The Reverse Charge Mechanism (RCM) is part of the Goods and Service Tax (GST) framework in India. In standard GST procedures, the supplier is responsible for collecting and remitting the tax to the government. Under the reverse charge mechanism, the customer or receiver of goods or services pays the required taxes. The system aims to increase tax compliance by making recipients pay taxes on behalf of suppliers when the latter lacks proper registration.

Companies need to understand the reverse charge mechanism to follow tax rules and develop effective GST business strategies. This blog will explore how RCM functions under GST law, alongside presenting its business applications and actual usage scenarios.

| Date | Update |

| 23rd July 2024 | The Union Budget 2024 proposed an amendment to Section 13 of the CGST Act. This amendment addresses the time of supply for services where the invoice is to be issued by the recipient in cases of reverse charge supplies from unregistered suppliers. This change will be effective upon notification by the CBIC. |

| 26th June 2024 | The Central Board of Indirect Taxes and Customs (CBIC) issued Circular No. 211/5/2024-GST, clarifying the recommendations by the GST Council regarding the availing of input tax credit under Section 16(4) of the CGST Act, specifically for cases where the recipient has issued the invoice under RCM. |

| 10th May 2023 | From 1 August 2023, e-invoicing became mandatory for taxpayers with an annual turnover exceeding ₹5 crore, impacting businesses that handle reverse charge transactions. |

What is Reverse Charge Mechanism (RCM) under GST?

A Reverse Charge Mechanism (RCM) is a system in which the recipient is liable for paying tax on a transaction.

RCM applies in two cases:1. Specified goods and services: The government lists particular items and services to which the RCM must apply.

2. Unregistered suppliers: A registered business, when it buys from suppliers who haven't registered with the GST system, must pay GST under RCM.

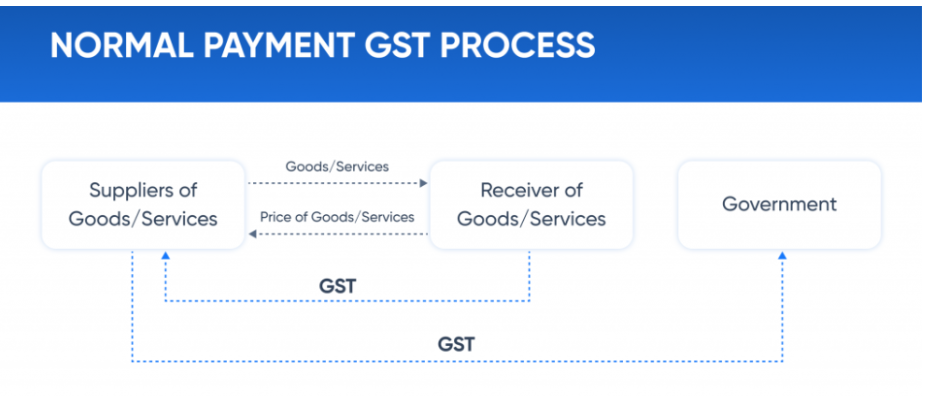

Normal GST Process :

Impact of RCM on businesses

RCM affects businesses in the following ways:

Cash flow impact: Since the recipient must pay GST upfront, it can impact working capital.

Accounting complications: Businesses need special systems to track their Recipient Created Tax (RCT) transactions.

Compliance obligations: The new system requires companies to maintain special records and manage their invoicing procedures.

Applicability of reverse charge with examples

Under RCM, all specified items must be subject to taxes regardless of supplier registration status.

1. Supply of notified goods and services

Certain goods and services are always taxed under RCM, regardless of whether the supplier is registered.

Examples of goods under RCM:

Raw cotton – Textile mills purchasing raw cotton from farmers must pay GST under RCM.

Cashew nuts (unprocessed) – Traders buying from farmers must pay GST.

Silk yarn – Manufacturers purchasing from unregistered suppliers must pay GST.

Tobacco leaves – Manufacturers must remit GST under RCM.

Examples of services under RCM:

Legal services – Businesses hiring independent advocates must pay GST.

Sponsorship services – Sponsors must bear the GST liability.

Goods Transport Agency (GTA) services – Companies using freight services must pay GST.

Director’s services to a company – GST is payable by the company.

2. Import of services

Businesses must pay GST under the reverse charge mechanism when they buy services from non-Indian providers because foreign vendors do not have Indian GST registration. For example, an Indian IT firm using Adobe Cloud services (USA-based) must calculate and remit GST.

3. Reverse charge in e-commerce transactions

Under Section 9(5) of the CGST Act, the e-commerce operator must pay GST taxes for specified digital transactions on behalf of the service provider.

Some examples include the following:

Uber pays GST on behalf of its independent cab drivers.

Zomato pays GST on delivery services provided by restaurant partners.

4. Reverse charge in real estate & construction

RCM applies heavily in the construction sector, especially for subcontractors and works contracts. For example, a real estate company hiring an unregistered plumber must pay GST under RCM.

5. Security and manpower supply services

Security services or manpower supply from unregistered providers require the recipient to pay GST. For example, a corporate office hiring security guards from a small, unregistered agency must pay GST under RCM and generate a self-invoice.

6. Agricultural produce purchases

Since farmers are exempt from GST, businesses purchasing raw agricultural goods must pay GST under RCM. For instance, a food processing company buying raw wheat from farmers must pay GST under RCM.

Goods and services under RCM

Certain goods and services covered under RCM:

Goods under RCM

- Cashew nuts (unpeeled or unprocessed)

- Raw cotton

- Silk yarn

- Tobacco leaves

- Supply of lottery tickets

Services under RCM

- Legal services by an advocate

- Services by a director to a company

- GTA services

- Sponsorship services

- Import of services

Businesses must ensure to comply with RCM if they deal with these goods and services.

Time of supply for goods and services under reverse charge

Under GST, time of supply is crucial as it establishes when tax payment is due. The time of supply rules for goods and services under RCM differ from those in regular GST transactions.

Time of supply for goods under reverse charge

For goods purchased under RCM, the tax liability arises at the earliest of the following events:

Date of receipt of goods – The day the recipient physically receives the goods.

Date of payment – The day the recipient makes the payment to the supplier, whether in full or in part.

30 days from the date of the supplier’s invoice – If the invoice is issued but payment or receipt of goods has not occurred, tax liability still arises on the 31st day from the invoice date.

Time of supply for services under reverse charge

For services, the tax liability under RCM arises at the earliest of the:

Date of payment – The day the recipient makes the payment to the supplier.

60 Days from the date of the supplier’s invoice – If payment is not made within 60 days from the invoice date, tax liability is automatically triggered.

Input Tax Credit (ITC) under RCM

A vital GST component named Input Tax Credit (ITC) enables businesses to obtain tax credits from purchases they make which lets them offset their output tax obligations.

Conditions for claiming ITC under RCM

- Only taxpayers registered under GST can receive this benefit.

- The purchased goods need to support business operations rather than individual use.

- You cannot get input tax credits from the reverse charge taxes you paid for tax-exempt or non-taxable supplies.

- You must pay the tax upfront before you can use the input tax credit.

- With RCM, the buyer pays taxes before claiming a tax credit, unlike the forward charge system, where suppliers handle tax collection and ITC claims together.

- The recipient must put the RCM tax amount into their GSTR-3B returns under the correct tax category.

Example of ITC under RCM

A company hires legal consultancy services from an advocate and pays 18% GST under RCM. The business can claim ITC for this amount in the same month when filing its GST return.

Correct recordkeeping of self-billed invoices allows companies to more effectively handle their GST claims and lower their total tax debt.

Who should pay GST under RCM?

The recipient of goods or services is liable to pay GST under RCM. This includes:

- Businesses purchasing from unregistered suppliers

- Service recipients availing notified services like legal consultancy

- Importers of goods and services

Reverse charge exemptions

Some exemptions exist under RCM:

- Goods or services below a specified value threshold

- Supplies from unregistered dealers if below ₹5,000 per day

- Certain government services exempted from RCM

For example, purchases from small unregistered suppliers may not attract RCM if they fall within exemption limits.

Mandatory Registration for Reverse Charge Tax Payers

As per the GST rules, a taxable person who is liable to pay tax under the reverse charge mechanism, will need to take mandatory registration under GST , irrespective of turnover.

FAQs

1.Is Input Tax Credit (ITC) allowed under reverse charge?

Yes, ITC is available on RCM tax paid, provided it is for business use.

2. When can one claim ITC of tax paid under RCM?

ITC can be claimed in the same month in which tax is paid.

3. Who is exempt from paying RCM?

Entities dealing in exempted goods or services, or transactions below prescribed limits, are exempt.

4. What is the reverse charge mechanism of GST?

It is a tax mechanism where the recipient, not the supplier, pays GST.

5. What is RCM in GST with an example?

RCM in GST is where a company buying goods or using services from an unregistered supplier must pay the GST on the latter’s behalf. For example, a company taking up legal services from an advocate must pay GST under RCM.

6. What is the reverse charging mechanism?

It is a taxation system that shifts tax liability from the supplier to the recipient.

7. In which cases is RCM applicable?

RCM applies to specified goods and services, purchases from unregistered suppliers, and imports.

Read More on GST

GST Software, GST Software for CAs, GST Software for Traders, GST Invoicing Software, GST Calculator, GST on Freight, GST on Ecommerce, GST Impact on TCS, GST Impact on TDS, GST Exempted Goods & Services, GST Declaration

GST Rates & Charges

GST Rates, GST Rate Finder, GST Rate on Labour Charges, HSN Codes, SAC Codes, GST State Codes

Types of GST

CGST, SGST, IGST, UTGST, Difference between CGST, SGST & IGST

GST Returns

GST Returns, Types of GST Returns, New GST Returns & Forms, Sahaj GST Returns, Sugam GST Returns, GSTR 1, GSTR 2, GSTR 3B, GSTR 4, GSTR 5, GSTR 5A, GSTR 6, GSTR 7, GSTR 8, GSTR 9, GSTR 10, GSTR 11