All the registered taxpayers in UAE are required to file the VAT returns either on the monthly or quarterly basis. If the output VAT in VAT return is higher than the recoverable input VAT, the difference will result in VAT liability which needs to be paid to the FTA. The steps to make VAT payment is listed below.

Steps to Make VAT Payment

After submitting the VAT return form, the VAT payable and the other liabilities like penalties which a taxpayer needs to pay will be shown under ‘My Payment’ in FTA portal. Below are the steps to check and pay the VAT liabilities:

- Login to FTA ( https://eservices.tax.gov.ae) using your username and password

- Navigate to 'My Payments' available in the portal dashboard

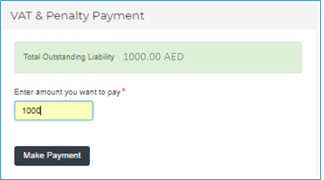

- In the next page under 'VAT & Penalty Payment', the amount which taxpayer needs to pay will be shown as 'Total Outstanding Liability'

- Below the total outstanding liability, you mention the amount you want to pay and click 'Make Payment' as shown below:

Please note that the partial payments can be made. However, make sure you pay the entire amount before the due date to avoid penalty. Also, older liabilities will be paid off first and then the more recent ones will be fulfilled afterwards e.g. if you make a payment, the VAT Return liability for the month of January will be paid before the VAT Return liability for the month of February

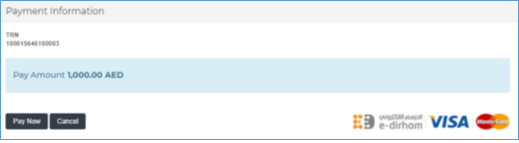

- On clicking 'Make Payment' you will be directed to 'Payment Information' as shown below:

Click on 'Pay Now' button to proceed with the payment. It will be directed to the e-Dirham gateway.

- Once you are redirected to the e-Dirham gateway, you will be able to make the payment through an e-Dirham or non e-Dirham card.

- After confirming the transaction and the VAT payment is processed successfully, you will be redirected to the FTA website.

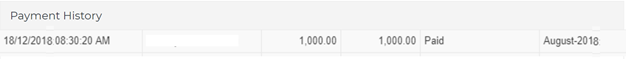

You can view the transaction history and payments under the 'VAT Transaction History' available in 'My Payments' tab as shown below.

These include your transactions and payments for your periodic VAT Returns as well as any penalties that could be applicable in relation to your VAT Returns, if applicable. For example, late filings or payments for your VAT Returns etc.

Penalties for Late payment of VAT

After submitting the VAT return, the taxpayer has to ensure that the payment is done within the timeline. Failure in the payment before the due date would result in a late payment penalty, as listed below:

- 2% of the unpaid tax immediately levied once the payment of payable tax is late

- 4% is due on the seventh day following the deadline for payment, on the amount of tax which is still unpaid.

- 1% daily penalty charged on any amount that is still unpaid for one calendar month following the deadline for payment with a maximum ceiling of 300%.