Tally Solutions | Updated on: March 2, 2022

- What is GIBAN?

- Which tax liabilities can be paid using GIBAN?

- From when can GIBAN be used as a mode of payment?

- How can a taxable person obtain a GIBAN?

- How can VAT payment be done using GIBAN?

To facilitate the VAT payment by persons registered under VAT, the FTA has introduced a new method of paying tax: GIBAN. This is in addition to the existing e-Dirham facility and credit card payment option. Let us understand what GIBAN is and how to pay VAT using GIBAN.

What is GIBAN?

GIBAN (Generated International Bank Account Number) is a unique IBAN (International Bank Account Number) that will be given to every taxable person under VAT. A taxable person can make a fund transfer from certain UAE financial institutions using the GIBAN. Transfer through GIBAN will ensure timely processing of fund transfers between bank accounts.

Which tax liabilities can be paid using GIBAN?

GIBAN can be used for settling outstanding VAT & Excise tax amounts as well as penalties.

From when can GIBAN be used as a mode of payment?

GIBAN can be used as a mode of payment from 28th February, '18.

How can a taxable person obtain a GIBAN?

Every taxable person will be allotted a GIBAN based on the TRN (Tax Registration Number). The GIBAN will be displayed in the person’s dashboard in the FTA e-Services portal.

How can VAT payment be done using GIBAN?

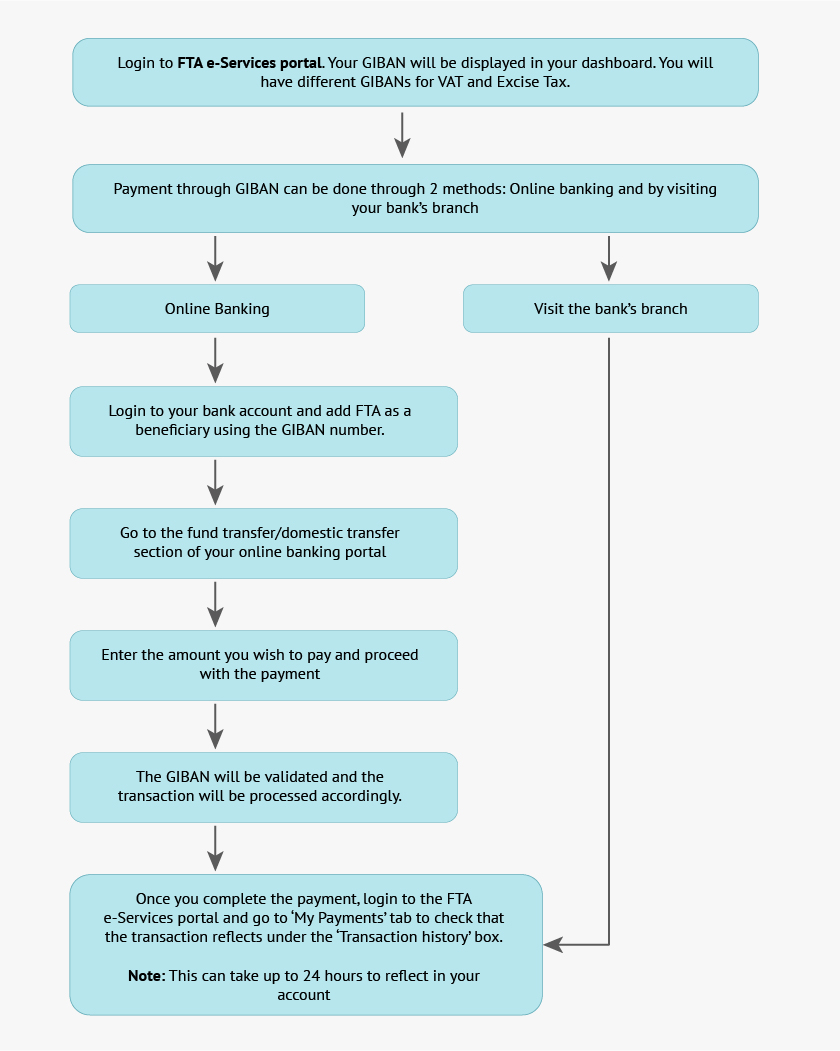

To pay a tax amount due using GIBAN, the following steps need to be followed:

Hence, the FTA has eased payment of tax for taxpayers by providing the new option of payment using GIBAN. Taxpayers can avoid the 2-3% fees while paying through credit card and opt for payment using GIBAN, which ensures timely remittance of the amount to FTA.

Read more on UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Registration

VAT Registration in UAE, How to link Tax Registration Number with Dubai Customs, How to Apply for VAT Registration in UAE, Is the Input VAT paid prior to Registration, claimable, Online Amendment or Change in Registration Details in UAE VAT, TRN, VAT Registration Deadlines in UAE, Who Should Register under VAT, How to de-register or amend a Tax Group under VAT in UAE, How to de-register under VAT in UAE

VAT Payment

VAT Payment in UAE, How to Make VAT Payment using GIBAN, How to make VAT Payment to FTA in UAE, VAT Payment on Import of Goods in UAE, VAT Payment through e-guarantee in UAE, VAT payment on commercial property in FTA Portal, VAT payment on import in FTA portal

FAQs on VAT

VAT FAQs on Education Sector in UAE, VAT FAQs on supply of real estate in UAE, VAT FAQs on implementing VAT in your business, VAT FAQs on Zero Rate and Exempt Supplies in UAE, VAT FAQs on UAE Free Zone, VAT return FAQs

Latest Blogs

How to prepare for UAE corporate tax filing?

How to Register for Corporate Tax in the UAE