- What are accounts receivables?

- What are accounts payables?

- What is the difference between accounts receivables and accounts payables?

- How to record accounts receivables?

- How to record accounts payables?

- Example of accounts receivables

- Example of accounts payables

Accounts receivables - Definition

Accounts receivable refers to the amount that a company is entitled to receive from its customers for goods or services sold on credit. In other words, it is the amount that your customer owes you with respect to contractual obligations.

Accounts receivables are also known as debtors, trade debtors, bills receivables or trade receivables.

Read more on Accounts Receivables – Definition, Example and Process

Accounts payables – Definition

Accounts payable is any sum of money owed by a business to its suppliers shown as a liability on a company's balance sheet. In simple words, when you buy goods or services with an arrangement to pay later, such an amount till it is paid, is referred to as accounts payable.

Accounts payable is also called as bills payable and the total amount that a company is liable to pay is shown as liability under the head ‘sundry creditor’ in the balance sheet.

Read more on Accounts Payable – Definition, Example and Process

What is the difference between accounts receivables and accounts payables?

Sound management of accounts receivables and accounts payables is crucial to assess a company’s financial health. While the two types of accounts are recorded in more or less similar way, it is imperative to keep in mind that one is an asset account and the other is a liability. Now, with the definition above, it can easily be concluded that accounts receivable is the money owed to your business by customers whereas, accounts payable is the money you owe to the suppliers. This gives us a clear understanding of which account is recorded under what criteria in the financial statement of a company. Since accounts receivable is the money owed to you, this will be recorded under assets, and since accounts payable is the money you owe, this will be recorded under liabilities.

|

Accounts Receivables |

Accounts Payables |

|

Money owed to your business |

Money you own to your supplier |

|

Current Asset |

Current Liability |

|

Sundry Debtors |

Sundry Creditors |

How to record accounts receivables?

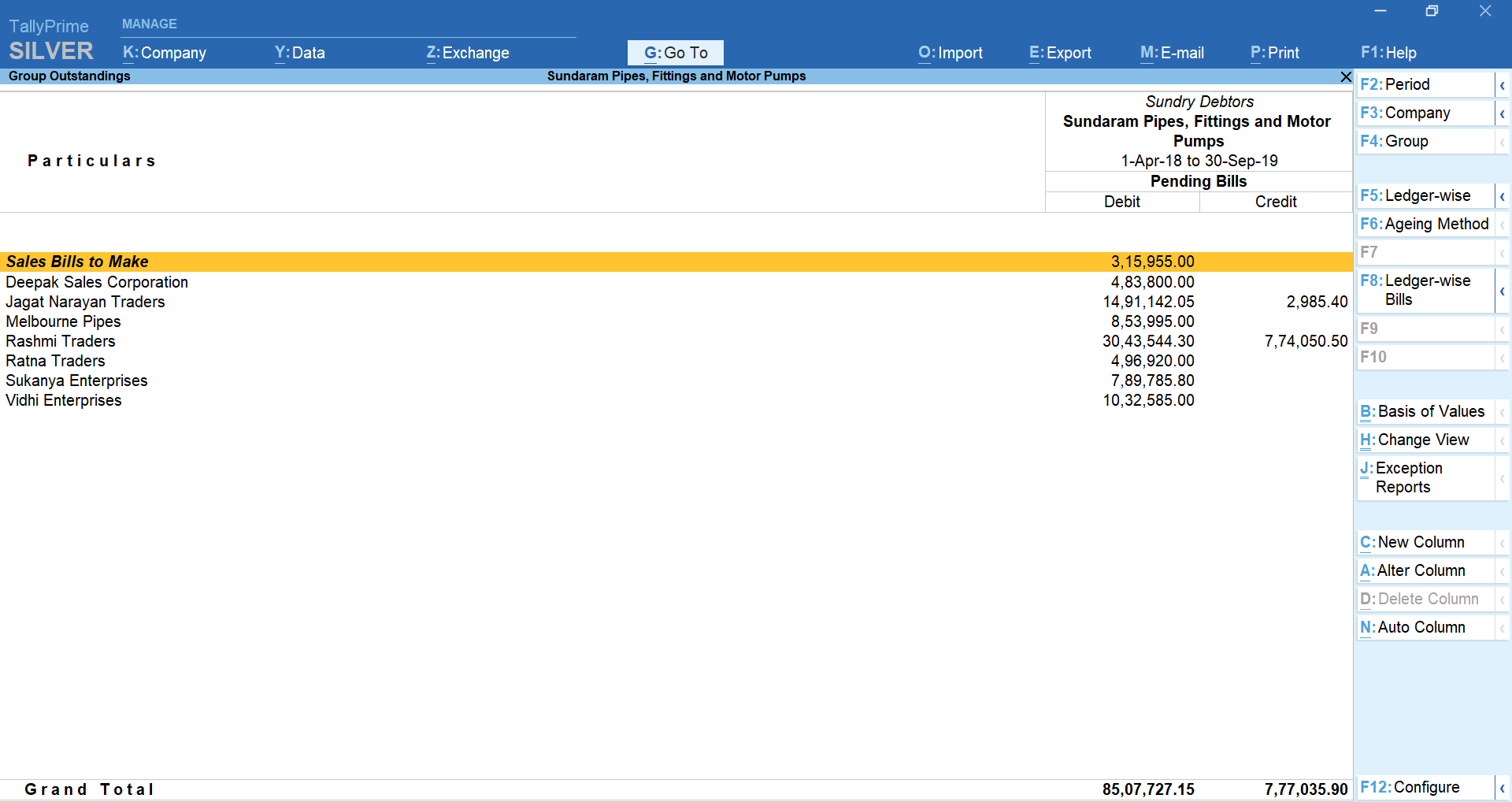

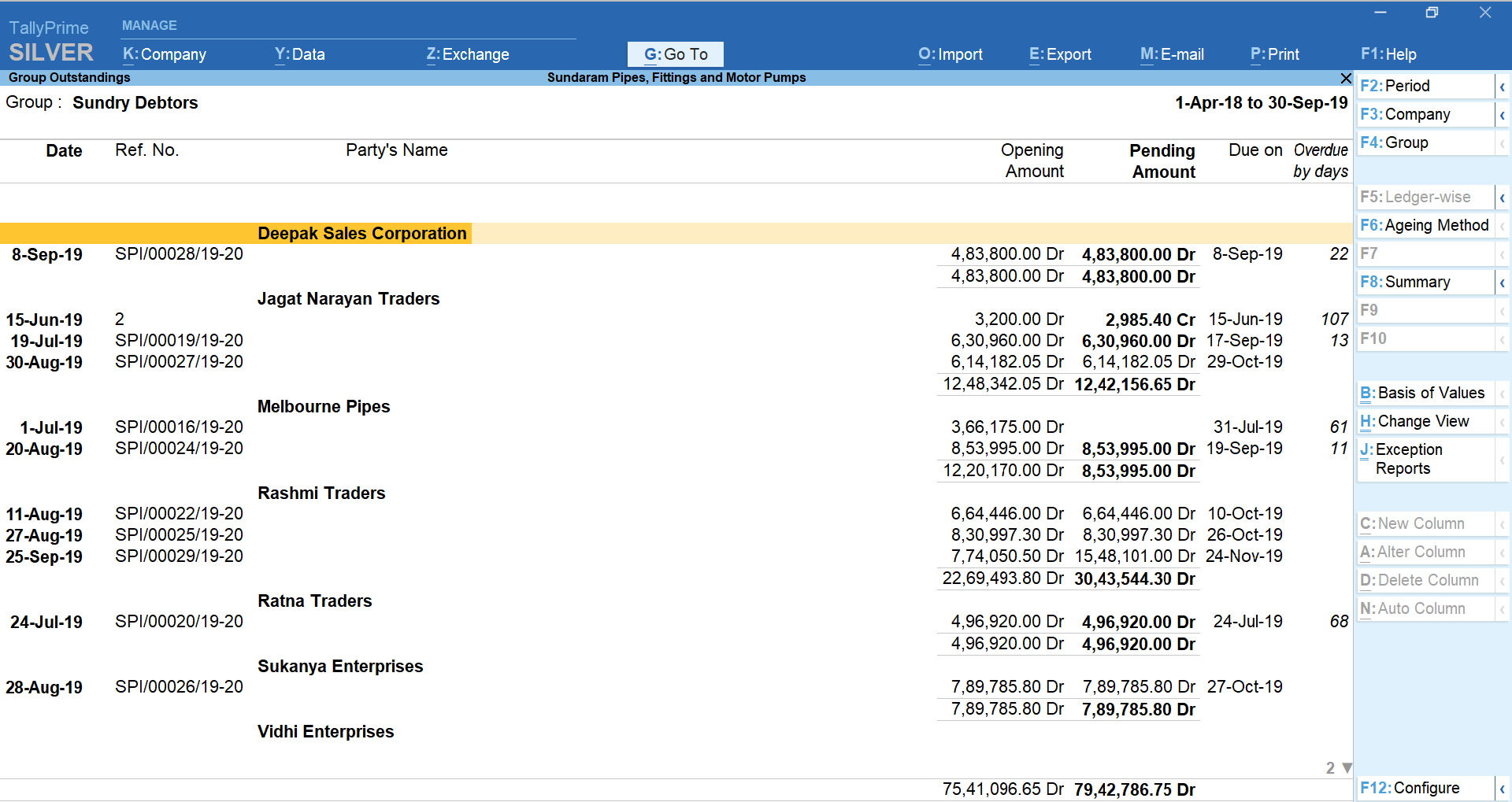

Recording of accounts receivables is extremely simple with TallyPrime. If you have a good relationship with your parties and trust them, and have sold goods or services on credit, TallyPrime takes care of tracking all your outstanding receivables from the parties. By referring to the corresponding reports, you can simply follow up with your parties, when needed, for recovery of the due amounts.

The following are journal entry to account and adjust the accounts receivables in the books of account

When a sale is made on credit

Deepak Sales Corporation (Customer) 4,83,800

Cr Sales a/c 4,83,800

When a sale bill is paid

Dr Bank/Cash a/c 4,83,800

Cr Sundaram Pipes and Fittings a/c 4,83,800

Once all the relevant ledgers of your accounts receivables have been recorded, you can view all your receivables at a glimpse. You can also change the view of these transactions as per your preference.

You can also view ledger-wise bills and understand the payment performance of your debtors and keep a track of your receivables to maintain optimum cash flow for your business.

How to record accounts payables?

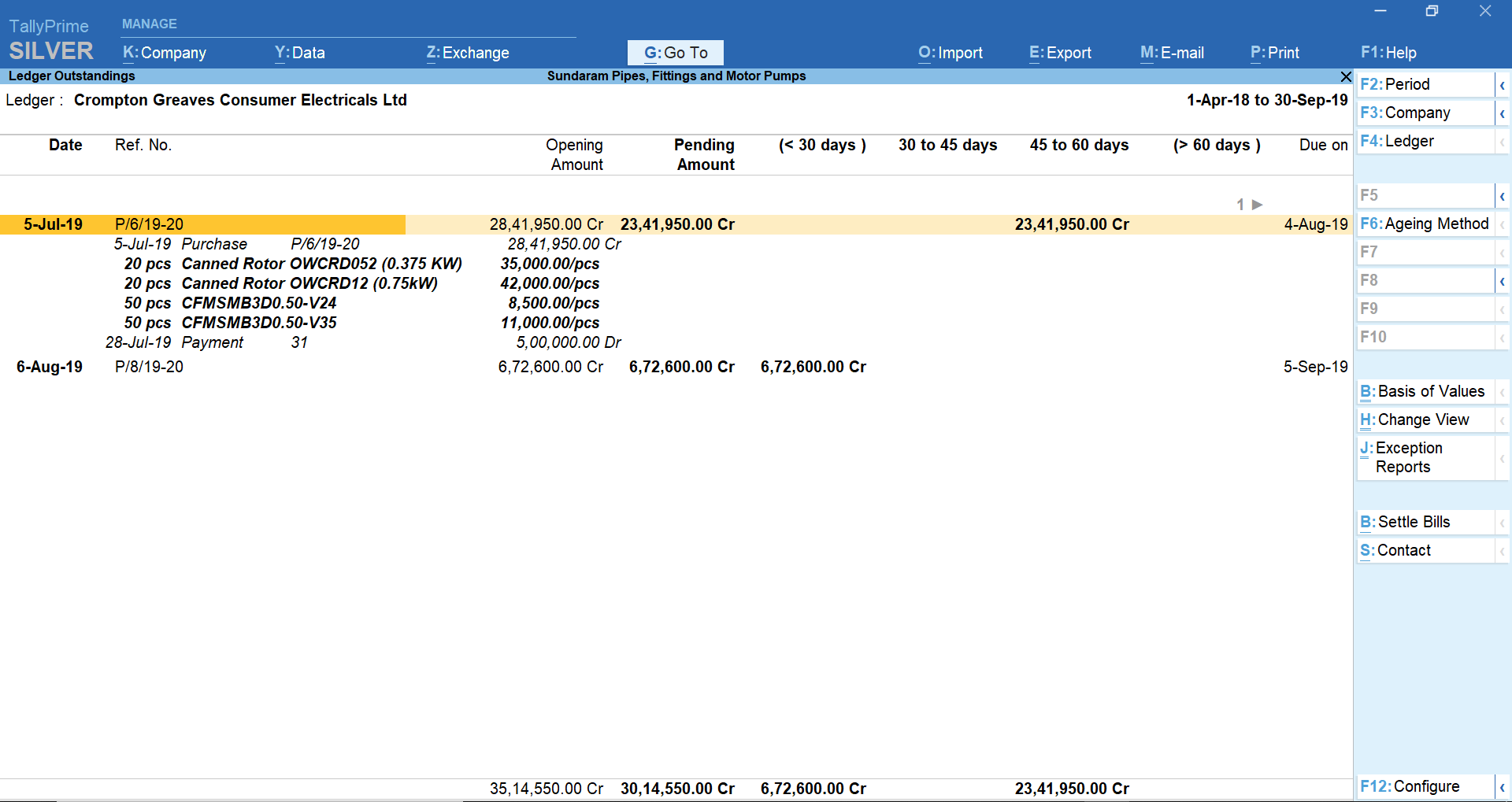

The outstanding payables report in TallyPrime gives you an overview of what your business owes for supplies, inventory, and services. You can get an overview of the amount and the creditors to whom you owe money and how much you owe each creditor and how long the money has been owed. Managing your outstanding payables will help you to know the time-to-time expenses, avoid overseeing the payments that you owe to the creditors, and help you manage the cash-flow in your business.

When a purchase is made on credit

Crompton Greaves Consumer Electricals (Supplier) 30,03,550

Cr Purchase a/c 4,83,800

When the purchase bill is paid by you

Dr Sundaram Pipes and Fitting a/c 4,83,800

Cr Crompton Greaves Consumer Electricals (Supplier) 4,83,800

Similar to the receivables report, TallyPrime gives you the liberty to choose a view based on your choice. With pre-built configurations to customise viewing of reports, TallyPrime allows you to analyse and slice and dice the reports the way you want.

With various options available you can see your credit period, maintain vouchers bill-wise for a particular party and even settle bills, at a click of a button. When you make a purchase of large amount and unable to pay at a time and have agreed to make partial payments in regular intervals, you can split such purchases into multiple bills. This helps you to track the payment breakup against the bills created and manage your outstanding payables systematically.

Example of accounts receivables

Let’s say on 1st August, 2020, Giri Enterprises sold goods worth 50,000 to Hinduja Traders with a credit period of 30 days. From 1st August to the date the bill is paid, 50,000 will be treated as accounts receivables against Hinduja Traders account.

Let’s say, on 15th Hinduja Traders paid 25,000 to Giri Enterprises. This will be reduced from Hinduja Traders’ account. Post adjustment, the overall accounts receivable will be 25,000.

Likewise, when you sell on credit to different customers, it will be added to the overall accounts receivable and when you receive from the customers, it will be reduced.

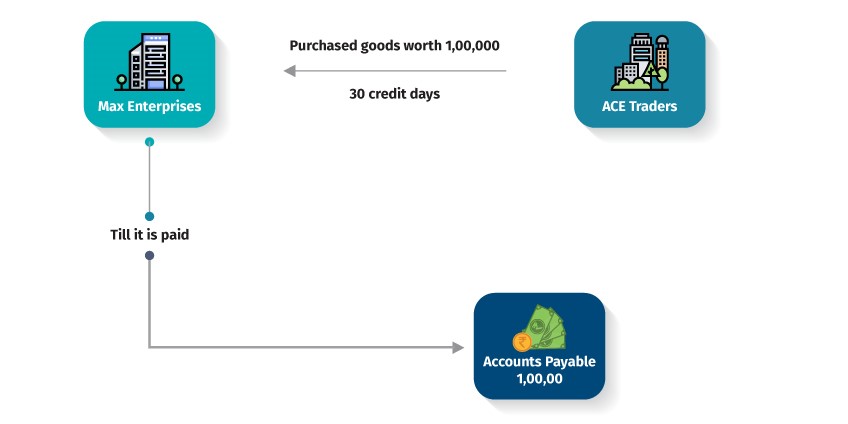

Example of accounts payables

Giri Enterprises purchased goods worth 1,00,000 from Falcom Traders. Falcom Traders offered a credit period of 30 days within which the bill should be paid by Giri Enterprises.

Here, till the date Giri Enterprises pays Falcom Traders, INR 1,00,000, it will be called as accounts payables and be shown as a liability towards creditors in the balance sheet.

Managing your accounts receivables and payables helps businesses maintain their working capital. While accounts receivables lead to the generation of cash in-flow in the financial books, maintain a good relationship between you and your vendor and hold a good credit score, accounts payables help in assessing the payment performance of debtors and improve liquidity. Keep your accounts receivables and payables at an all-time steady with TallyPrime. Take a free-trial today and be amazed!

Watch Video on How to Track and Match Invoices using TallyPrime’s Receivables and Payable Management

Watch Video on Receivables, Payables & Effective Inventory Handling In Tally

Watch Video on How to Manage Receivables and Payables using Bill wise Details in TallyPrime

Read more on Cash and Credit Management

Accounts Payable, Fund Flow Statement, Accounts Receivables, Cash Flow Projection, Receivable Management, Cost of Accounts Payable, How to Calculate Cash Flow?, Accounts Receivables Turnover Ratio

Accounts Receivables & Accounts Payables

What is Accounts Receivables, Accounts Receivables Turnover Ratio, Tips to Manage Accounts Receivables Efficiently, What is Accounts Payable, Cost of Accounts Payable