In our previous article ‘Transitional Vat Return Filing Period for 2019,’ we have discussed the different VAT return filing periods for different businesses. In this article, we will be discussing the VAT return filing period applicable from 2020 onwards.

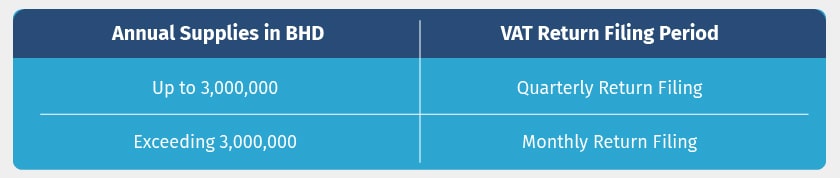

The VAT Return filing period for 2020 onwards is classified into monthly and quarterly VAT Return filing. The following table explains the applicability of the monthly and quarterly Vat return filing period in Bahrain.

VAT Return Filing Period – 2020 Onwards As mentioned in the above table, taxable persons with annual supplies not exceeding BHD 3 million will have quarterly tax periods. Taxable persons with annual supplies exceeding BHD 3 million will have a monthly tax period.

A taxable person with annual supplies not exceeding BHD 3 million can request the National Bureau for Taxation (NBR) to have monthly tax periods. If the NBR accepts the request, it will notify the taxable person about the change in the tax period.

Monthly return tax periods

Taxable persons with annual supplies exceeding BHD 3 million will have a monthly tax period. The following taxable explains the Monthly VAT return filing schedule and due date to file.

As mentioned above, the monthly Vat return is due on the last day of the subsequent month. For example, for the tax period January, 2020, you need to file the returns by 29th February, 2020.

Quarterly VAT return period

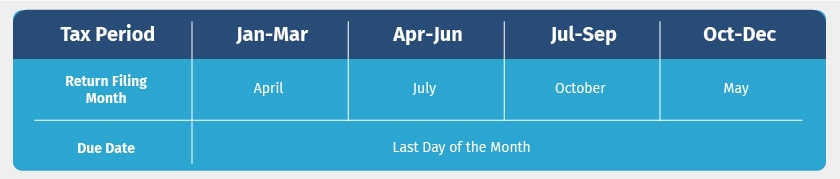

The taxable persons with annual supplies not exceeding BHD 3 million will have quarterly tax periods. The following is the quarterly Vat return filing schedule.

As mentioned above, the quarterly Vat return is due on the last day of the subsequent month following the end of the quarter. For example, for the tax period January- March 2020, you need to file the returns by 30th April 2020.

The Vat return period discussed above is applicable only from 2020 onwards. For the first year i.e. 2019, NBT has designed a transitional VAT return filing period. The transitional filing period is different for different businesses bases on the date of registration.

Read more on Bahrain VAT

VAT in Bahrain, VAT Invoice in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, Transitional VAT Return Filing Period for 2019, VAT Payment in Bahrain

Domestic Reverse Charge under Bahrain VAT, Credit Note under Bahrain VAT, Reverse Charge Mechanism Under Bahrain VAT, Tax Identification Number (TIN)

Read More on Bahrain VAT Registration

VAT Registration Deadline in Bahrain, VAT Registration in Bahrain