Huge steps towards tomorrow have been taken; the traditional paper-printed invoice in Saudi Arabia is now a thing of the past. As Saudi Arabia rapidly moves towards its ambitious vision, companies are adjusting to a new environment where everything can be measured and processed in seconds.

On December 4, 2020, the Zakat Tax and Customs Authority (ZATCA) published an e-invoicing regulation setting out the terms, requirements and conditions for electronic payments and related terms Providing two-way e-invoicing is it mandatory in Saudi Arabia. The first phase, which began on December 4, 2021, required businesses to use custom software to process and store electronic payments. As of this date, manual payments are not accepted.

|

How to Generate e-invoices Instantly with TallyPrime in Saudi Arabia |

The second phase commenced on February 1, 2023, where businesses had to integrate their e-invoicing system with the ZATCA FATOORA platform for real-time verification and reporting Depending on the taxable services, this integration is being rolled out in waves. For example, taxpayers with more than SAR 30 million had to comply by June 30, 2025, while taxpayers with more than SAR 25 million had to accrue by October 1, 2024. Wave another will take place in early 2025, targeting businesses with lower income thresholds.

Digitization of all businesses and processes is critical to success in this new era. e-invoicing offers a win-win solution for vendors and customers in Saudi Arabia, allowing them to generate invoices, credit notes and debit notes in a structured and secure electronic format through customized e-invoicing software This transformation not only does it maximize efficiency but it also ensures compliance with tax laws, so as to be more transparent and convenient Paving the way for a professional environment

Identifying the Right Format for Your E-Invoice

Before diving into the unique e-invoice codecs, it is important to recognize what qualifies as a compliant e-invoice. According to ZATCA's e-invoicing rules, and bill is simplest if it is generated in a structured electronic format via digital approach. This approach ought to be issued and distributed solely in digital shape—no paper copies or scanned variations are allowed.

Invoices transformed from paper via copying or scanning do not now qualify as digital invoices. Similarly, invoices created by using word processing or graphic software are not considered compliant. Only invoices generated by way of authorized e-invoicing systems that adhere to ZATCA's specs are identified as compliant electronic invoices.

E-Invoice Formats in Saudi Arabia

In Saudi Arabia's VAT machine, forms of invoices are issued for taxable substances: the Tax Invoice and the Simplified Tax Invoice. If you are selling to any other business (B2B), you will need to problem a tax e-bill. If you are selling to individual customers (B2C), you'll issue a simplified tax invoice. Both forms of invoices fall below the scope of e-invoicing, so organizations must follow ZATCA’s hints while issuing them.

E-Invoice Format for Tax Invoice

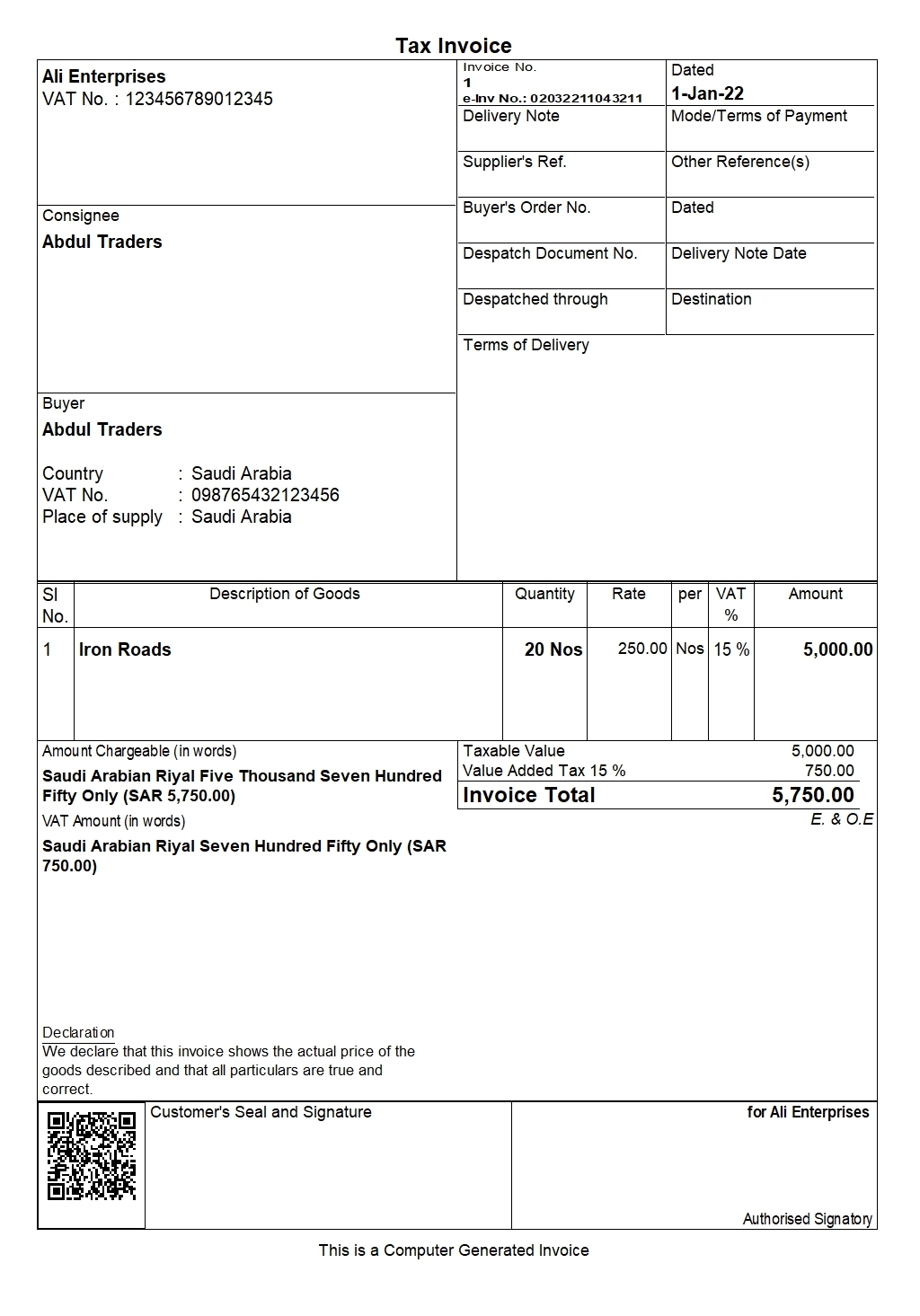

The Tax Invoice layout is vital for Business-to-Business (B2B) and Business-to-Government (B2G) transactions in Saudi Arabia. This layout is ruled through guidelines mounted by way of the usage of the Zakat, Tax and Customs Authority (ZATCA) to make certain compliance with the Kingdom's VAT laws. Here is an extensive rationalization of the critical aspect components that must be covered in a tax bill:

A sample tax e-invoice format generated from TallyPrime

- Seller and Buyer Information: The invoice must display the names, addresses, and VAT registration numbers of the seller and the customer. This statistic is critical for identifying the parties concerned in the transaction and for tax reporting capabilities.

- Invoice Issuance Date: It is essential to include the date while the invoice is issued. This enables to monitor payment timelines and ensuring compliance with tax pointers.

- Description of Goods/Services: A special description of the goods or offerings being billed must be blanketed. This not only clarifies what is being charged however also aids in stock management and monetary reporting.

- Total Amount Due, Including VAT: The bill has to sincerely use a the overall quantity payable, which incorporates any relevant VAT. This transparency is crucial for each occasion to recognize their economic duties.

- Unique Invoice Identifier (UUID): Each tax bill should have a unique identifier, referred to as a Universally Unique Identifier (UUID). This ensures that every invoice can be tracked for my part within the tax machine.

- QR Code: While non-obligatory for B2B transactions, a QR code is mandatory for Business-to-Consumer (B2C) transactions. The QR code serves as a gadget-readable representation of key invoice information, facilitating brief validation and enhancing protection.

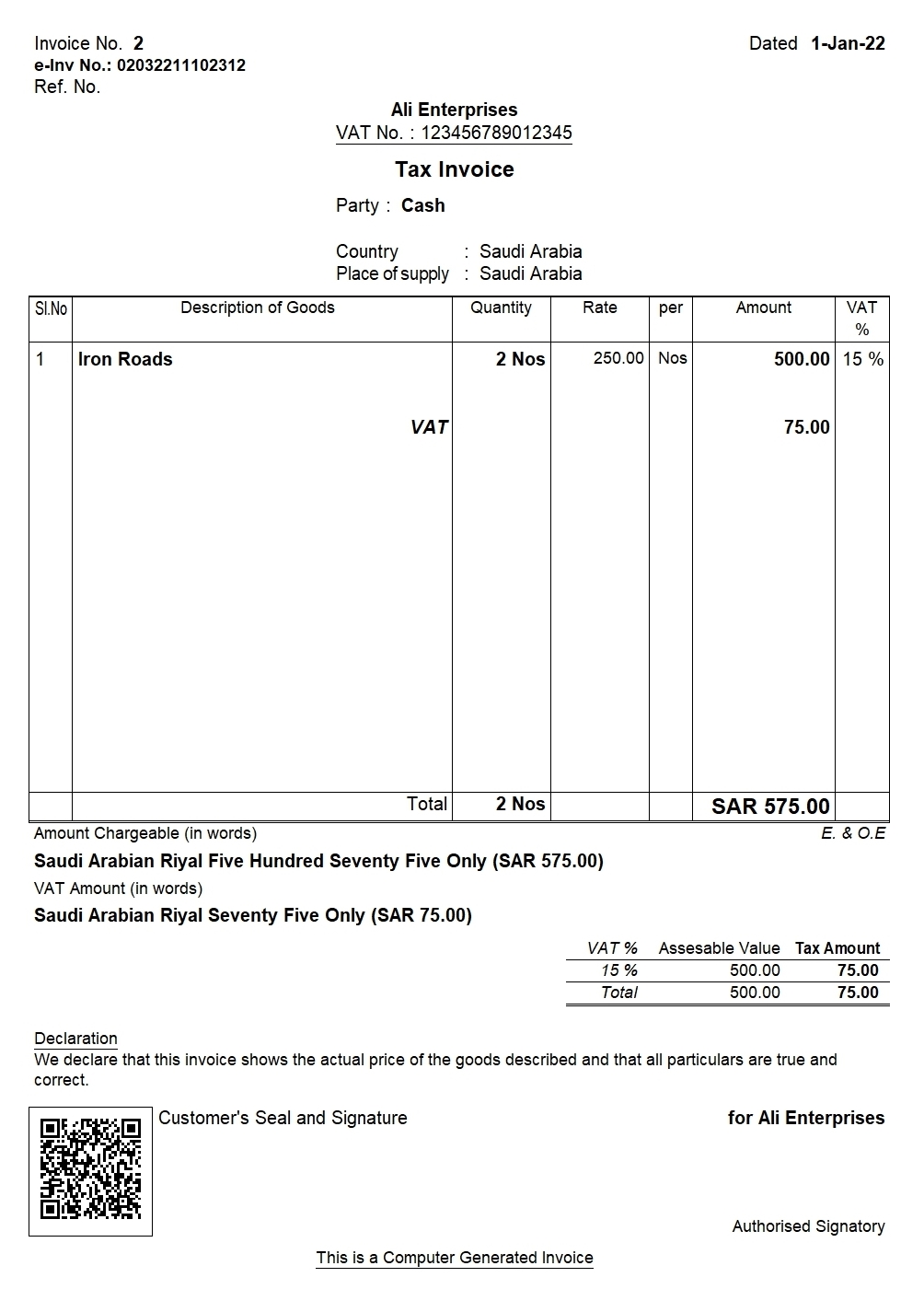

E-Invoice format for simplified tax invoice

If you sell to individual customers in Saudi Arabia, you can issue a simplified invoice. Also, if the supply value does not exceed SAR 1,000, a simplified tax invoice can be issued

For sales to individual customers or when the supply value does not exceed SAR 1,000, businesses can issue a simplified tax invoice. The requirements for simplified e-invoices include:

A sample simplified e-invoice format generated from TallyPrime

Here are the mandatory fields for an E-invoice

- Invoice Type: Need to mention that it is a simplified tax invoice in its document title.

- Invoice Identifiers: Identifiers that are distinct to each simplified e-invoice, such as Invoice Reference Number (IRN), Universally Unique Invoice Identifier (UUID), etc.

- Date: Needs to contain the date and time of its generation.

- Seller Identification: A simplified e-invoice needs to contain fields that assist in seller identification, such as name, address, VAT registration number, etc.

- Buyer Identification: Needs to contain details of the buyer to whom the invoice has been issued, such as name, buyer ID etc.

Note: for simplified e-invoice, ZATCA only requires the addition of the buyer's name. - Line Items: This field states the description of goods and services including unit price, quantity, discounts, VAT total, tax code and subtotals.

- Totals: The invoice needs to state the total amount to be charged and the totals for discounts and VATs.

- Payment Terms: This field should specify if the mode of payment

- Notes: These are inserted in every invoice to capture fields other than those covered above.

- Cryptographic Stamp: Added on e-invoice to ensure authenticity of origin and integrity of the content.

Technical Specifications

The technical specifications for e-invoices in Saudi Arabia include:

- Formats: e-invoices must be generated in XML or PDF/A-3 formats with embedded XML.

- Security: Invoices must include digital signatures, unique identifiers (UUID), and hash generation to ensure integrity.

- Internet Connectivity: The invoicing system must be capable of connecting to ZATCA’s API for real-time validation.

Difference between tax and simplified e-invoice formats

So, if you are thinking about which e-invoice format your business should issue, you just need to identify the business model. This will help to know if you need to issue a tax e-invoice or a simplified tax e-invoice. To make it easy, we have summarized the differences in the table below.

|

Details |

Tax E-invoice |

Simplified Tax E-invoice |

|

Buyer Type |

Business or Company |

Individual Customer |

|

Invoice Requirements |

Same requirements of regular tax invoices |

Same requirements of regular simplified tax invoices |

|

Buyer VAT Number |

If registered under VAT |

Not Applicable |

|

QR Code |

Optional |

Mandatory |

|

Main Requirements of any e-invoice type |

Seller’s name VAT registration number of the seller Timestamp of the Electronic Invoice or Credit/Debit Note (date and time) VAT total Electronic Invoice or Credit/Debit Note total (with VAT) |

|

How TallyPrime can help you in e-invoicing?

TallyPrime 5.1 is recognized by ZATCA as compliant e-invoicing (FATOORA) software, designed to simplify the entire process — from generating e-invoices instantly to securely storing them, while offering comprehensive reporting features to track all transactions seamlessly.

Key E-Invoicing Features of TallyPrime 5.1:

- Seamless E-Invoice Generation: Create e-invoices effortlessly during invoice recording or from reports anytime.

- Support for Multiple Document Types: Handle tax invoices, simplified invoices, debit notes, and credit notes with ease.

- Automated Archiving: Invoice details are automatically saved in XML format to meet compliance requirements.

- Tamper-Proof Documentation: Prevent further edits once an invoice is recorded, ensuring data security and integrity.

- Enhanced Reporting: Access exclusive e-invoice reports and event logs for complete visibility into invoicing activities.

In conclusion, as Saudi Arabia continues to embrace digital transformation with mandatory e-invoicing, understanding its formats and benefits becomes essential for businesses seeking compliance and growth. By leveraging TallyPrime 5.1, companies can achieve both regulatory compliance and improved efficiency in their invoicing processes.

Frequently Asked Questions

What is the format of e-invoice in Saudi Arabia?

E-invoices in Saudi Arabia must follow the ZATCA (Zakat, Tax, and Customs Authority) requirements. The standard format is XML or a hybrid format that includes both XML and a human-readable PDF/A-3. The e-invoice must contain key information such as supplier and buyer details, VAT registration numbers, invoice number, issue date, line items, total amounts, and VAT details.

Is QR code mandatory for an e-invoice in KSA?

Yes, a QR code is mandatory for e-invoices in Saudi Arabia for simplified tax invoices (used in B2C transactions). The QR code should contain essential information like the seller's VAT registration number, invoice date and time, total invoice amount, and VAT amount. For standard tax invoices (B2B), ZATCA requires electronic signatures instead.

What is ZATCA in Saudi Arabia?

ZATCA (Zakat, Tax, and Customs Authority) is the regulatory authority responsible for overseeing taxation, customs, and zakat collection in Saudi Arabia. ZATCA manages the implementation of e-invoicing regulations, ensuring compliance with tax laws, and promoting digital transformation in taxation processes. Their role includes issuing guidelines for e-invoicing and monitoring businesses for compliance.

These e-invoicing regulations help streamline taxation processes and enhance transparency in financial transactions across Saudi Arabia.