What is an invoice?

An invoice is simply a document that contains the particulars regarding the goods sold and the services provided by a business. In short, an invoice is a documented record that specifies the details of transaction between a seller and buyer. The details of an invoice include terms of payment such payment methods accepted, shipping and handling charges, late fees, and the due date among others. For a business owner, an invoice can be termed as a sales invoice while it is termed as a purchase invoice for the entity receiving the goods or service provided by a business. Timely invoice payment is essential for a business to run smoothly as it ensures constant cash flow.

What is a past due invoice?

Every invoice clearly mentions a due date by which the payment should be made. If the payment is not made within the specified due date then the payment is termed as past due. A past due invoice or an overdue invoice is simply a term used to indicate an invoice payment that has not been made by the mentioned due date. Not receiving timely payments can be detrimental to MSMEs in the long term as they can cripple cash flow. Every business owner must take invoice payment seriously and ensure they expertly handle past due invoices.

How to handle late payments & past due invoices?

Handling late invoice payment and past due invoice is critical to any business. Here are some ways to ensure they are handled correctly.

Know the numbers

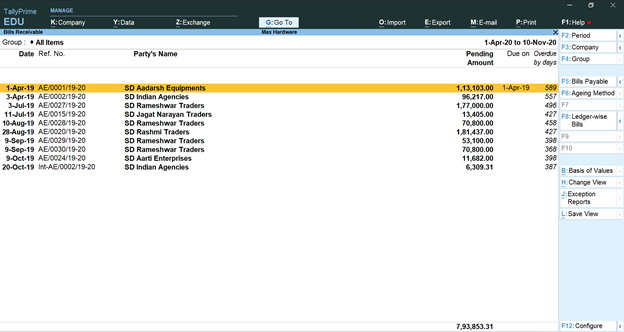

It can be embarrassing for MSMEs to quote the wrong invoice payment or invoice number to the client. And this can easily sour your relationship with the client which is something you must avoid at all costs. To avoid such blunders, it is best to first choose a good accounting software tool that comes with invoicing and billing capabilities. TallyPrime is an invoicing software solution that enables you to get a detailed view into the payments that are owed to you and by whom. TallyPrime gives you all the important details such as date, party’s name, reference number, pending amount, due date, and final balance.

TallyPrime lets you see all the bills receivables in a consolidated fashion.

Be clear from the get go

Making it clear from the start is the best way to prevent late invoice payment. When you are generating invoices, make sure you include the due date in such a way that it cannot be missed by your client. Using an invoicing solution can help you generate detailed invoices. Speaking to your client beforehand and being clear about the payment terms is also a good idea as it can establish trust between both parties early on. You can ask for a percentage of the total payment before you provide the goods or services. This way you are on the safe side. Else, for smaller payments, you can ask for the payment upfront where applicable.

Keep track of all bills

If you want to always receive invoice payment on time, you need to keep track of all your bills. When you generate hundreds of invoices each day, tracking all the bills won’t be an easy task if you are considering doing it manually. Instead, using TallyPrime can help you keep track of each invoice and ensure you know which bills are outstanding and which have been paid. This helps you always be on track with your bills; so you can take the necessary action when required.

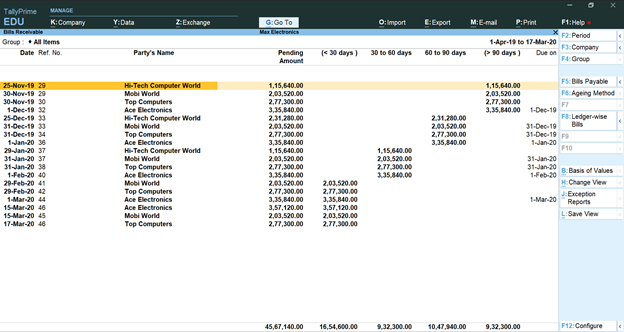

Ageing analysis

Ageing analysis enables you to know precisely who owes you and since when. When invoice payment hasn’t been done for a long time, then it directly impacts your cash flow. This can hamper your business and can even put a stop to certain business processes. By knowing who hasn’t been paying for the longest time, you have information of whom you need to contact. For example, the ageing analysis report feature of TallyPrime allows you to know specifically all the bills that have been pending for a long time. This allows you to know who is really late with their payments.

TallyPrime’s ageing analysis by group.

Credit policy and limits

Having an invoicing solution simplifies the process of understanding which customers pay on time and which don’t. If you notice late payments then it is time to make changes to your credit policy and notify your customers of the same. An invoicing tool can help you comprehend payment performance. This throws light on which customers pay, even if they do so later, and which customers take the longest to pay. When you constantly look at the payment performance of your customers, you can plan a credit policy accordingly.

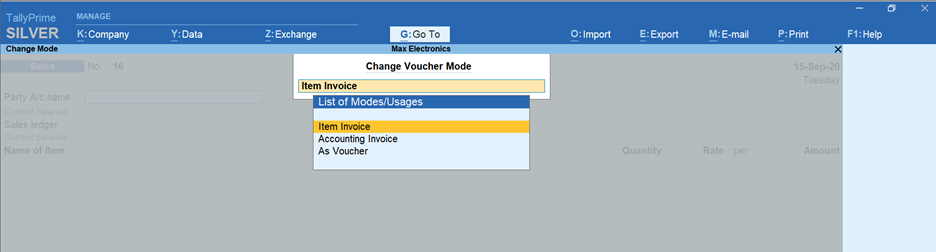

Send timely invoices

The biggest mistake MSMEs often make is to delay invoice generation, which undoubtedly causes a delay in invoice payment. Ideally, you should send the invoice ASAP because the sooner you send it the faster the chances of receiving payment from your client. This helps prevent late payments and will leave no room for confusion. You can use a trustworthy invoicing solution to create professional and detailed invoices instantly. This will enable you to eliminate invoice-related errors while giving you the freedom to generate invoices as per your choice.

TallyPrime enables you to create business invoices.

Be prepared for negotiation

Your clients are humans after all and they may have a solid reason for not paying on time such as a financial issue. However, you can make it a little easy on them with negotiations. Sometimes, your clients might initiate negotiations after you send a reminder of a past due invoice. This can be beneficial for both parties and can enable you to at least get a portion of the payment. For example, you can give your client the option of partial payments so they can make smaller payments over time. In this way, you will get the complete payment eventually.

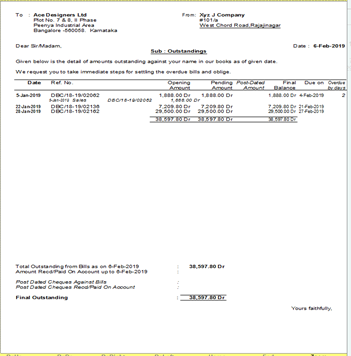

Opt for professional reminder letters

The best time to remind your clients of the invoice payment is a few days before the due date so they remember the payment date is coming close. Then after that you can keep sending reminders until complete payment is done. You must ensure you are always professional because as an MSME you don’t want to burn any bridges. Instead of manually sending reminders which can eat up your precious time, you can automate the process by using an invoicing solution such as TallyPrime. You can easily generate and print reminder letters which you can send to your clients to remind them in a timely fashion.

You can quickly print reminder letters using Tally.

Provide incentives

You can also provide incentives so your clients are willing to pay on or before the due date as a way to ensure timely invoice payment. For example, you can give them a discount for paying within a week of invoice issue date or for honoring the due date. Else, if you are a software company, you can provide an add-on for a discounted rate when they pay on time. Depending on the nature of your business, you should provide incentives accordingly. You should ensure that you are not at a loss by providing incentives that prove to be costly for your business. It should be a win-win situation so you get the payment and your customer is happy to pay on or before time.

MSMEs cannot afford to allow invoice payments to stack up. If you already feel bogged down with what you need to do for your business then you can count on TallyPrime, a reliable invoicing and accounting software to lighten the load. It makes handling late invoice payments and past due invoices effortless. It helps you have complete control over your business accounting and ensures you can comfortably manage your business with complete accuracy. TallyPrime makes getting instant insights simple and ensures you are on top of the game every day as you run your business. It is one of the most robust and secure e-invoicing software solutions out there.

Read more:

TallyPrime’s Amazing Invoicing Experience, TallyPrime Features, Analysing Business Reports Just Got Easier with TallyPrime, How to Write Business Plan, Arm’s Length Transaction, Data Synchronisation, Microenterprise, Contingent Liabilities, Convenience Vs Security, 4 Technology Trends which can Reduce your Business Woes, MSME Registration, Best E-commerce Practices for Small Businesses, Key Things to Keep in Mind While Taking a Business Loan, Crowdfunding: Smart funding for SMBs, How the Startup Culture is Impacting the Indian Economy, Digital Marketing & its Advantages to Boost the MSME Sector in India, Tips for a Small Business to Survive the Crisis