- Introduction

- Calculation of Cost of Accounts Payable

- Formula to calculate the cost of accounts payable

- Cost of Accounts Payable Example

Introduction

There is a saying in business that if you can buy well then you can sell well. Management of your creditors/suppliers or trade payables as we call is just as important as managing your debtors or trade receivables. Trade payables are one of the major sources of cash outflows which arises in the ordinary course of business.

The reason accounts payables are critical is slow or delayed payment by may create ill-feeling and the supplies could be disrupted and also impacts the credibility of the business. The way you manage your accounts payable has a direct impact on cash flow and therefore it should be managed carefully to enhance the cash position.

More often, it is assumed that accounts payable does not carry any cost. Now that we have mentioned about the cost of accounts payable, the first thing which all of us think is about the late payment charges to be paid on the delayed payments.

No! You got it wrong.

While it is one of common practice, the cost of accounts payable is not only about it. It has a lot more than that.

Let’s look at like this.

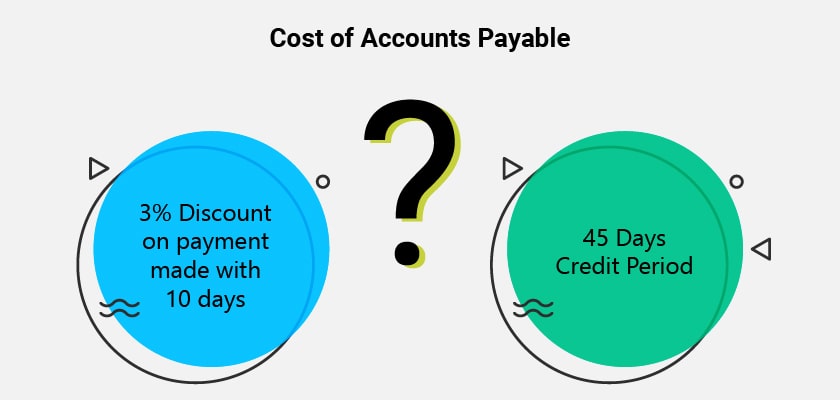

Your supplier offers you a discount of 3% if the payment is made within 10 days. Else you got a full credit period of 45 days to settle the due.

Which one do you opt for?

It’s obvious that opting discount looks beneficial as you are going to pay lesser.

Again, you got it wrong! Why? Let’s figure it out.

Calculation of Cost of Accounts Payable

Considering the above examples, the reason why opting discount is not always beneficial is in when you compare with the cost of credit or rate of return on investment.

Think like this, if you opt for discount, you have pay in 10 days and if not, I can have so much of cash with me for a period of 45 days (considering you are paying him on the last date).

Needless to say, what money can bring to your business? Still, let us put it here. The additional cash you can possibly invest in the business and make more money out of it if the rate of return is good.

The other reason why discount on accounts payable is not always beneficial is when your business is in a cash crunch situation.

Let’s say, you have recently invested in a new project or new product line and don’t have enough cash cushion. Here, opting the discount and making early payment will further impact the situation. Doing so may require you to look for an additional source of financing which comes at a cost. To cut the long story short, it is all about the benefits of discount Vs cost of credit.

This sounds good but now the fundamental question arises as to know which one is beneficial? How do I arrive at that?

To answer, you need to calculate the cost of not taking the discount. Basically, you need to check the opportunity cost or implied cost of not availing the discount vis-a-vis the return on investment.

Formula to calculate the cost of accounts payable

To calculate the cost of not taking the discount on an annual basis, the following formula needs to be used.

((100 + Discount%) / (100 - Discount%)) ^ (365 / (Total credit period – Discount days)) - 1

Here, the total credit period is the number of credit days. Say 30 days. Discount days are nothing but the last day within which the payment needs to be done to avail the discount.

We know, most of us don’t like formulas but can’t help. To make it easier to understand the cost of accounts payable, let’s consider an example.

Cost of Accounts Payable Example

ABC Ltd, a company incorporated in India has been offered credit terms from its major supplier of 3 / 10, net 45. Looks confusing, isn’t it? Let’s make it simple. 3/10, net 45 is nothing but 3% discount if the payment is done within 10 days else full payment within 45 days. It’s common practice to write the credit days in an aforesaid manner.

ABC Ltd.’s decision as to whether the discount should be accepted depends on the opportunity cost of not availing the discount. Meaning, it’s about ABC Ltd.’s ability to generate the return on the amount (by not paying in 10 days which they are holding back) in a span of 35 days (45 days – 10 days)

Let’s figure it out by applying the cost of accounts payable formula.

If the company does not avail the cash discount and pays the amount after 45 days, the implied cost of interest per annum would be as below:

((100 + 3) / (100 - 3%)) ^ 365 / 35 - 1 = 37%

Now let us assume that ABC Ltd. can invest the additional cash and can obtain an annual return of 25% and the amount of invoice is Rs. 10,000. The alternatives are as follows:

|

Particulars |

Refuse Discount |

Accept Discount |

|

Payment to the supplier (Accounts Payables) |

Rs. 10,000 |

Rs. 9,700 |

|

Return from investing Rs. 10,000 between day 10 and day 45 |

(-240) |

|

|

Net Cost |

Rs. 9,760 |

Rs. 9,700 |

Looking at the above, it would better for the company to accept the discount, as we pay less by Rs. 60/- accepting the discount proposal than to retain trade payables and pay on the due date which is Rs. 9,760 /- (Rs. 60 higher than what it would be required to pay if ABC Ltd refuses the discount)

To summarize it, it is clear that accounts payable has costs associated with it. By using the accounts payable judiciously, a firm can reduce the burden on Working Capital.

Read more on Cash and Credit Management