The e-invoicing system, which is already being implemented for businesses with turnover exceeding 10 crores from 1st October 2022, is primarily designed with 2 key aspects. First is the adoption of a standard for the invoice, which will enable standardization and swift data exchange across the different systems. The next being the register the invoice with Government, through the Invoice Registration Portal (IRP) which will ensure the authenticity of the invoices.

In the recent update, from 1st August 2023, e-Invoicing will be essential for all the registered persons whose aggregate turnover (based on PAN) in any prior fiscal year from 2017-18 onwards exceeds 5 crores. Know more about Invoice Reference Number (IRN) and How e-Invoice System works?

At a larger picture, it is believed that e-invoicing will play a key role to ensure the interoperability of the data with various systems alongside curbs tax evasion.

| Best e-Invoicing Software Solution for Businesses in India | Generate e-Invoice Instantly in TallyPrime |

With the implementation of e-invoicing, the GST system shall be able to validate all the B2B transactions electronically and pre-populate the same in the taxpayer’s GST return forms and e-way bill, as per the e-invoice details uploaded by the taxpayer.

Before getting into the process to generate an e-invoice, it is important to note that there has been a major misconception surrounding e-invoice generation. The famous misconception here is that businesses can generate invoices centrally through the government's portal.

That’s not true! e-invoice does not mean the generation of invoices from a central portal of the tax department. Instead, an e-invoice requires a business to generate the invoice in the prescribed format using the accounting software and upload it to the portal designed to authenticate such invoices.

Let’s now understand the steps to generate the e-invoice.

How to generate e-invoice?

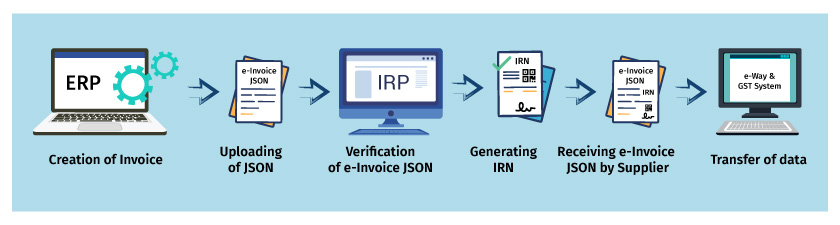

As illustrated above, the following are the detailed steps to generate an e-invoice in GST.

Step -1 Creation of e-invoice JSON: The first step is to create the invoice JSON using the accounting software as per the prescribed format. The taxpayer can generate it either using ERP software or using the offline utility provided by the government.

Step -2 Uploading of JSON: In this step, the invoice JSON for every B2B invoice generated using accounting software or any other utilities are uploaded to the IRP system. If the ERP software is integrated with IRP via GSP, the upload of the JSON file will be automated, meaning the system sends the required details directly to the IRP portal.

Step-3 Verification of e-invoice JSON: In this step, the IRP system validates the e-invoice JSON and checks the central registry of GST for any duplication.

Step-4 Generating invoice reference number (IRN): After successful validation of e-invoice JSON, the IRP system will generate IRN. IRN generated will be a unique number of each invoice for the entire financial year. Also, the e-invoice JSON will be updated with a digital signature along with a QR code.

Step-5: Receiving digitally singed e-invoice JSON: Here, the digitally signed e-invoice JSON along with QR code is sent to the supplier. The IRN and QR code will be printed on the invoice before issuing it to the buyer. In case of an integrated environment of ERP and IRP via GSP, the software will automatically fetch and print such details

Step-6 Transfer of data to e-way bill system and GST system: The invoice JSON data uploaded, will be shared with the e- way bill and GST system, for preparing e - waybills and for auto-population of GST return.

- Part-A of e-way will be auto-populated with e-invoice data

- GSTR-1 of the supplier will be auto-populated as per the e-invoice details uploaded into IRP portal

- GSTR-2A will be updated, giving a real-time view to the buyer

Got questions on e-invoice? Read our article ‘What is e-invoicing’ to know and understand the fundamentals of the e-invoicing concept.

Common errors code while generating e-Invoices under GST

|

E-invoice Error Codes |

Error Messages |

Reason for the Error |

Resolution/Fix |

|

2150 |

Duplicate IRN |

You attempted to upload an invoice already registered with the IRP and the IRN is generated |

Refrain from placing the same request simultaneously. In order to avoid this situation, update your billing system with the IRN number when received. You can send the request again if you still need to receive the IRN |

|

2172 |

For intrastate transaction IGST amounts is not applicable for item - {0} and Sl. No {1}, only CGST and SGST amounts are applicable |

The IGST entered amount for intra-state transactions instead of CGST and SGST |

Recheck the transaction's tax applicability. CGST and SGST are applicable if the state code of the recipient and supplier at the Point of Supply (POS) is the same. If IGST applies, enter the "IGST" amount and mark the intra-state transaction as "Y" in exceptional circumstances |

|

2176 |

Invalid HSN code(s)-{0}

|

The HSN code entered in the invoice is incorrect |

Recheck the HSN code on the portal. In case of further clarification send the HSN details to the helpdesk for verification |

|

2182 |

Taxable value of all goods must be equal to the total taxable value |

The cumulative taxable amount doesn’t match the total taxable value of individual line items |

Evaluate whether the total taxable value is as same as the taxable value of all the individual line items in the uploaded invoice

|

|

2189 |

Invalid total invoice value |

The sum value of the invoice does not match the total of the individual line items. |

Recheck whether the cumulative value of the invoice equals the individual line items’ value.

Upload the invoice after considering other charges and discounts with a tolerance limit of (+/-).

|

|

2193 |

AssAmt value equals the (TotAmt – Discount) for HSN – {0} and Sl. No {1} |

Incorrect assessable amount entered for a particular item |

Calculate the assessable value by lowering the discount of the total amount |

|

2194 |

Invalid total item value for HSN – {0} and Sl. No {1}. |

Total item value entered is incorrect |

The cumulative item value is the sum of assessable value plus all taxes, cess and other charges. |

|

2211 |

Supplier and recipient GSTIN should be different |

Same GSTIN for the supplier and buyer has been entered |

Avoid using self-generated invoices for e-invoice generation |

|

2212 |

The GSTIN of the recipient cannot be URP for supply type {0} |

Invoices pertaining to Unregistered Persons is wrongly entered as a B2B transaction |

Enter the actual GSTIN |

|

2227 |

The SGST and CGST amounts should be equal for HSN – {0} and Sl. No {1} |

The CGST and SGST amounts are not similar |

Ensure that CGST and SGST amounts are same for the specific item |

|

2233 |

Duplicate SI numbers are not allowed in items |

Duplicate serial numbers were issued different items in the item list. |

Assign unique serial numbers for all items |

|

2234 |

The SGST and CGST amounts for HSN – {0} and Sl. No {1} are invalid |

Incorrect SGST and CGST amounts were entered for a specified item |

Enter the correct amounts for SGST and CGST |

|

2235 |

The IGST amount given with HSN -{0} and Sl. No {1} is invalid |

Wrong IGST amount is entered for a specific item in the list |

Ensure that correct SGST and CGST amount is passed. SGST and CGST values should be equal to [taxable value X tax rate / 2]. Note that there is a tolerance limit of +/- 1 |

|

2240 |

The GST rate for HSN -{0} and Sl. No {1} is invalid |

Incorrect GST rate was entered |

Enter the correct GST rate |

|

2244 |

Recipient pin code is mandatory for the transaction -{0} |

Recipient pin code is missing for the specific transaction

|

Provide the correct recipient pin code |

|

2265 |

Recipient GSTIN state code should be the same as the state code passed in recipient details |

The initial two digits and the state code of the GSTIN doesn’t match the details of the recipient |

Check the first two digits of the GSTIN match the state code, under the recipient details |

|

2275 |

Recipient PIN code should be 999999 for direct export |

The PIN code added for recipient details should be 999999 |

999999 should be entered for specific transactions

|

|

3028 |

No GSTIN present in the invoice system |

Recipient GSTIN is invalid or doesn’t exist in the e-invoice system |

Make sure the GSTIN is correct. If taxpayers are confident in its accuracy, select "Sync GSTIN from GST CP" API option. The GST portal lets you access your GSTIN: Once you have the information, you can send the IRN generation request again. API verification was unsuccessful: To manually verify the status, visit the einvocie1.gst.gov.in portal and select "Taxpayer/ GSTIN" from the search menu.

|

|

3029 |

GSTIN is not active |

The GSTIN is inactive/cancelled |

Make sure the GSTIN is correct. If taxpayer is confident in its accuracy, select the "Sync GSTIN from GST CP" API option. The GST portal lets you access your GSTIN: Once you have the information, you can send the IRN generation request again. API verification was unsuccessful: To manually verify the status, visit the einvocie1.gst.gov.in portal and select "Taxpayer/ GSTIN" from the search menu. |

Watch: How to Generate E-invoices Online in TallyPrime

Watch: How to Generate E-invoices Offline in TallyPrime

FAQ:

How to resolve an e invoice error code?

Double check the accuracy of the HSN code on the e-invoice portal. However, if you believe it to be accurate, please send the details to the helpdesk for e-invoice system verification.

What is schema error in e invoice?

An e-invoice schema is defined to take care of fundamental errors in the Json like Mandatory Fields error, Field Specification Error, Json Schema invalid and more.

Can we generate e invoice in the GST portal?

How to generate bulk e-invoice?

Know more about e-invoices in GST