- What is e-invoicing?

- TallyPrime, the best e-invoice software in India

- Features of TallyPrime’s e-invoice solution

- How to generate e-invoice instantly in tallyprime?

Whether you run a small business or manage accounts for a growing enterprise, generating GST-compliant e-invoices is now quicker, smarter, and fully automated. Software like TallyPrime helps you with the required compliance by offering a connected and intelligent e-invoicing experience. As soon as you record an invoice, the software automatically sends the details to the government’s Invoice Registration Portal (IRP), fetches the unique Invoice Reference Number (IRN), and adds the QR code. You don't need to visit any portal or do any manual uploading.

So, if you’re getting started with e-invoicing or looking for a better solution, you must know the process to make sure it is reliable, secure, and accurate. Let’s explore how e-invoicing in TallyPrime works.

What is e-invoicing?

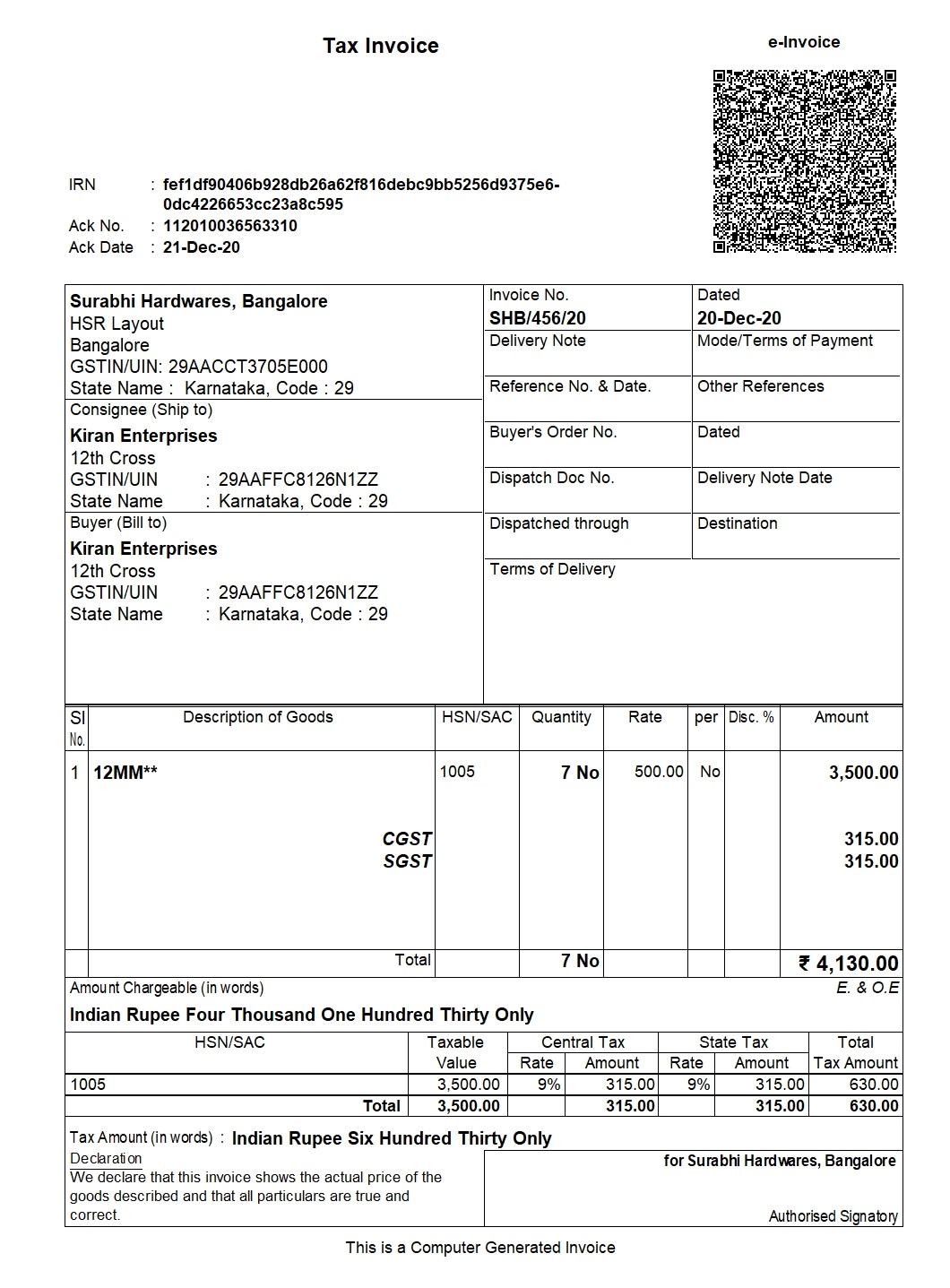

e-Invoicing, or electronic invoicing, is a process under GST through which B2B (business-to-business) transactions become more transparent, standardised, and easy to track. To give a brief, e-invoicing is the process of uploading all your B2B transactions (Sales, Credit Note and Debit Notes made to businesses, including all types of exports) on the IRP (invoice registration portal) for authentication. This portal offers a robust e-invoicing system that checks and verifies the invoice and then provides the following:

- IRN (Invoice Reference Number): A unique number given to every invoice after verification

- QR Code: A machine-readable code that contains key invoice details for quick access and verification

Once these are received, you must add the IRN and QR code to your invoice. Only then your invoice will be considered valid under GST rules.

Who needs to do e-invoicing?

e-Invoicing is mandatory for businesses that cross a certain annual turnover limit (e.g., ₹5 crore or more, as per the latest government notification). It applies to B2B transactions, export invoices, credit notes, and debit notes issued to other businesses.

Why is e-invoicing important?

e-Invoicing is important because it:

- Reduces invoice mistakes and mismatches

- Helps prevent tax evasion and fraud

- Makes filing GST returns easier and more accurate

- Ensures all invoices are reported to the government at once

- Promotes transparency and improves trust between businesses

TallyPrime, the best e-invoice software in India

For businesses to have a smooth transition to an e-invoicing software, it is extremely imperative that your business management software is integrated with the IRP portal.

TallyPrime is built especially for Indian businesses and offers everything you need to handle e-invoicing smoothly, without making you change the way you already work. It stands out as the best e-invoicing software in India, which has direct integration with the government portal (IRP).

As you may be aware, Tally is a recognized GSP (GST Suvidha Provider) which ensures TallyPrime directly integrates with the IRP portal to generate e-invoices seamlessly.

- You can send your invoices through TallyPrime directly to the IRP

- Once they are authenticated by the IRP, TallyPrime will receive the IRN and QR code directly from the IRP and update your invoices accordingly. All this automatically

- You can then simply print the IRN and QR code on your invoice

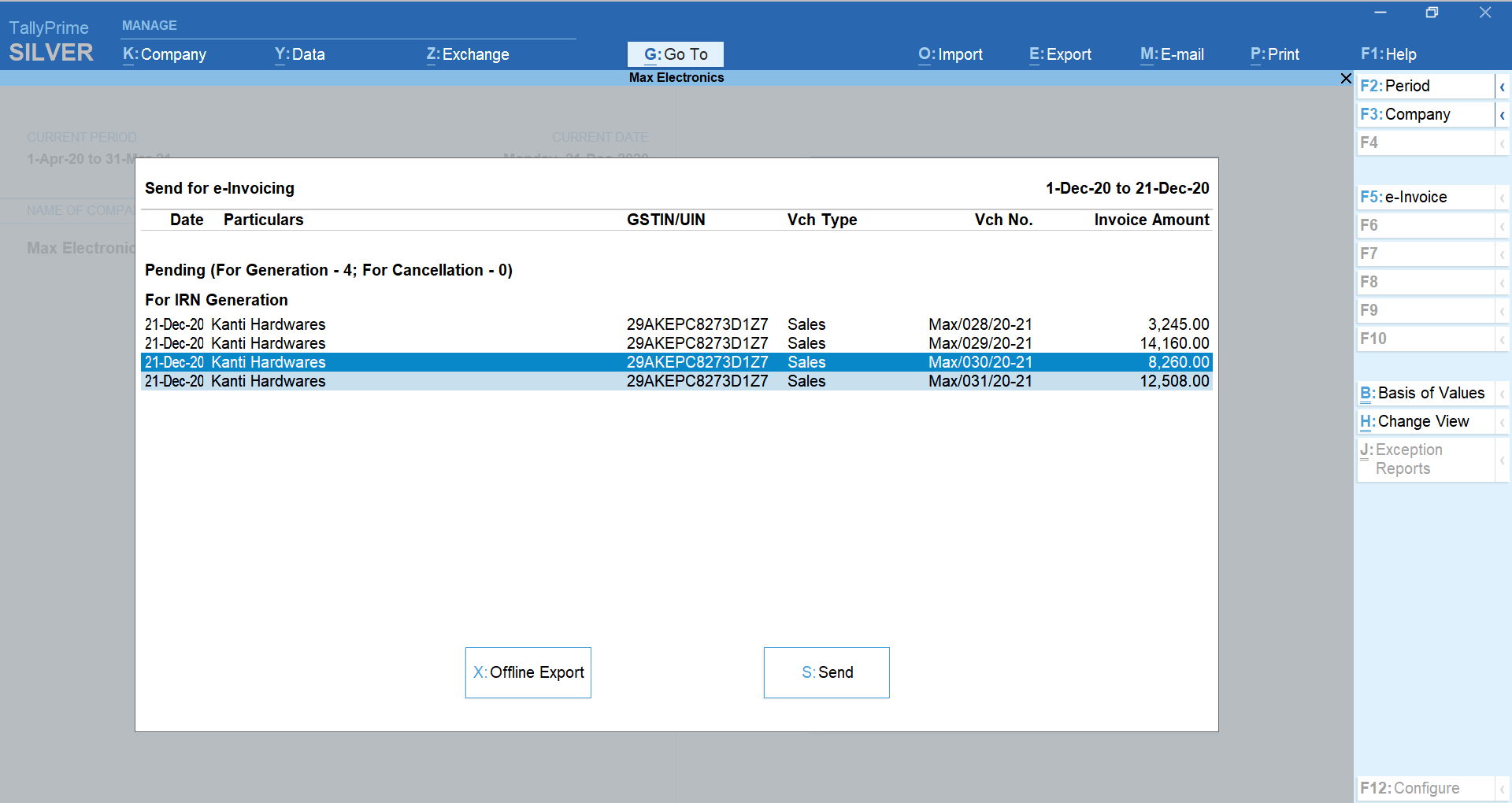

| Bulk Generation of e-Invoices in TallyPrime |

Features of TallyPrime’s e-invoice solution

We understand that this is a completely new experience and you will take time to get used to it. Moreover, you may be faced with different situations while needing to comply with e-invoicing norms. TallyPrime has therefore made the product extremely flexible so that the process is convenient and adapts to your comfort.

Here are some of the best features of TallyPrime’s e-invoicing solution that will take care of your needs seamlessly:

- Instant e-invoice

With TallyPrime’s fully connected e-invoicing solution, you can generate e-invoices instantly, with zero manual processes. Just record the invoice and print, TallyPrime will automatically add IRN and QR code.

- Single or bulk e-invoice

You can either generate an e-invoice in the flow of recording invoice or do this in bulk for multiple invoices together. TallyPrime will adapt to your preference

- e-invoice with e-way bill

If your supply requires an e-way bill, TallyPrime will automatically generate e-way bill in the process of getting e-invoice details.

- Online e-invoice cancellation

In those scenarios where an e-invoice needs to be cancelled, you can easily send the cancellation request from TallyPrime.

- Supports offline mode

It is quite possible that the system you normally use to generate e-invoice may get disconnected from the internet. In such a case, TallyPrime will help you handle the situation by exporting e-invoice-related data in the form of a JSON file

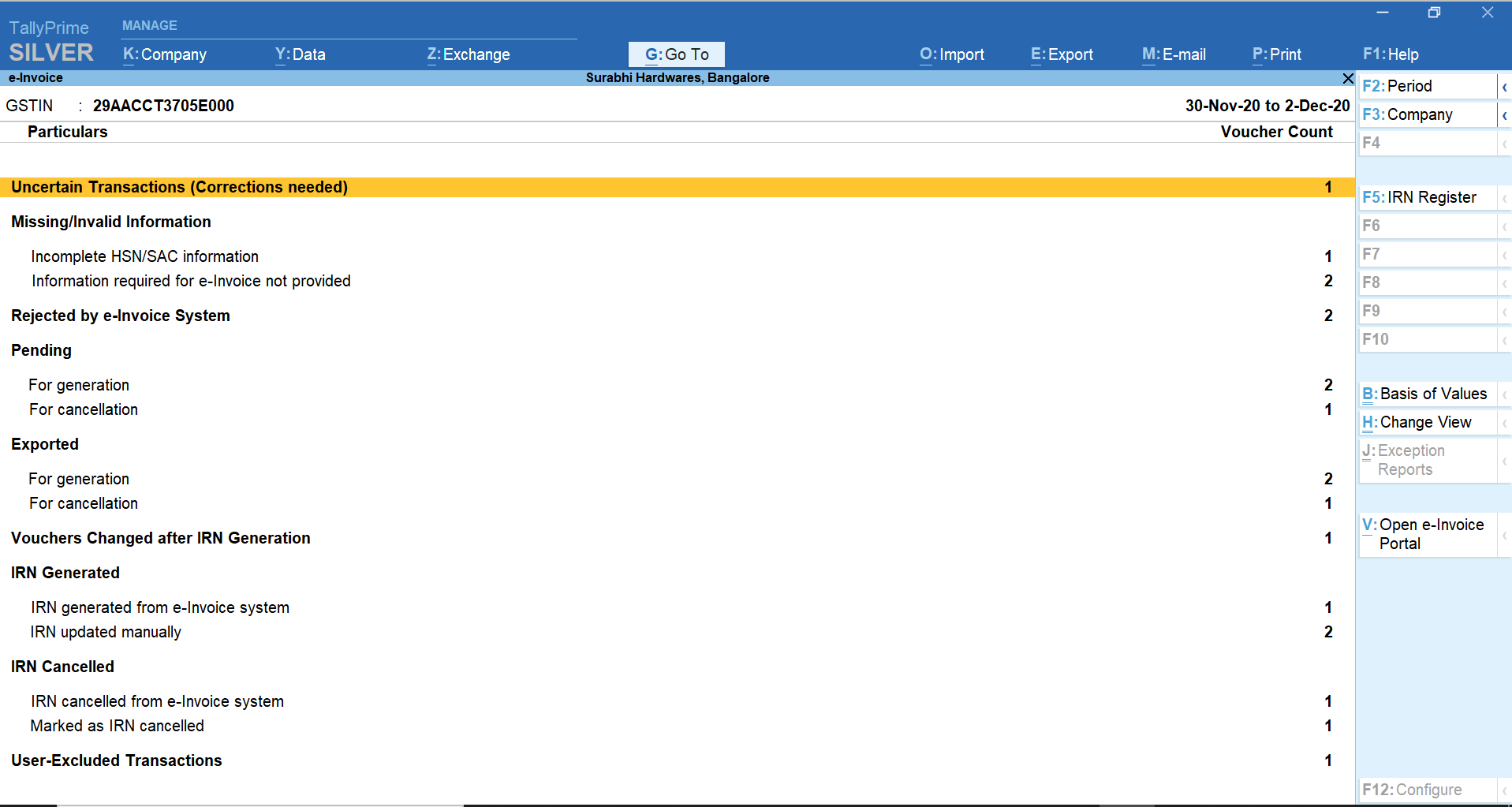

- e-invoice reports

TallyPrime’s exclusive report will give you a complete view of the status of your transactions with respect to e-invoicing. You can quickly get to the completed, pending, cancelled etc.

- Useful alerts

Useful alerts Alerts will be available in multi-user scenarios to prevent redundancy and ensure that the latest data is shared with e-invoice portal. Also, it helps you safeguard against accidental modification/deletion/cancellation of IRN generated for a particular transaction

How to Generate e-Invoice Instantly in TallyPrime?

If you're using TallyPrime for your accounting, generating an e-way bill in TallyPrime is seamless. Thanks to its integration with the e-way bill system, you can generate bills directly from your invoices—no need to switch between platforms. You wouldn’t need to change the way you work at all as TallyPrime adapts to your working style and gives you the flexibility to generate reports your way, in just 3 steps: Enable, record and print.

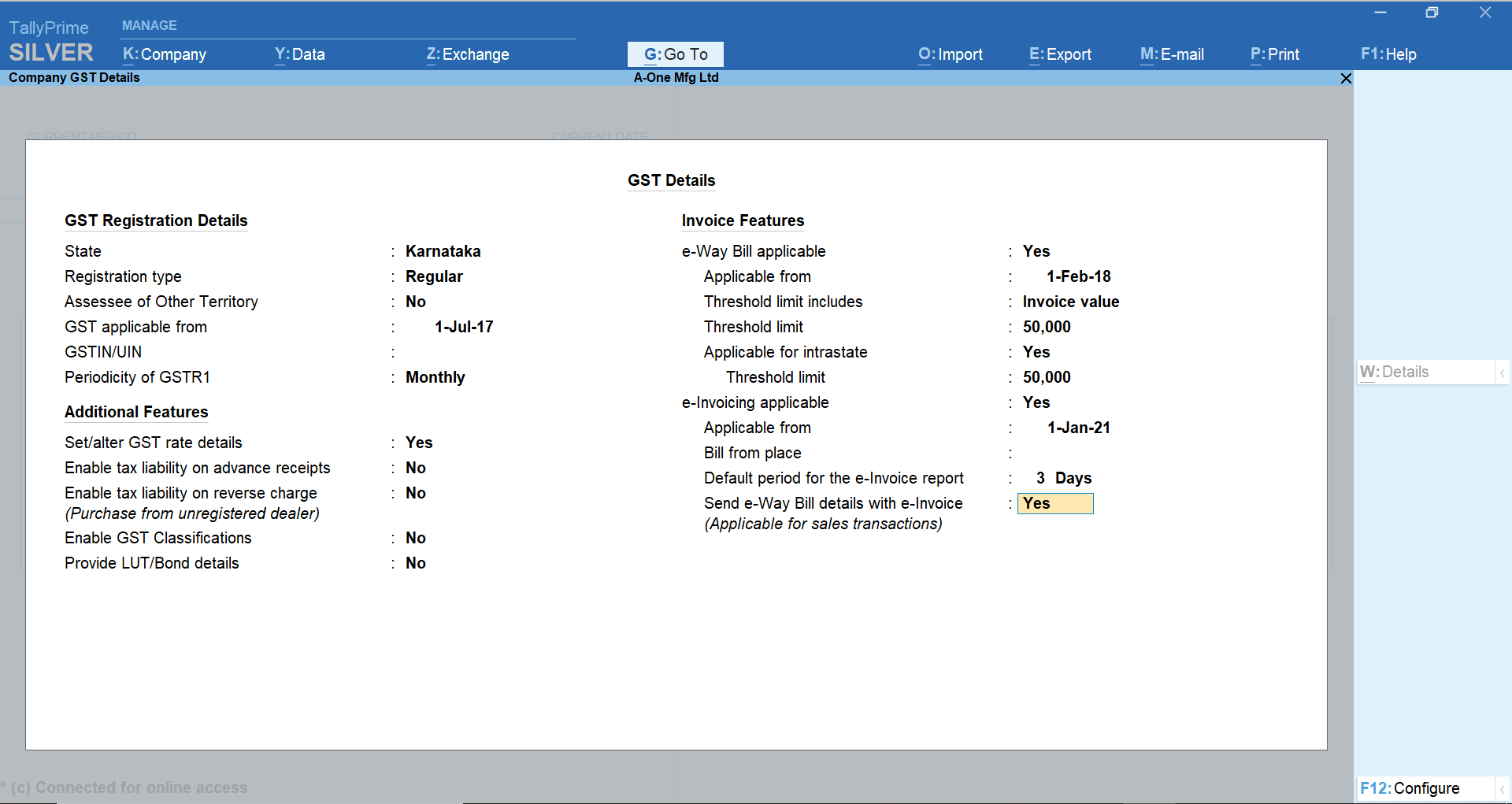

Step 1: Enable e-invoicing in TallyPrime

Before you start, you need to switch on the e-invoicing option in your settings.

- Go to Gateway of Tally > Press Alt+G (Go To) > Type and select Voucher Type.

- Choose Sales (or any voucher type you use for invoices).

- In the screen that appears, set "Allow e-Invoicing" to Yes.

- If your sales require an e-way bill too, set "Enable e-Way Bill" to Yes.

Step 2: Create a sales voucher (Invoice)

This is just like your regular billing process.

- Go to Accounting Vouchers > Select Sales.

- Enter the required details like party name, items, quantity, rate, tax, etc.

- Once everything is filled, press Enter to accept and save the voucher.

Step 3: Generate the e-invoice

As soon as you save the sales voucher, TallyPrime will ask if you want to generate an e-invoice.

- Select Yes when prompted.

- TallyPrime will automatically send the invoice details to the IRP (Invoice Registration Portal).

- Within seconds, it will fetch the IRN (Invoice Reference Number) and QR Code and attach them to your invoice.

Step 4: Print or share the invoice

Now your e-invoice is ready with the IRN and QR code. You can print it, email it, or save it, whatever suits your business process.

Yes, it is that simple!No manual uploads, no switching between portals. TallyPrime makes the e-invoicing process fast and smooth.

With TallyPrime, e-invoicing becomes quick, easy, and hassle-free. You just record your invoice, and TallyPrime handles the rest automatically. It's the smart way to stay GST-compliant without changing how you work. Take a free trial today and be pleasantly surprised with our unmatched prevention, detection and correction capabilities.

Watch: How to Generate E-invoices Instantly in TallyPrime

FAQ

How to enable e-invoice in TallyPrime?

e-Invoice can be enabled in TallyPrime in three quick steps:

- Press Alt+G (Go To) > Alter Master > Voucher Type > type Sales > press Enter. Alternatively, Gateway of Tally > Alter > Voucher Type > type or select Sales > press Enter.

- In the Voucher Type Alteration screen for Sales, set Allow e-Invoicing to Yes.

- Press Y to accept the screen.

How do I make a quick e-invoice?

TallyPrime adapts to your working style and gives you the flexibility to generate reports your way, in just 3 steps: Enable, record, and print.

Know more about e-invoices in GST