From 1st January, 2019 onwards, the supplier of the taxable goods or services need to charge VAT at 5% and pay it to the government. Generally, the supplier is responsible for collecting and remitting the tax to the government. However, the Bahrain VAT Law and Regulations notify certain type of supplies on which VAT need to be charged on the reverse charge mechanism.

In this article, we will understand the reverse charge mechanism in Bahrain VAT in detail.

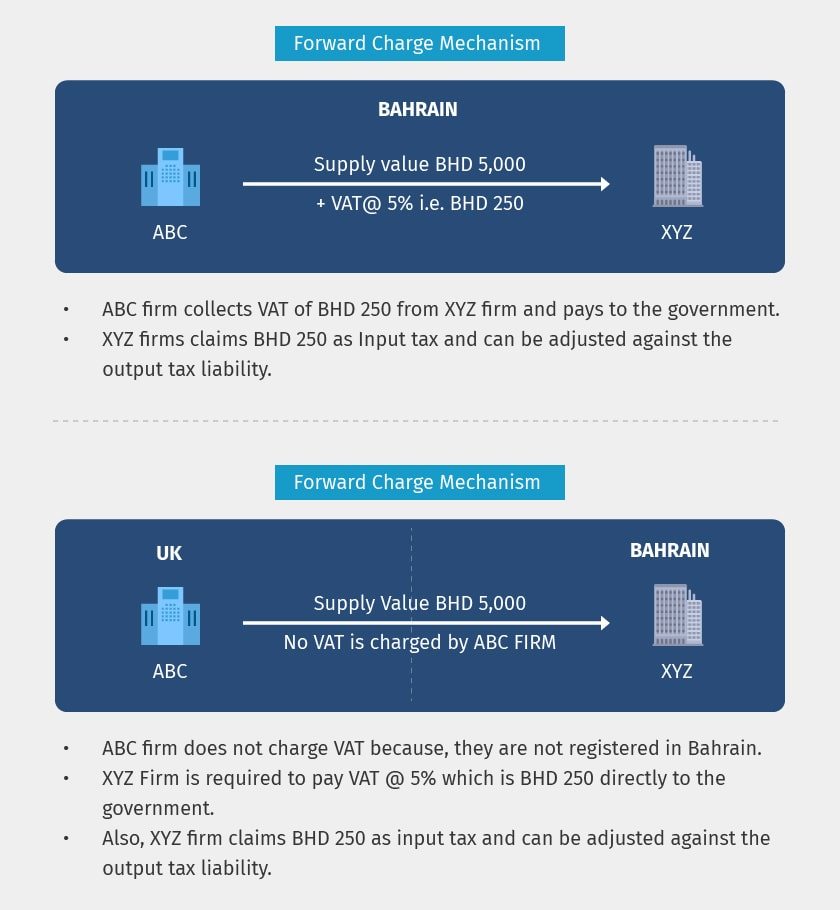

Before understanding the reverse charge mechanism, we need to know the forward charge mechanism.

In the forward charge mechanism, the supplier must levy VAT and pay it the government. For example, Super Cars Ltd sold spare parts worth BHD 100,000 to General Automobiles Ltd and collected VAT of BHD 5,000 at the rate of 5%. The VAT of BHD 5,000 is collected on a forward charge basis.

What is Reverse Charge Mechanism Under Bahrain VAT?

Reverse charge mechanism is a concept under which the recipient or buyer is responsible to determine the tax applicable on the supply and pay to the government unlike forward charge, where the supplier has to pay the tax.

Reverse Charge Mechanism is applicable only for certain notified supply of goods or services and for a certain type of taxable person. On supply of those notified goods or services, the supplier will not charge VAT, instead, the recipient must pay VAT to the government.

How different is Reverse Charge VAT Compared to Forward Charge?

Let’s make the comparative analysis of VAT on forward charge and reverse charge with an example.

If you closely observe the illustration, the net result of reverse charge mechanism is the same as that of a forward charge basis. The only difference in reverse charge VAT is the shift in the responsibility of paying VAT which is moved from supplier to the recipient. In the above illustration, it is moved from ABC Firm to XYZ firm.

What Are The Supplies Liable for Reverse Charge in Bahrain?

The following are the supplies on which reverse charge VAT is applicable in Bahrain.

- Import of Goods or services

- Exporters meeting certain conditions may apply for a domestic reverse charge on certain supplies received from taxable persons in Bahrain.

Read more on Bahrain VAT

VAT in Bahrain, VAT Invoice in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, Tax Invoice Format in Bahrain, Simplified Tax Invoice Format Under VAT in Bahrain, VAT Return Filing Period, Checklist for Tax Invoice in Bahrain, Domestic Reverse Charge under Bahrain VAT, Credit Note under Bahrain VAT