In the previous article ‘Reverse Charge Mechanism in Bahrain VAT’, we understood the concept of the reverse charge mechanism. In this article, we will discuss the Domestic Reverse Charge in Bahrain VAT.

What is Domestic Reverse Charge under Bahrain VAT?

As the name suggests, the domestic reverse charge is a concept in which VAT needs to be paid on reverse charge by the recipient on the domestic supplies. Exporters meeting certain conditions may apply for a domestic reverse charge on certain supplies received from taxable persons in Bahrain.

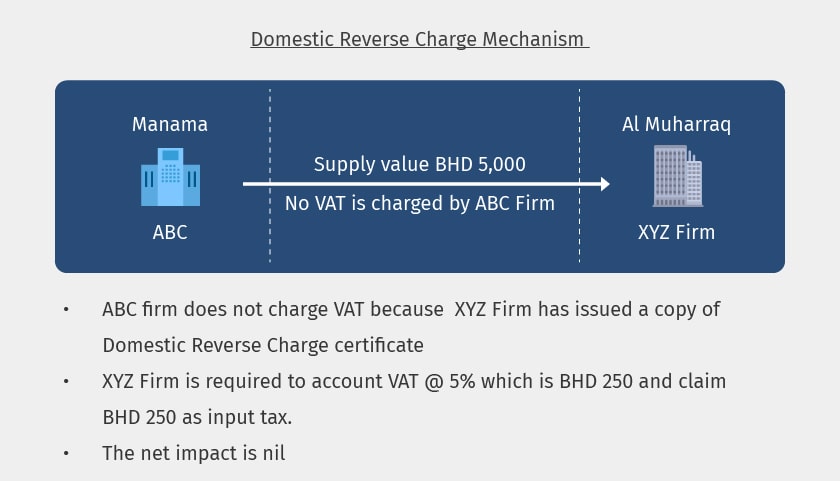

Under Domestic Reverse charge concept, the supplier of goods or services will not charge VAT though he is registered under VAT. The recipient will be liable to account and pay the VAT on reverse charge basis as shown in the below illustration.

Who Can Apply for Domestic Reverse Charge Mechanism?

The registered business primarily engaged in making ‘Intra-GCC Supplies or Exports of Goods’ can apply for domestic reverse charge mechanism by submitting an application to the Nation Bureau of Taxation (NBT) in the prescribed format.

If all the conditions are met, the application will be approved by NBT and a certificate granting rights to apply for domestic reverse charge will be issued. In order to purchase goods or services under this concept, the exporter should issue a copy of the domestic reverse charge certificate to his supplier.

What Are The Conditions to Apply for Domestic Reveres Charge Mechanism?

In order to apply for a domestic reverse charge, the exporter has to meet the following conditions:

- The VAT due on the goods or services supplied should be fully recoverable as Input Tax by the taxable person.

- The Taxable Person should demonstrate that the total amount of Intra-GCC Supplies and Exports exceeds 50% of the total value of his Supplies.

- The Taxable Person should provide reasonable grounds to the Bureau evidencing that the net tax, in accordance with his VAT return, will be a negative amount (excess of Input Vat over Output VAT) on a recurring basis. As a result, it will have a material impact on his financial position of the business.

The concept of Domestic reverse charge is introduced in Bahrain VAT to mitigate the risk of potential cash flow impact on the exporters. If you are primarily engaged in export of goods or services, opting domestic reverse charge will bailout you from cash flow blockage.

Read more on Bahrain VAT

VAT in Bahrain, VAT Invoice in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, Tax Invoice Format in Bahrain, Simplified Tax Invoice Format Under VAT in Bahrain, VAT Return Filing Period, Checklist for Tax Invoice in Bahrain

Credit Note under Bahrain VAT, Reverse Charge Mechanism Under Bahrain VAT, Tax Identification Number (TIN), Important terms under VAT in Bahrain, List of Exempt Supplies under VAT in Bahrain, Zero-Rated supply under VAT in Bahrain

Read More on Bahrain VAT Registration

VAT Registration Deadline in Bahrain, VAT Registration in Bahrain, VAT Payment in Bahrain