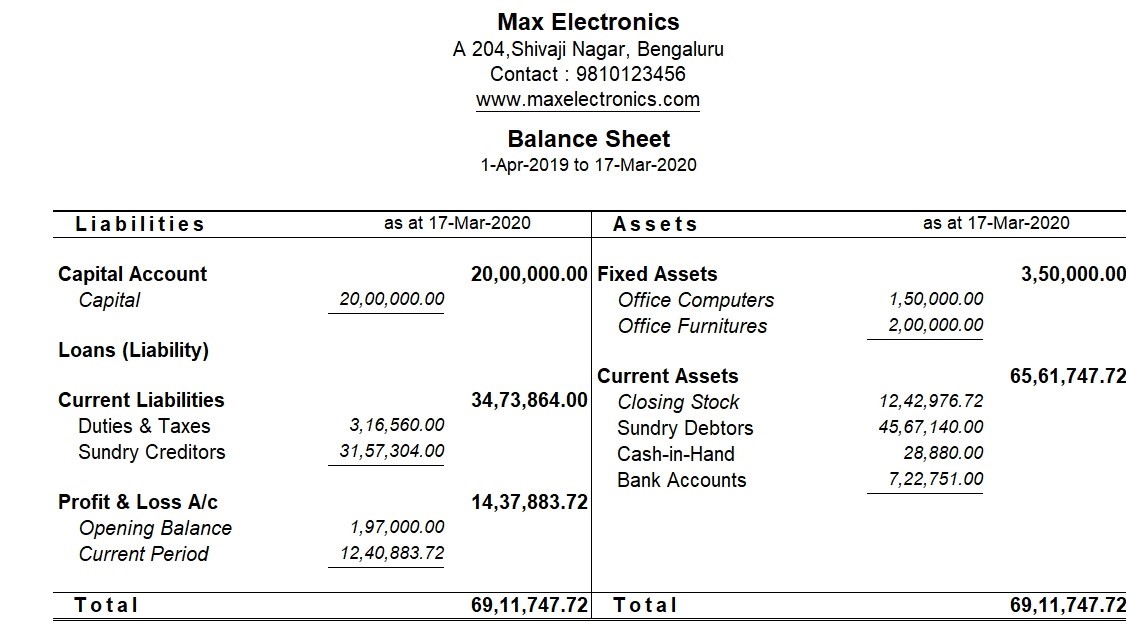

As you know, accounts receivable is the amount that is yet to be received from your customers within a defined period, usually a short period, thus it is treated as current assets. As on the date of creating financial statements, the total accounts receivables are shown under the current asset section of the balance sheet as bills receivables, sundry debtors, trade receivables etc.

The sample format of accounts receivables in the balance sheet is shown below:

Accounts receivables process

While the process of accounts receivables differs from business to business, we have listed common things that you will get to see in accounts’ receivables process followed by most businesses.

- Invoicing the customer on credit as per the credit policy

- Capturing or recording the credit days or due date

- Follow-up and collection schedule

- Generating the overdue bills and the ones that are pending for the longer time

- Sending reminder letter with the details of bills that are pending

- On receiving payment, account for the receipt and adjust the receivables accordingly.

- If there are any cash discount for early payment, the relevant adjustment to the receivables account needs to be made.

Costs of accounts receivables

- The company requires additional funds as cash is blocked in receivables which involves a cost in the form of interest (loan funds) or opportunity cost (own funds)

- Administrative costs such as record keeping, sending reminder letters etc.

- Collection costs

- Defaulting costs as a result of bad debts

Importance of accounts receivables

Management of receivables refers to planning and controlling of debt owed to the customer on account of credit sales. In simple words, the successful closure of your order to sales is determined only when you convert your sales into cash. Till your sales are converted into cash, you need to manage ‘how much you need to receive? from whom? And when?

To do this, you need accounts receivables management, popularly known as a credit management system in place.

Another reason, accounts receivables are one of the key sources of cash inflow and given the volume of credit sales, a large amount of money gets tied up in accounts receivables. This simply implies that so much money is not available till it is paid. If these are not managed efficiently, it has a direct impact on the working capital of the business and potentially hampers the growth of the business.

Take a look at 6 tips to manage accounts receivables efficiently

On the other side, managing accounts receivables efficiently will benefit the business in several ways. The most important is the increased cash inflow by a faster realization of sales to cash. It also helps you to build a better relationship with your customer by not having discrepancies in pending bills and mitigates the risk of bad debts. All these require you to be top of your account’s receivables and you can easily achieve this by using accounting software. It helps you track, monitor, and on-time action on overdue/long-pending bills resulting in an increased inflow of cash that is essential for business growth.

Read more on Cash and Credit Management