- What is e-invoice?

- TallyPrime’s e-invoicing solution

- With TallyPrime generate e-invoices instantly with a single click

- How to generate e-invoice instantly in TallyPrime?

- Enabling e-invoice in TallyPrime

- Generate e-Invoice for KSA

With a focus on digitizing business processes, the authority of Saudi Arabia has introduced a slew of measures. As per the regulation issued by Saudi Arabia’s General Authority of Zakat and Tax (GAZT), businesses will be required to implement e-invoicing (Fatoora) from 4th December 2021 onwards.

The move of introducing e-invoicing by the GAZT comes under the pretext of limiting shadow economy and promoting fair competition among businesses, thereby protecting consumers. It also aims to control commercial and tax fraud, thus enabling a better business outcome. Now, being a business operating in the Saudi Arabia, you might have some questions like what is e-invoice? How to seamlessly shift to an e-invoicing process? How to generate e-invoice instantly in TallyPrime? Here’s what you need to read to get insights into it.

What is e-invoice?

E-invoice refers to the digital tax document of any B2B transaction and this concept requires businesses to store electronic invoices and notes using compliant e-invoicing software or any other electronic system. It should be noted that scanned or photocopied invoices are not considered as e-invoices.

| Best e-Invoicing (Fatoora) Software in Saudi |

TallyPrime’s e-invoicing solution

As a rule of thumb, all VAT-registered business entities are required to generate e-invoices to remain compliant with the e-invoicing regulations.

To begin with the e-invoicing process, your business management software should generate and store electronic invoices and notes as per the guidelines issued by ZATCA. Being an inclusive software, TallyPrime is compliant with Saudi Arabia's e-invoicing mandate. Here's how you can generate e-invoicing with TallyPrime in Saudi Arabia:

- Instantly generate e-invoices in a single click

- Seamlessly print QR code on invoices

- Generate both simplified and tax e-invoices

- You will get an exclusive e-invoicing report that will provide you with a single view of all tasks related to e-invoicing

- Tackle exceptions with the intuitive prevention, detection, and correction mechanisms

- E-invoices for debit note, credit note POS invoice, and receipts are also supported

- E-invoice can be exported in XML file that adheres to the ZATCA (GAZT) requirement

- Security control and user login management provides enhanced efficiency

- User session log register lets you view all the log details the provides the entire history of the masters & transactions

With TallyPrime generate e-invoices instantly with a single click

TallyPrime is an intuitive software that just requires a one-time setup, post which you can start generating and printing e-invoices easily. With a quick enable, record and print, TallyPrime will take care of all business processes:

- Generates e-invoices while simultaneously recording invoices, or do it anytime from the reports

- Supports e-invoices for tax invoice, simplified invoice, debit notes, and credit notes

- TallyPrime is devised to archive invoice details in XML format all the while recording your invoices - a mandatory requirement to be a compliant e-invoice solution

- Once recorded, the system doesn't allow any further edits or alteration to the invoice, thus ensuring that it is tamper-proof

- E-invoice reports and event log provides you with a comprehensive overview of e-invoice activities and entire transaction history

How to generate e-invoice instantly in TallyPrime?

With TallyPrime, businesses can quickly generate e-invoices, without any hassle. Being an intuitive software, it requires a one-time setup to start generating and printing e-invoices. Additionally, it quickly adapts to your working style while providing you with the flexibility to create reports. To generate e-invoices in TallyPrime, all you need to do is enable e-Invoice, record transactions, print invoices, and view e-Invoice reports in TallyPrime.

- For starters, you should have the latest TallyPrime Release 2.0 or later with a valid TSS. To understand how to upgrade to the latest version of TallyPrime and Renew TSS.

- Your Tally Serial Number should be eligible for e-invoicing in TallyPrime. You can know the eligibility and activate e-invoicing for your Tally Serial number

e-Invoicing in TallyPrime is as easy as 1,2,3…enable, record and print e-invoices. Let’s start with one-time configuration to enable e-invoice

Enabling e-invoice in TallyPrime

Company configuration

To get started with e-invoicing, you will need to enable e-invoicing for a Company. To enable, Press F11→ Set ‘e-invoicing applicable’ to ‘Yes’ →Mention the applicable date →Enable ‘e-invoice for B2B transactions’ →Archive e-invoices’ to store a digital copy of the invoice in XML.

Enabling e-invoice in TallyPrime

Enabling e-invoice in TallyPrime

Voucher type configuration

The next step is to enable e-invoicing for voucher types (transaction type) for which you want to generate e-invoices. This includes sales invoice, both tax invoice and simplified invoice, credit note and debit note.

To get started follow the below-mentioned steps:

- Press Alt+G (Go To) > Alter Master (You can select ‘Create’ if you want to create new voucher type > Voucher Type > type Sales > press Enter

- Alternatively, you can also click on Gateway of Tally > Alter/Create > Voucher Type > type or select Sales > press Enter.

- Once you get to the Voucher Type Alteration screen for Sales, you can set Allow e-invoicing to Yes. Press Ctrl + A to Accept

Generate e-Invoice for KSA

After you have done the one-time configuration to enable e-invoicing, you are all set to record and generate e-invoices. The best part is that e-invoices can be printed in a bilingual format as per your requirement.

- Gateway of Tally > Vouchers > press F8 (Sales) Mention the invoice details > Save > Print e-invoice.

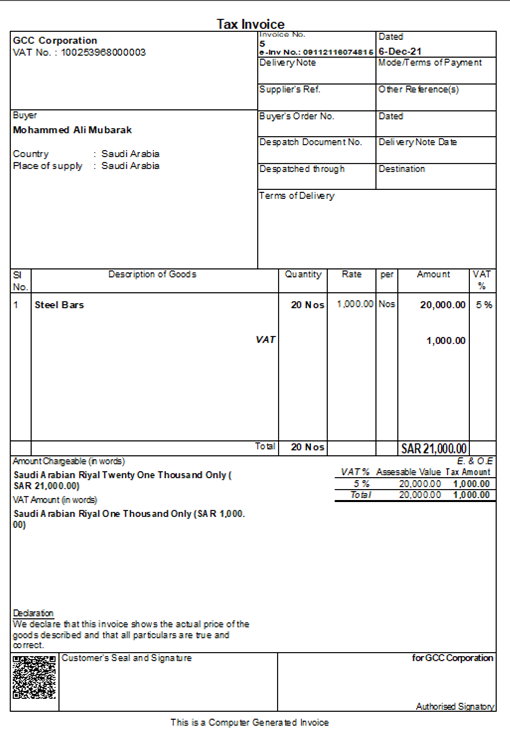

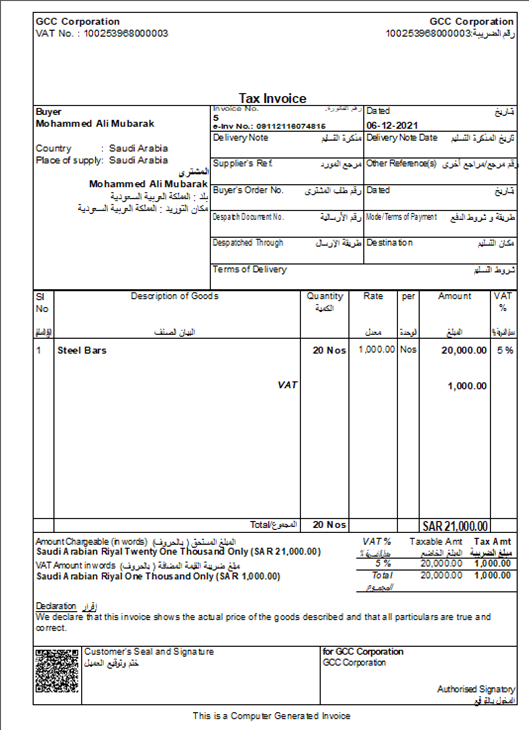

e-invoice in TallyPrime

e-invoice in TallyPrime

Bilingual e-invoice in TallyPrime

Bilingual e-invoice in TallyPrime

- What’s more? Once the voucher is saved, TallyPrime automatically exports the invoice to XML format. This is one of the key requirements to archive the invoice. Also, TallyPrime ensures that editing or deleting the invoice is restricted as per the guidelines issued by the authorities.

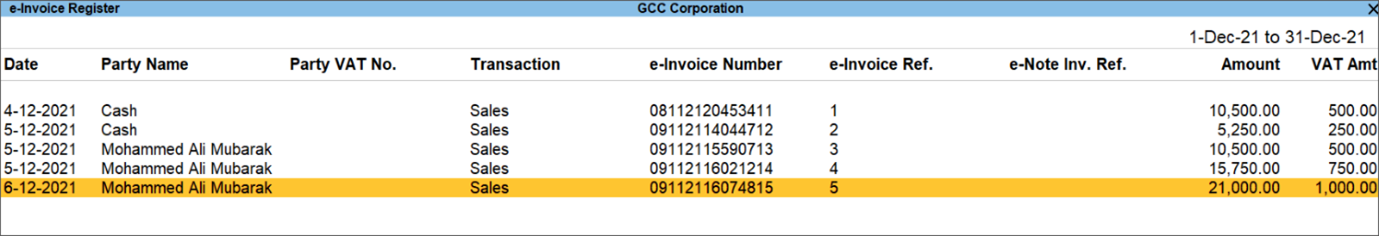

- e-invoice report: TallyPrime comes with 2 exclusive e-invoice reports – e-invoice register and e-invoice event log that help stay on top of e-invoicing activities. e-Invoice register shows you all the e-invoices with details such as party name, e-invoice number, date, VAT amount etc.

e-invoice report using TallyPrime

e-invoice report using TallyPrime

e-Invoice event log shows various events related to e-invoice transactions such as created, tampered, etc. with user’s details and time stamp. To get an e-invoice experience, book a free trial of TallyPrime today!

Read more on Saudi Arabia VAT

Saudi VAT Return Format, What is Time of Supply under VAT Saudi Arabia, Export of goods to Non-GCC countries from Saudi Arabia, How should VAT records be maintained in Saudi Arabia

VAT invoice

e-Invoicing Software in Saudi, e-Invoicing (Fatoora) in Saudi Arabia, VAT invoice in Saudi Arabia, VAT invoice format in Saudi Arabia, Types of invoices under VAT in Saudi Arabia, Simplified Tax Invoice in Saudi Arabia, Checklist for VAT invoice in Saudi Arabia, Supplies Covered Under e-Invoicing in Saudi, How Phase-1 of e-Invoicing System Work, Date & Implementation Phases of e-invoicing (Fatoora)

VAT registration

VAT Registration Process in Saudi Arabia, VAT Registration Threshold Calculation in Saudi Arabia, 5 Key Benefits of VAT Registration in Saudi Arabia

VAT payment

VAT payment in Saudi Arabia, VAT Payment on Import of Goods under Saudi VAT, FAQ on VAT Payment in Saudi Arabia