Introduction

With the introduction of VAT in UAE, it is important to note that sale of commercial property is subject to VAT @ 5%. The buyer of the commercial property has to make the VAT payment on the purchase in the FTA portal. In this article, let us understand the process for a person buying commercial property to make payment of the VAT due in the FTA portal.

Steps for VAT payment on commercial property in FTA Portal

Step 1: Create an e-Services account

To pay VAT on purchase of commercial property, you have to first create an e-Services account in the FTA portal, if it is not created already.

The sign-up process is as follows:

- Sign up as a new user by entering your email ID and a unique password

- You will receive an email at the registered email ID asking you to verify your email ID

- Once your email ID is successfully verified, your e-Services account will be created and you can login to the FTA e-Services portal

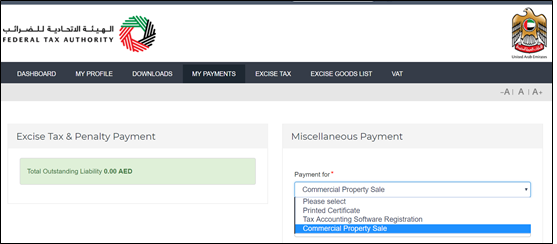

Step 2: Login to FTA portal and go to 'My payments' tab

Step 3: Enter the details under 'Miscellaneous payment'

Under 'Miscellaneous Payment' box, select 'Commercial property sale' from the 'Payment for' drop-down list as shown below:

Step 4: Enter the mandatory details

Note: The seller of the commercial property will give you a tax invoice showing the VAT amount and the seller’s TRN. It is very important that you keep a copy of this tax invoice.

The following mandatory details are required to be entered under the 'Miscellaneous payment' box:

- VAT amount- This will be available on the tax invoice issued by the seller

- Seller's TRN- This will be available on the tax invoice issued by the seller

- Commercial property number- This number can be provided to you by the seller or the land department

- Date of sale- This will be available on the tax invoice issued by the seller

- Land department- Select the relevant land department from the drop-down list

Once the above fields are filled, click on 'Make Payment' button.

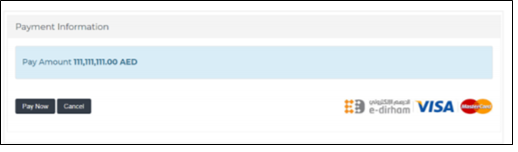

Step 5: Make the VAT payment

Once you click on 'Make payment' button, the 'Payment Information' screen appears. Click on 'Pay Now' button at the bottom left and you will be directed to the e-Dirham gateway to complete the payment.

Once you are redirected to the e-Dirham gateway, you will be able to make a payment through an e-Dirham or non e-Dirham card. Once the payment is done, the payment transaction number will be generated automatically.

Note: Keep the payment transaction number with you when you visit the Land Department to continue processing the ownership transfer process. Remember that without the payment transaction number, the purchase of the property will not proceed.

Hence, the process for VAT payment by buyers of commercial property is easy and direct. Buyers of commercial property should note that the payment for VAT should be done in the FTA portal and the payment transaction number should be retained for further processing of the ownership transfer process to you.