The Zakat, Taxation and Customs Authority (ZATCA) plays a key role in the introduction of e-invoicing in Saudi Arabia. Established to spruce up tax compliance and streamline budgeting, ZATCA has mandated a shift from traditional to electronic taxation (e-invoicing) as a comprehensive approach to the country’s tax system is part of the modernization Widespread e-invoicing is huge for companies , as it forces a shift towards efficiency, transparency and regulation additional controls on financial token transactions The website will allow people to understand the first phase of the e-invoicing process, known as the generation phase, which began on December 4, 2021.

| Date and Implementation Phases of e-invoicing (Fatoora) in Saudi |

Understanding Phase 1: Generation of E-Invoices

In the first or generation phase, businesses are required to electronically prepare and store tax returns. This section is designed to help businesses transition from manual to digital invoicing, ensuring all payments comply with ZATCA regulations This section requires businesses to implement an e-invoicing system capable of compliant structured electronic payments meet the specific requirements set by ZATCA.

Key Requirements

To ensure phase one compliance, companies must meet several mandatory requirements:

Format Compliance: Invoices must be generated in a structured electronic format, typically XML or PDF/A-3 with XML.

Mandatory fields: Each invoice must include the required information, e.g.

Details of seller and buyer (name, address, VAT number)

Invoice Date

Description of products/services offered

All amounts due including VAT

Unique Invoice Identifier (UUID).

QR code inclusion: While optional for B2B transactions, QR codes are mandatory for Business-to-Consumer (B2C) transactions to facilitate quick authentication.

Digital Signature: Invoices should have a digital signature to ensure authenticity and authenticity.

Timeline for implementation

The first phase officially kicked off on December 4, 2021, and required businesses to comply with this rule by creating and storing electronic invoices. It is not necessary to include ZATCA in plans at this time; However, the groundwork for the next phase of integration, which began on January 1, 2023, was laid.

How phase-1 of e-invoicing system work

In the first phase, called the generation phase, the critical requirement is that the business uses e-invoicing software or a solution that complies with the e-invoicing requirements and specifications issued by the authority.

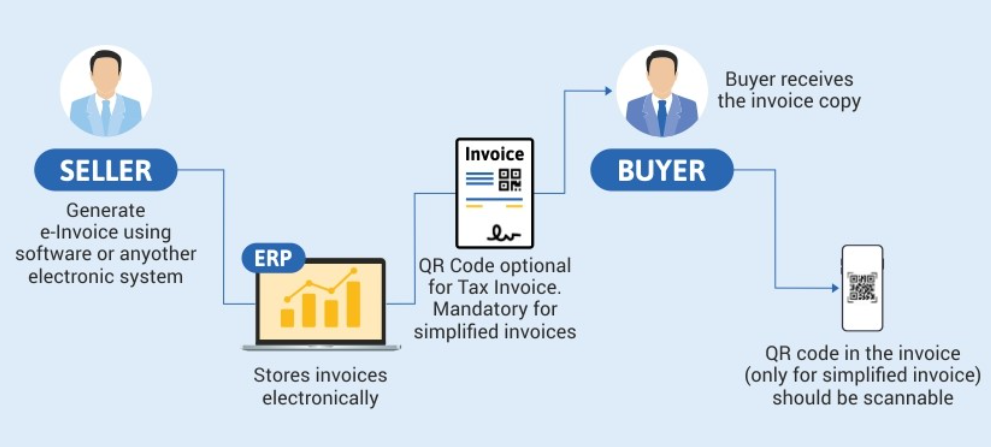

In this phase, you need to generate an e-invoice using business software or other electronic means and issue it to the seller. The only thing that businesses need to ensure is that invoice consists of all mandatory components like TRN number, QR code in case of simplified invoice etc. Adding of QR code is compulsory for Simplified invoices and tax invoices. It is optional. Let’s understand this with an illustrative workflow.

The above illustrative diagram on e-invoice system is explained below:

- The seller generates e-invoice through a complaint e-invoice system which can be ERP software or any other electronic system

- The e-invoice generated should include all the mandatory details of the invoice. The mandatory details e-invoice will have the same requirements as the current invoice specified in VAT law and regulations

- The additions in the e-invoice are buyers VAT registration number for tax invoices and QR code on simplified invoices

- Once an e-invoice is generated, the seller stores the invoices in the same e-invoicing system.

- The buyer receives a copy of the e-invoice

- In case if it is a simplified invoice, the QR code printed on the e-invoice should be scannable

Compliance Checklist for Phase 1

To help businesses ensure they meet all requirements for Phase 1 compliance, here’s a handy checklist:

- Generate invoices in XML format.

- Include mandatory fields such as:

- VAT numbers

- Timestamps

- Seller and buyer information

- Ensure QR code inclusion where applicable (mandatory for B2C).

- Implement digital signatures for authenticity.

- Store and archive all electronic invoices securely.

Challenges and Solutions

As companies transition to Phase I e-invoicing, they may face several challenges:

- Integration with existing systems: Many companies are struggling to adapt their current payment systems to the new e-invoicing rules.

- Data Security: Ensuring the proper handling of sensitive financial information can be difficult.

- Paper-to-digital transition: The transition from traditional invoices to digital formats can create operational challenges.

To meet these challenges, companies can consider the following practical solutions.

- Check with certified solution providers: Working with experienced e-invoicing solution providers can facilitate a smooth transition.

- Ask ZATCA for help: Companies should not hesitate to contact ZATCA for compliance and best practice guidance.

- Invest in training: Training employees on new policies can improve overall performance to support the change process.

How TallyPrime Helps/Supports

Though defining e-invoicing solutions for employers there are several criteria, key companies should follow:

- Security Features: Ensure that the company offers solid security features to movie sensitive information.

- Compliance Capabilities: The solution must fully comply with all ZATCA requirements for e-invoicing. TallyPrime 5.1 is recognized for its compliance with FATOORA standards, making it a trusted choice.

- Ease of Integration: Look for solutions that seamlessly integrate with existing accounting or ERP systems. TallyPrime 5.1 offers effortless integration to support your accounting operations.

The first stage of e-invoicing in Saudi Arabia marks a significant step in modernizing financial transactions in the Kingdom. Compliance with this phase is essential as it paves the way for more advanced requirements in phase two. Businesses that adopt e-invoicing now, using solutions like TallyPrime 5.1, will not only ensure compliance but also enhance operational efficiency and stay future-ready for dynamic tax changes.