- Introduction

- How is composite supply defined under GST Act

- Examples of composite supply in GST

- Mixed supply – A riddle bin understanding GST composite supply

- How to determine whether the supply is composite or mixed supply in GST

- Composite supply examples: From the reading of circulars issued by CBEC

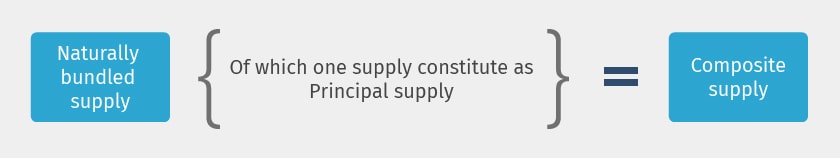

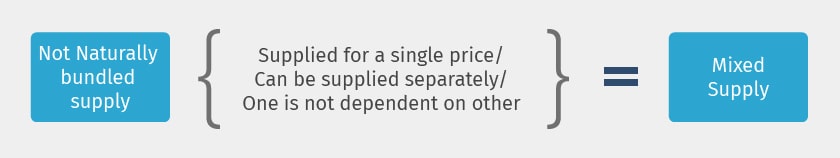

- Formulae to bifurcate GST composite supply from a mixed supply

Introduction

Supplies of Goods and Services are clearly defined under GST, similarly the rates and place of Supply rules for each and every goods/services is finalised.

But in general business practices, all supplies will be not be such simple and clearly identifiable supplies. Where many of the supplies may be a combination of goods or combination of services or combination of goods and services both.

There fore, the GST Law identifies GST composite supply and mixed supply and provides certainty in respect of tax treatment under GST for such supplies.

How is composite supply defined under GST Act

GST Composite supply means a supply made by a taxable person to a recipient

- consisting of two or more taxable supplies of goods or services or both, or any combination thereof,

- which are naturally bundled and supplied in conjunction with each other in the ordinary course of business,

- one of which is a principal supply.

A principal supply on the other hand is defined as any supply which consists of goods or services and which constitutes the predominant element of a composite supply to which any other supply forming part of that composite supply is ancillary

Examples of composite supply in GST

- Goods are packed/repacked, loaded/unloaded, staked/re-staked and transported/ transshipped with insurance

- Booking a Rajdhani train ticket which includes meal and insurance also,

- A works contract: It is a classic example of composite supply

- Eatery business provides a bundled supply of preparation of food and serving the same

Mixed supply – A riddle bin understanding GST composite supply

A mixed supply means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single consideration and where such supply does not constitute a composite supply.

For Example : A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drinks and fruit juices when supplied for a single price is a mixed supply.

Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately.

Here are some more examples of mixed supply in GST :

- A Diwali gift box consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drink and fruit juices supplied for a single price is a mixed supply,

- a free bucket with detergent powder

- Portable water with Food in restaurants

How to determine whether the supply is composite or mixed supply in GST

- Rule out that the supply is a composite supply

- A supply can be a mixed supply only if it is not a composite supply

- If the items can be sold separately, i.e., the supplies not naturally bundled in the ordinary course of business, then it would be a mixed supply

- Once the amenability of the transaction as a composite supply is ruled out, it would be a mixed supply, classified in terms of a supply of goods or services attracting highest rate of tax

Composite supply examples: From the reading of circulars issued by CBEC

|

Circular |

Supply of books, pamphlets, brochures, envelopes, annual reports, leaflets, cartons, boxes etc. Printed with logo, design, name, address or other contents supplied by the recipient of such printed goods, Analysis : The following supply is a good example of composite supply in GST and the question, whether such supplies constitute supply of goods or services would be determined on the basis of what constitutes the principal supply |

|

In the case of printing of books, pamphlets, brochures, annual reports, and the like, Where only content is supplied by the publisher or the person who owns the usage rights to the intangible inputs, While the physical inputs including paper used for printing belong to the printer In the given case, supply of printing [ of the content supplied by the recipient of supply] is the principal supply and therefore such supplies would constitute supply of services and the GST rate for composite supply in the given case would be 12% |

|

|

In case of supply of printed envelopes, letter cards, printed boxes, tissues, napkins, wall paper etc. printed with design, logo etc. Supplied by the recipient of goods But made using physical inputs including paper belonging to the printer Predominant supply is that of goods and the supply of printing of the content [supplied by the recipient of supply] is ancillary to the principal supply of goods and therefore such supplies would constitute supply of goods. |

|

|

Supply of UPS with battery is a mixed supply under GST Act |

It is rightful to say, the UPS serves no purpose if the battery is not supplied along with it. |

Formulae to bifurcate GST composite supply from a mixed supply

Know more about GST Composition Scheme

GST Composition Scheme, GST Composition Scheme Rules, Mixed Supply & Composite Supply under GST, Composite Dealer under GST, Composition Scheme for Services, Composition Scheme Tax Rates, How to Switch to Composition Scheme

GST

GST Software, GST Calculator, GST on Freight, GST Impact on TCS, GST Impact on TDS, GST Exempted Goods & Services, Reverse Charge Mechanism in GST, GST Declaration

GST Rates & Charges

GST Rates, HSN Codes, SAC Codes, GST State Codes

GST Returns

GST Returns, Types of GST Returns, New GST Returns & Forms, Sahaj GST Returns, Sugam GST Returns