What is balance sheet?

Balance sheet refers to a financial statement which reveals the complete financial position of the company for a given date. A company’s balance sheet tells you the details of assets, liabilities and owners’ equity for the business. In simple words, the balance sheet is a statement which tells you the assets of the business, the money others need to pay you and the debt you owe others including the owner’s equity.

Balance sheet is one of the important financial statement used for making business decisions. Balance sheet is used by various stakeholders like management, employees, investors, creditors, banks, regulatory authorities, tax authorities etc.

Balance sheet objectives

A balance sheet is also called as a top financial statement. Let’ us understand this by knowing the purpose and objective of the balance sheet. The following are some of the key objectives of the balance sheet:

- It helps in ascertaining the financial position of the business on a given day.

- Details of owner’s equity can be determined

- The information from the Balance sheet helps you create provision for future loss/contingencies by creating reserves

- It provides a snapshot of business health including the economic resources the business owns, owes, and the sources of financing for those resources.

- Ascertain if the business is financially autonomous and therefore solvent

- Determine the financial liquidity of the business

Features of Balance Sheet

- It provides a snapshot of a company's financial position at a specific point in time.

- It consists of assets, liabilities, and equity arranged according to the accounting equation Assets=Liabilities+Equity

- It helps assess liquidity, solvency, and capital structure.

- It displays reserves and surplus under equity, separating capital reserves and revenue reserves.

- It is prepared periodically and follows standardized accounting principles for consistency and comparability.

Importance of Balance Sheet

- Acts as a crucial financial statement for investors, creditors, and management to evaluate company’s financial health.

- Helps in decision-making about investments, lending, and strategic planning.

- Assists in analyzing the company’s ability to meet obligations and fund growth.

- Provides transparency and accountability in financial reporting.

- Serves as a legal document reflecting the company’s financial standing and compliance with statutory requirements.

What are balance sheet accounts receivable?

While managing a business, a close watch on the cash flow is crucial and it is obvious. While reconciling your company's balance sheet, you must pay attention to the receivables that your business is entitled to receive from its customers/buyers.

Accounts receivable refers to the amount that a company is entitled to receive from its customers for goods or services sold on credit. In other words, it is the amount that your customer owes you in respect of contractual obligations. Accounts receivables are also known as debtor, trade debtors, bills receivable or trade receivables.

Management of these receivables will ensure that you are paid by your debtors on time and that your business' cash flow is consistent.

More on Accounts Receivables: Definition, Examples, Process and Importance

What are balance sheet accounts payable?

Similar to your receivables, management of payables is also crucial to maintain optimum cash flow in a business. When there is an inflow of cash, it is a given that cash would also leave the system. Therefore, it’s important to keep a close eye on your accounts payable, as these are payments you owe other businesses.

Accounts payable is any sum of money owed by a business to its suppliers shown as a liability on a company's balance sheet. In simple words, when you buy goods or services with an arrangement to pay at a later date, such amount till it is paid is referred to as accounts payable.

Accounts payable is also called as bills payable and the total amount that a company is liable to pay is shown as liability under the head ‘sundry creditor’ in the balance sheet.

More on Accounts Payable – Definition, Example and Process

Reconciling balance sheet accounts

Reconciliation of balance sheet gives you a clear picture of your financial health and is also an indicator of all the entries being captured, accurately. Several businesses reconcile their balance sheet against their bank statements. You can also use your sub-ledgers, such as accounts receivables reports, accounts payables reports or even fixed asset transactions to ensure that your balance sheet is accurate.

At the conclusion of each month, quarter, or year, your balance statement should be reconciled. As a small business owner, you have complete control over the timing. Reconciling your balance sheet as part of your closure procedure, on the other hand, is recommended.

Once you've decided that your balance sheet is accurate, you may utilise it to make future financial decisions with ease and confidence.

What is a budgeted balance sheet?

One of the primary objectives of an automated accounting process is to forecast a business' financial health so that you can take sound business decisions beneficial for your business in the short as well as in the long run. A budgeted balance sheet is nothing the same as your current balance sheet, except that it reflects an estimate for future budget periods. It forecasts and gives you a view of where your balance sheet accounts will be at the end of future accounting periods if you stick to your current budget.

Balance sheet components

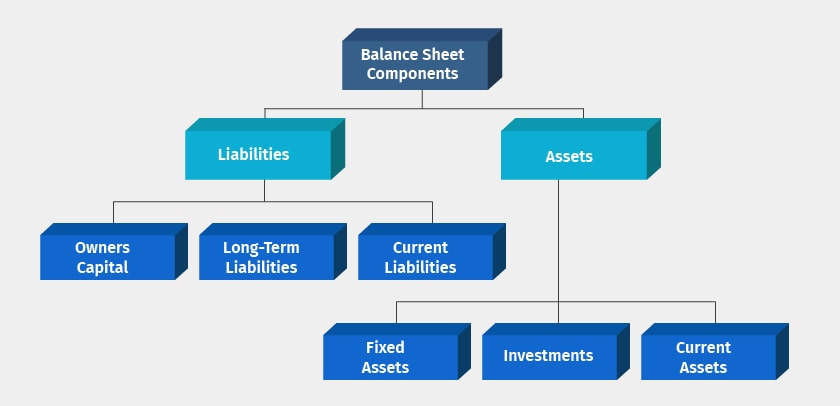

Balance sheet components are broadly divided into ‘Assets’ and ‘Liabilities’. Each of this balance sheet components consists of several sub-components. The following are balance sheet items:

[caption id="" align="alignnone" width="840"] balance sheet components[/caption]

balance sheet components[/caption]

As shown in the above balance sheet illustration, assets are broadly classified into fixed assets, investments and current assets. Similarly, liabilities are classified as owner’s capital, long-term debts and current liabilities. Let’s understand these balances sheet items in detail.

Assets

Something that an entity has acquired or purchased and owned, regarded as having value and available to meet debts, commitments or legacies. Assets are further broadly classified as:

- Fixed Assets

Assets that are purchased for long-term use and are not likely to be converted quickly into cash, such as land, buildings, and equipment.

- Current Assets

Current assets are those assets that can be converted into cash within one year. Examples of current assets are, Cash, Bank balances, Investments, Deposits, Accounts receivables, and Inventory

Liabilities

Liabilities are the obligations or Debts payable by the enterprises in the future in the form of money or goods. Liabilities are further broadly classified as:

- Equity or Capital:

Money invested in the business to generate income.

- Loans & Borrowings

Money borrowed from a financial institution or from others to be utilized in business for generating income and managing the day-to-day affairs of the business. Ex: Bank Overdraft, Term Loan.

- Current Liabilities

Current liabilities are debts or obligations payable within a short period of time or one year. Ex: short term debt, trade payables, taxes due, accrued expenses.

What is Reserve in Balance Sheet?

A reserve in the balance sheet refers to a portion of a company's profits that is set aside or retained for a specific purpose or to strengthen the financial position. Reserves are a part of shareholders' equity and typically appear under "Reserves and Surplus" on the liabilities side of the balance sheet. They can be general (no specific purpose) or specific (earmarked for certain uses like expansion, debt repayment, contingencies). Reserves provide financial stability, help manage future uncertainties, and fund planned expenditures.

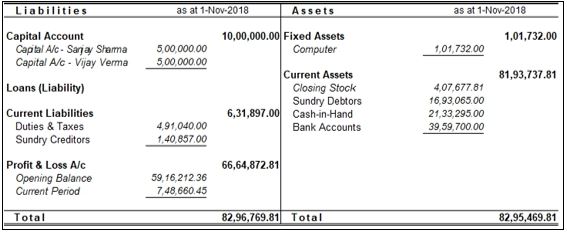

Balance sheet format

Below is the balance sheet format

[caption id="" align="alignnone" width="567"] balance sheet format[/caption]

balance sheet format[/caption]

As illustrated above, on the left side of the balance sheet format, all the assets are shown followed by the sub-components of assets. On the right side of the balance sheet format, liabilities followed with sub-components are displayed.

Balance sheet equations

As shown in the above balance sheet format, the balances of total liabilities and assets owned by the business always match. This implies that the total value of assets always adds up to the total liabilities of the business. The following are balance sheet equations:

- Assets = Liabilities + Owner’s Equity: This balance sheet equation tells you that all the assets owned by the business are either sponsored using the owners’ equity or the amount which company should owe others like suppliers or borrowings like loans

- Liabilities = Assets – Owner’s Equity: The difference of assets and owner’s investment into business is your liabilities which you owe others in the form of payables to suppliers, banks etc

- Owners’ Equity = Assets – Liabilities: This equation reveals the value of assets owned purely by owner equity

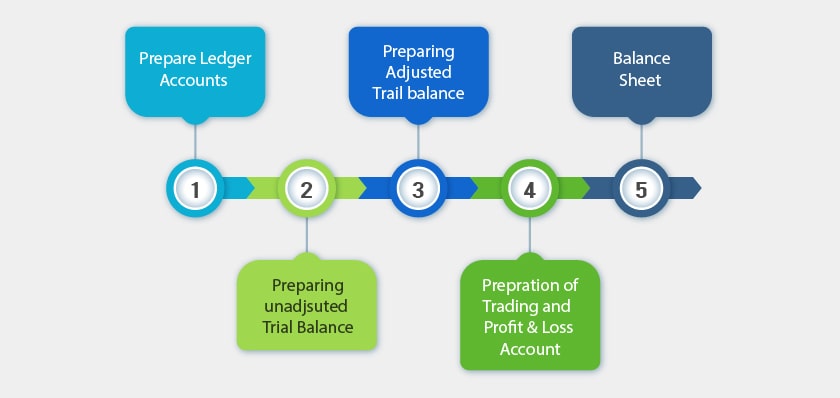

How to prepare a balance sheet?

Balance sheet preparation involves multiple steps to consolidate the accounting records and preparing various statements.

The following are the steps to prepare a balance sheet:

- Posting of accounting records from journal books to individual ledge accounts

- Preparing ledger accounts and ascertaining the closing balance of each ledger accounts

- Preparing trial balance summarizing the closing balance of ledger accounts

- Computing the debit and credit balance in trial balance to ensure the journal and ledger posting are arithmetically accurate.

- If there is any difference in trial balance, errors need to be identified and corrected

- Post correction and fixing the errors, an adjusted trial balance needs to be prepared

- Preparing trading and profit & loss account by considering all the ledgers having income and expenses nature from trial balance

- Finally, preparing a balance sheet in the format shown above by considering all assets and liabilities from the trial balance.

Balance sheet prepared by modern day business

Today, most businesses have automated balance sheet preparation using accounting software. Businesses believe using accounting software helps in saving time and efforts involved in managing books and preparing financial statements such as balance sheet. Further, the use of accounting software facilitates in generating comparative balance sheet – across periods and branches and consolidated balance sheet of all the branches or business verticals.

Frequently asked questions

What is the balance sheet used for?

A balance sheet is an extremely important financial statement used by business owners, investors, accountants, and other relevant stakeholders to assess a company's financial health. It helps answer several questions about a business like - its ability to meet short and long terms debts, net worth and assets and liabilities.

What is included in the balance sheet?

Apart from including a company's assets and liabilities, a balance sheet also includes short terms assets like; cash and accounts receivable; or long-term assets such as property, plant, and equipment. Similarly, its liabilities might include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.

Who prepares the balance sheet?

A balance sheet could be prepared by anyone in the company be it owner or accountant or a third party, depending on the business. The balance sheet for a small privately held business may be prepared by the owner or a company bookkeeper. They may be prepared internally by a mid-size private firm and then reviewed by an external accountant. Public firms, on the other hand, are obligated to have their accounts audited by public accountants and to maintain a far higher standard of accounting.

Watch Video on How to View and Analyse Balance Sheet in TallyPrime