- Connected solution to generate accurate e-way bills online, seamlessly

- e-Way bill features in TallyPrime

- How to generate e-way bills in TallyPrime?

- Get your E-way bill software free trial today

- Benefits of e-way bill

- GST E-way bill format

- Video on How to Generate E-way Bill Online Using TallyPrime

- 5 factors to help you choose an e-way bill software

- Frequently asked questions

Connected solution to generate accurate e-way bills online, seamlessly!

With one-time quick setup and configuration, we have provided you complete flexibility to generate e-way bills according to your business requirements. From generating accurate e-way bills to cancel/update/extend e-way bills, TallyPrime deals with your e-way bill compliance with utmost care.

|

Tally being one of the recognised ISO certified GSP (GST Suvidha Provider), TallyPrime directly integrates with the e-way portal to seamlessly generate e-way bill for you |

e-Way bill features in TallyPrime

Tally’s fully connected e-way bill solution is simple, seamless with zero manual work. Take a look at some of the key features of a connected e-way bill solution

Generate e-way bill instantly.

Using TallyPrime, you seamlessly generate an e-way bill online by just recording the invoice. You can generate e-way bills instantly, either for a single invoice or multiple invoices in bulk. This is made possible through TallyPrime’s full connected solution absorbs the complexity by directly sending the details in prescribed format to the portal and fetches e-way bill details automatically.

Cancel, extend and update e-way bill online

In some situations, the invoices for which e-way bill is already generated requires to be cancelled. Using TallyPrime, you can cancel, extend and update e-way bills online without the need to manually perform these actions from the portal

Generate EWB online along with e-invoice

Using TallyPrime, you can generate e-way bill along with an e-invoice or can separately generate only e-way bill as it suits your need

e-Way bill reports

TallyPrime’s connected e-way bill solution comes with exclusive reports for e-way bill giving you a complete view of the e-way bill transactions and their status. You can track pending/cancelled/generated) and perform various other actions such as cancel, extend, etc. as per your needs.

Supports other modes for e-way bill generation.

In case of exigency cases like unavailability of internet services on a system or due to any other reason, if you wish to use other modes of e-way bill generation such as using offline utility, a direct entry on the portal etc. TallyPrime fully supports these situations

| Generate e-Way bill Instantly Using TallyPrime | Online Bulk E-Way Bill Generation Software |

A quick video walkthrough on connected e-way bill features in TallyPrime

How to generate e-way bills in TallyPrime?

Using TallyPrime’s online connected e-way bill solution, you can instantly generate e-way bill. All you need to do is just record an invoice in your usual way, and TallyPrime will automatically generate an e-way bill and capture the e-way bill number on the invoice.

Tally being one of the recognised ISO-certified GSP (GST Suvidha Provider), TallyPrime directly integrates with the e-way portal to seamlessly generate e-way bill for you. It is so simple that you will certainly feel that generating an e-way bill is just the same as invoicing.

Tally’s fully connected e-way bill solution is simple, seamless with zero manual work.

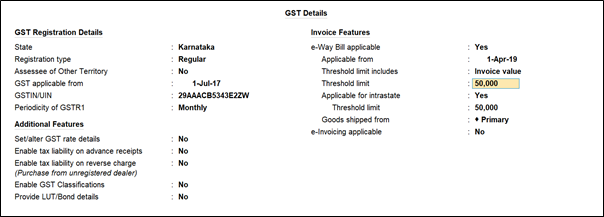

A single-time configuration is sufficient for you to generate accurate e-way bills based on the defined threshold in TallyPrime. As per the settings, appropriate transactions will be made eligible for e-Way Bills by TallyPrime.

Get your E-way bill software free trial today!

Get your GST-ready TallyPrime Perpetual License for Rs. 18000 + 18% GST (INR 3,240).

Call 1800-425-8859/+91 80 25638240 for any queries. Click here to take a free trial!

Benefits of e-way bill:

- Less documentation

- No tax evasion

- Provide digital compliance solution

- Avoid check-posts and delays

- Easy and quick generation of e-way bill

GST E-way bill format

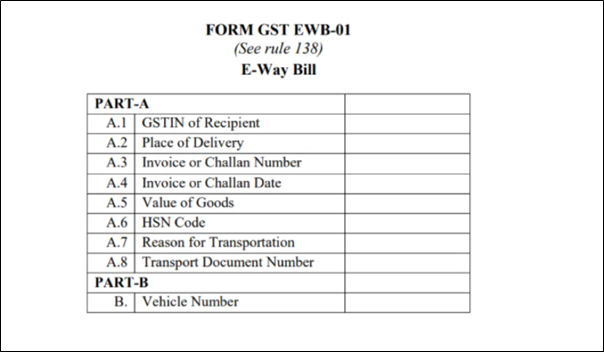

The E-Way Bill format in GST comprises of 2 parts – Part A and Part B. Below is the image of the e-Way Bill that will be electronically generated after completing the Form GST EWB-01.

The Part A of E-Way Bill in Form EWB 01 aims to collect the details of the consignment, usually, the invoice details such as the customer’s GSTIN, invoice number, Value etc. Part B comprises of transporter details (Vehicle number and transporter ID). Part B needs to be used to update the transport details.

Watch Video on How to Generate E-way Bill Online Using TallyPrime

5 factors to help you choose an e-way bill software with connected services

- Connected solution ability with the e-way bill portal

- Flexibility to generate in real-time or as bulk at end of the day

- Cancel/extend/update e-way bill

- Ability to handle e-way bill in offline mode

- Generate e-way bill along with e-invoice

- Switch easily between portal and your system

Frequently asked questions

What is GST e-Way bill?

Under GST, the process and procedural aspects for the movement of goods are prescribed in the e-way bill rules. E-way bill stands for Electronic Way Bill. It is usually a unique bill number generated for the specific consignment involving the movement of goods.

When should the E-way bill be generated?

The E-Way Bill needs to be generated before the commencement of movement of goods.

Who should generate the E-way bill?

- When goods are transported by a registered person, either acting as a consignee or consignor in his own vehicle, hired vehicle, railways, by air or by vessel, the supplier or recipient of the goods should generate the E-Way Bill

- When the goods are handed over to a transporter, the E-Way Bill should be generated by the transporter. In this case, the registered person should declare the details of the goods in a common portal

- In case of inward supplies from an unregistered person, either the recipient of supply or the transporter should generate the E-Way Bill.

If you are using e-way bill or e-invoice from TallyPrime, you will get additional connected service capability to get and view details pertaining to a GSTIN or HSN code from TallyPrime itself.

How to generate the E-way Bill?

Form GST EWB-01 is an E-Way Bill form. It contains Part A, where the details of the goods are furnished, and Part B contains vehicle number.

Can E-way bill be generated for consignments of value less than INR 50,000?

Yes, either a registered person or a transporter can generate an E-Way Bill although it may not be mandatory.

What happens if multiple consignments above the threshold limit are transported in one vehicle?

The transporter should generate a consolidated E-Way Bill in the Form GST EWB 02 and separately indicate the serial number of E-Way Bill for each of the consignment.

On the generation of E-way bill, will there be any reference number generated?

Upon generation of the E-Way Bill, on the common portal, a unique E-Way Bill number called ‘EBN’ will be made available to the supplier, the recipient, and the transporter.

What happens if goods are transferred from one vehicle to another vehicle in the course of transit?

Before transferring the goods to another vehicle and making any further movement of such goods, the transporter needs to update the details of conveyance in the E-Way Bill on the common portal in Form GST EWB 01.

Note: If goods are transported for a distance of less than ten kilometres within the State or Union territory from the place of business of the transporter finally to the place of business of the consignee, updating the details of conveyance in the E-Way Bill is not mandatory.

What must be done if the validity of the e-way bill expires due to vehicle breakdown or other circumstances?

The validity of the e-way bill can be extended under circumstances of exceptional nature, law and order issue, trans-shipment delay, accident of conveyance etc by updating the reason for extension and the details in Part B of Form GST EWB-01.