Businesses registered under VAT are required to issue tax invoice on supplying taxable goods or services in Bahrain. To know more about the Tax invoice and simplified tax invoice, please read our article ‘VAT Invoice in Bahrain’. Similarly, in certain situations, the taxpayer needs to issue a Credit note. In this article, we will understand the following:

- What is Credit Note and when to issue it?

- Mandatory details to be included in the Credit Note

What is Credit Note and when to issue it?

A credit note is a document that needs to be issued by the supplier in all those situations in which the VAT collected exceeds the VAT due on the supply.

The following are situations in which the Credit note needs to be issued by the supplier.

- Goods sold are returned by the customer

- Decrease in the taxable value of the supply

- Decrease in the tax value

Let us understand Credit note with an example.

On 15-01-2019, Abdul & Co. supplies 10 Monitors @ 70 BHD each, to Ali Electronics. VAT charged on the supply is BHD 35. On the same day, Ali Electronics returns 1 monitor to Abdul & Co., as it was found to be damaged. In this case, Abdul & Co. should issue a credit note to Ali Electronics for the monitor returned and reverse the VAT charged on the monitor.

The issue of Credit note will impact the following:

- Reduction in tax payable by the supplier on the supply

- Reduction in input tax recoverable by the recipient on the supply

What are the mandatory details to be included in the Credit Note?

The following are the mandatory details to be included in the Credit note:

- The words “Credit Note” are clearly stated on the document

- The name, address, and Registration Number of the Taxable Person

- The name and address of the Customer

- A sequential Credit or Debit Note number

- The date of issue of the Credit or Debit Note

- The number of the original Tax Invoice or original document subject to the adjustment

- The adjusted value of the Supply and the Tax amount to be adjusted in Dinars

Time period to retain Credit Note

The taxable person should retain Credit note for a period of five years from the end of the tax period to which it relates.

Example: A Credit note issued on 25th April’ 19 relates to the tax period of January-December '19. Hence, it should be retained until 31st December '24.

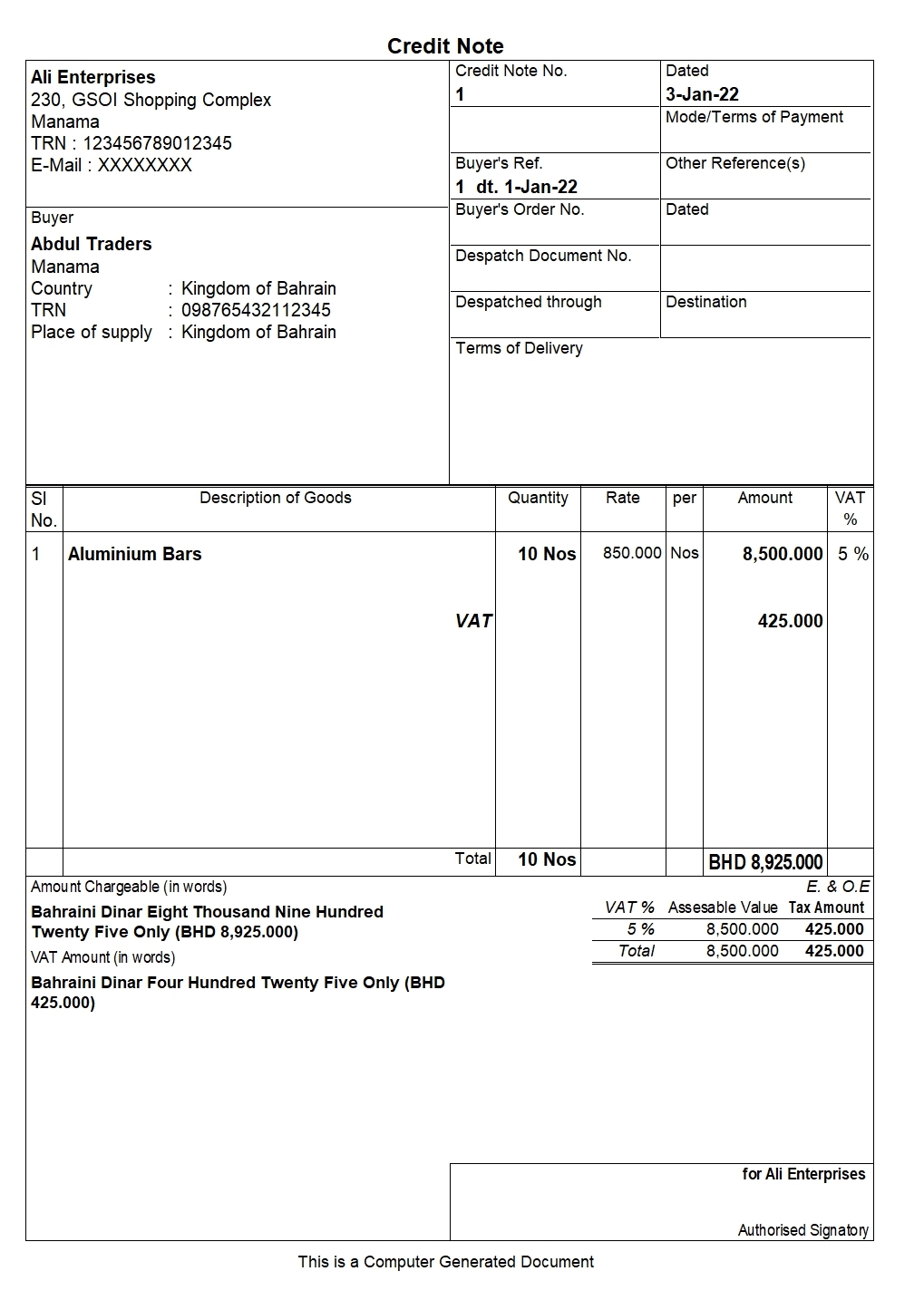

VAT credit note template

The header section of the credit note

One of the mandatory requirements under the header section of a credit note is to have the words “Credit Note” mandatorily mentioned. Followed by the date and original invoice details.

Customer details section in Credit note

Similar to tax invoices, credit notes should also capture the customer details consisting of name, address and TRN number.

Product details section in credit note

Here, the details of the product along with the quantity that's returned should be mentioned. This also includes the rate and value on which the VAT is calculated.

Other details in the credit note

Credit note value, VAT amount, the amount in words etc. are other details that are captured in credit notes.

FAQs on credit note in Bahrain

Is there VAT on a credit note?

Yes. On issuing credit notes against the taxable sale, the VAT needs to be calculated. The reason is that VAT from credit notes will be reversed from the total VAT liability for the tax period.

Is a VAT credit note a refund?

A VAT credit note is generally issued for sales returns and this will be adjusted against the sales made during the tax period.

Is credit note a tax invoice?

Yes, it is one of the tax documents that need to be mandatorily issued on sales returns or any other scenarios as prescribed by the law and regulations.

Read more on Bahrain VAT

VAT in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, Tax Invoice Format in Bahrain, VAT Payment in Bahrain, List of Exempt Supplies under VAT in Bahrain, Zero-Rated supply under VAT in Bahrain, Tax Identification Number (TIN)

Read more on Bahrain VAT Registration

VAT Registration in Bahrain, VAT Registration Deadline in Bahrain