Introduction

In the event of a change in the business details submitted while applying for VAT registration, it is the responsibility of the taxpayer to notify the changes to the FTA and amend the registration details. If the changes are not notified and amended, a penalty could be levied.

FTA allows the taxpayers to modify the registration details online by login in to the FTA portal. However, not all details can be modified online, as certain fields are blocked from modification.

The following are the registration details which can be modified from the taxpayer's portal:

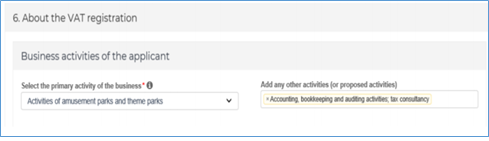

- Business Activities of the applicant: Details such as primary activities of the business and any other activities or proposed activities can be modified.

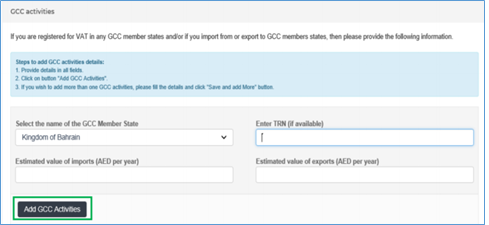

- GCC Activities: This section applies to businesses who are registered in any other GCC Member State and importing from or exporting to GCC Member State. You can modify the following fields under this section:

- Name of the GCC Member State

- TRN

- The estimated value of imports (AED per year)

- The estimated value of exports (AED per year)

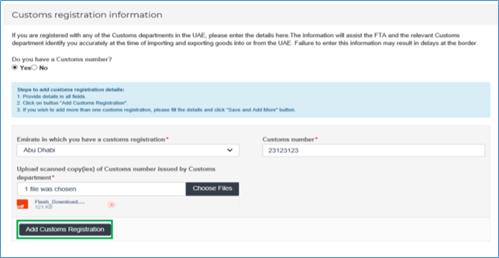

- Customs Registration Information: The following fields under this section can be modified

- An emirate in which you have a customs registration

- Customs Registration number

- Upload scanned copies of Customs number issued by Customs department

Once the above details are modified and submitted, changes will be reflected automatically in the portal as these changes do not require approval from the FTA.

Steps to modify the details in FTA portal

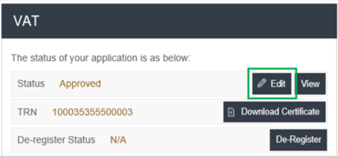

Once the registration application is approved and you wish to make changes to your registration details, click the ‘Edit’ button available in the VAT box under the Dashboard as shown below:

On clicking the 'Edit' button, all the sections and the relevant fields will be available with the auto-populated information which you had submitted while applying for VAT registration.

Navigate to the relevant section which requires modification as shown below and submit the changes:

- Business activities of the applicant section

After selecting the details from the drop-down list, save the details.

- GCC activities section

Once you edit the above fields, click on 'Add GCC Activities' to save the details of this section

- Customs Registration Information section

Once you edit the above fields, click on ‘Add Customs Registration’ to save the details of this section.

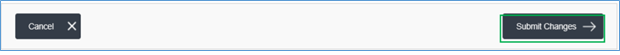

After amending the details of the relevant sections as discussed above, you need to click the 'Submit Changes' button as shown below:

Click on 'Submit Changes' button to modify the changes. If you wish to cancel, click on the 'Cancel' button. Once you click 'submit changes', changes will be reflected automatically as these changes do not require approval from the FTA. No message will be shown once you click on 'Submit Changes' button.

Apart from the above-discussed sections and fields, businesses are not allowed to make online changes to other details submitted while applying for VAT registration. To know the details which are blocked for online modification and the process to amend, please read 'Amendment of details which are blocked for Online Modification'.