Majority of businesses in UAE which meet the criteria for registration under VAT have already registered by now. A registered taxable person is required to comply with the required rules and processes under VAT. Invoices have to be issued in the specified format, returns need to be filed on a timely basis and the tax due needs to be paid by the due date. The VAT Law provides registered taxable persons with the facility to cancel their VAT registration. Let us understand the circumstances in which a person can de-register under VAT and the process to be followed for the same.

What is VAT De-registration?

Tax De-registration is the provision for a registered taxable person to cancel his/her VAT registration. It means de-activation of the registration and the VAT number of the taxable person. Tax de-registration can be applied for by a person registered under VAT or done by the FTA on finding that a person meets the conditions for de-registration.

When can a person apply for VAT De-registration in UAE?

A person registered under VAT can apply for Tax De-registration in the following 2 cases:

- The person stops making taxable supplies and does not expect to make any taxable supplies over the next 12-month period OR

- The person’s taxable supplies or taxable expenses incurred over a period of 12 consecutive months is less than the voluntary registration threshold (AED 187,500) and he/she does not anticipate to cross this threshold in the next 30 days

Note that a person who has voluntarily registered under VAT cannot apply for de-registration in the 12 months following the date of registration.

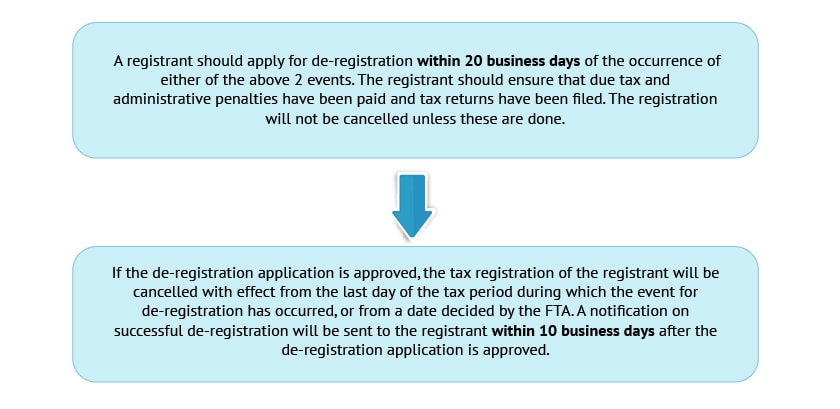

What is the process of de-registration under VAT in UAE?

The process for de-registering under VAT is shown below:

When can a registration be cancelled by the FTA in UAE?

The FTA can cancel a person’s registration if it is found that the registrant satisfies either of the 2 conditions listed above for de-registration. This is called mandatory tax de-registration.

Hence, VAT de-registration is a welcome option for persons who have registered under VAT but do not continue to make supplies requiring registration. Such persons do not need to continue being registrants and can apply for tax de-registration on satisfying the applicable conditions.