Time of supply in Saudi VAT simply refers to the point in time when your output tax is required to be paid. The time of supply provisions in Saudi VAT determines the date on which output tax liability on a given supply arises.

The concept of time of supply is very crucial for businesses to know the period in which the output VAT needs to be paid to the Government. The output tax on the supplies needs to be paid periodically, either monthly or quarterly. To determine the output tax which needs to be reported in that period, you need to apply the time of supply provisions.

Let us consider a scenario to understand why is Date of Supply or Time of supply is crucial for businesses?

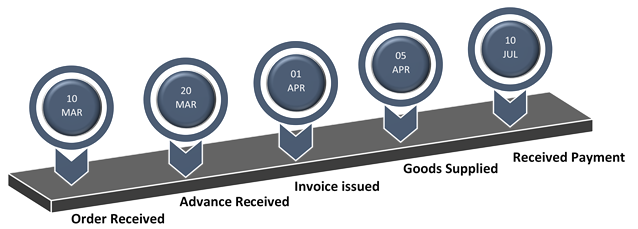

- 10th March, 2018 : Receipt of sales order from a customer to supply goods

- 20th March, 2018 : Receipt of advance amount (10% of supply value)

- 1st April, 2018 : Invoice is issued to the customer with details of supply and applicable VAT

- 5th April, 2018 : Goods are delivered to the customer

- 10th July , 2018 : Received remaining payment (90%) including VAT from the customer

Let us assume that you are required to file quarterly VAT returns i.e. Jan-Mar’18, Apr-Jun’18 and Jul-Sep'18.

If you closely look at the above illustration, a single transaction of supply consists of multiple dates spread across three VAT return periods.

Now, considering the above scenario, what will be the date of supply?

Going with the plain understanding, you may think 10th July, 2018 as the date of supply since the full payment along with VAT is received only on 10th July, 2018. Another taxpayer may think, it should be the date of actual delivery of goods i.e. 5th April, 2018 and so on. This ambiguity does exist even in the case of a supply of services too.

In order to remove the above ambiguity and to appoint one specific date for the taxpayer as well as for tax administration to quantify the amount of tax to be paid for the return period, the Saudi VAT law is provisioned with the concept of 'Date of Supply'.

For businesses, the concept of time of supply helps in remitting the correct VAT payment to the General Authority of Zakat and Tax (GAZT). Any discrepancies in applying the time of supply provisions will have a significant impact on the cash outflow of the business. Wrong determination of the date of supply will either lead to delay in paying the tax which will attract a penalty or you may end up, in early payment of tax which will impact your cash outflow. To know about the different events of supply considered in determining the time of supply, please read 'Time of Supply in Saudi VAT'.

Read more on Saudi Arabia VAT

Introduction to VAT in Saudi Arabia, Saudi VAT Return Format, Saudi VAT for Export of Services Outside GCC, VAT rates in Saudi Arabia, Zero-Rated Supplies under VAT in Saudi Arabia, Difference between zero rated & exempt VAT in Saudi Arabia, VAT Exempt Supplies/Items in Saudi Arabia

VAT Invoice

VAT invoice in Saudi Arabia, VAT invoice format in Saudi Arabia, Types of invoices under VAT in Saudi Arabia, Simplified Tax Invoice in Saudi Arabia, Checklist for VAT invoice in Saudi Arabia

VAT Registration

VAT Registration Process in Saudi Arabia, VAT Registration Deadline in Saudi Arabia, VAT Registration Threshold Calculation in Saudi Arabia, Who should register for VAT in Saudi Arabia?, 5 Key Benefits of VAT Registration in Saudi Arabia

VAT Payment

VAT payment in Saudi Arabia, VAT Payment on Import of Goods under Saudi VAT, FAQ on VAT Payment in Saudi Arabia

Input VAT Deductions

Input VAT deductions in Saudi Arabia, Checklist for Input VAT Deduction, Eligibility for Input Tax Deduction under Saudi VAT