e-Invoice (also known as 'Electronic invoicing') is a system in which all B2B invoices are electronically uploaded and validated by the specified portal. IRP generates a unique Invoice Reference Number (IRN) for each invoice after successful authentication.

Each invoice is digitally signed and includes a QR code in addition to the IRN. Under GST, this is referred to as e-invoicing.

| Generate e-invoice instantly with TallyPrime |

Step-by-Step Process for e-Invoicing Registration

Step-1: Log in to the e-invoicing system

The registration technique for GST taxpayers for the e-invoice system is straightforward. If a taxpayer has already registered with the e-way bill portal, they can use the same login credentials to access the e-invoice system.

If a taxpayer is not enrolled in the EWB portal, he or she can register on the e-invoice system. The taxpayer must have a GSTIN issued by the GST system as well as a mobile phone registered with the GST system. You can simply go to https://einvoice1.gst.gov.in/ and register for e-invoicing as shown below.

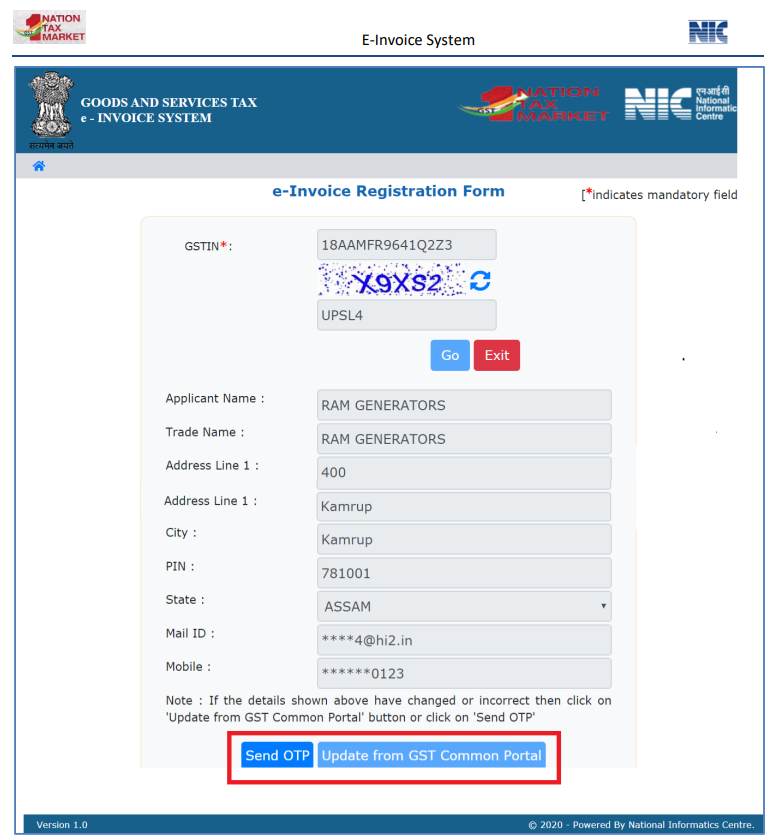

Note: First-time GSTIN can register by clicking on 'Portal Login' under 'Registration' in the top menu. The user is then led to the 'e-invoice registration form'.

Step-2: e-invoice enablement

The user must input their GSTIN and the presented captcha and click ‘Go’ to submit the request. Post submitting the request, the user will be taken to the e-invoice registration form.

Step-3: Enter data on the registration form

As per the entered GSTIN, the applicant’s information will be presented in the e-invoice registration form---the applicant's name, trade name, mobile number, email address as they appear on the GST site, and so on. The user may confirm the information by clicking ‘Send OTP’ followed by getting the registration form verified.

Upon the successful OTP verification, the user can simply set the ID and password for the portal for easier usage in future. In case you forget the credentials, simply enter the GSTIN number and the registered mobile number under forget password/id, and you are good to go.

Who must register for e-invoicing?

Ever since the inception of e-invoicing, the Government of India has been rolling out this regulation in a phased manner. Below is the timeline of the mandatory implementation of the e-invoicing and the most recent update as of August 2023.

Note: As of 1st August 2023, all registered businesses (based on PAN) with an annual turnover in any preceding fiscal year from 2017-18 onwards exceeding 5 crores are mandated to generate e-invoices.

|

Annual turnover |

New date of mandatory implementation of e-invoice |

|

Exceeding 500 crore |

1st October 2020 |

|

Exceeding 100 crore |

1st January 2021 |

|

Exceeding 50 crore |

1st April 2021 |

|

Exceeding 20 crore |

1st April 2022 |

|

Exceeding 10 crore |

1st October 2022 |

|

Exceeding 5 crore |

1st August 2023 |

Wish to learn more about e-invoicing under GST? Check out our other blogs on:

- How to Generate e-Invoices in GST: A Step-by-Step Guide | Tally Solutions

- How to Generate Bulk e-Invoices in TallyPrime? | Tally Solutions

- How to Cancel e-Invoice in GST | Tally Solutions

Explore More Products