- What is a Profit and Loss Statement?

- Is a P&L statement enough for understanding business performance?

- Cash vs. Accrual basis

- Analyzing a P&L statement

- Business management software for effective accounting

What is a Profit and Loss Statement?

The profit and loss statement or P&L statement is one of the main financial statements that your business will generate. It is also called an income statement, statement of earnings, statement of income, and statement of operations. The P&L statement reports your business expenses, revenues, profits, and losses over a span of time. This time frame can be a quarter of a year, nine months, 52 weeks, 4 weeks, a single month, and so on. Sometimes, businesses will not report some of the profits and losses that were incurred in the income statement. Instead, these profits and losses will be written in the statement of comprehensive income which is also a type of financial statement.

The profit and loss statement is crucial for your business because it provides details to understand how well your business is doing in terms of profits and losses. As a business owner, you should compare the income statement of this accounting period with the previous one to know if your business performance improved. It can also show you whether you earn better now, how much revenue is coming in, and the operating costs that you should watch out for. With the help of the income statement, you can calculate important financial metrics such as net profit margin, operating profit margin, and gross profit margin.

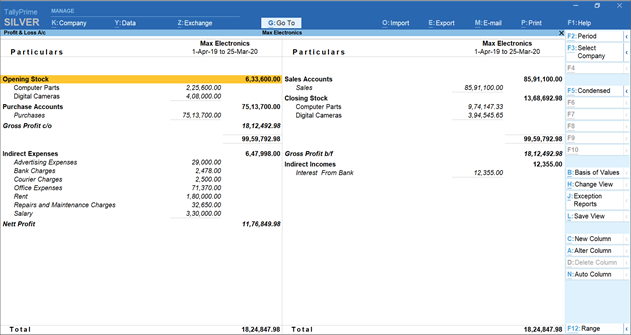

Profit and loss A/C in TallyPrime

An income statement is used by both people who work internally and those on the outside of a business. For example, management is an internal component of a business. It uses the income statement to see if enough profit is being generated or not. It enables them to understand the business position, expenses, and revenue so decisions can be made on which strategies to use. If there is a profit, you can invest it in machinery and expand your workforce if required. When it comes to external users, the income statement can be used by people such as creditors and investors to determine the profitability of your business. If your profits are high, they are more likely to lend and invest in your business.

Is a P&L statement enough for understanding business performance?

While the income statement is a great indicator of whether your business is profitable or not, its usage does not extend much beyond that. It works better in conjunction with the other major financial statements which are the statement of cash flows and the balance sheet. The statement of cash flows shows you exactly how much cash is available in your business. The balance sheet gives you insight into your assets, liabilities, and equity which show your liquidity and ability to take loans. Together, the profit and loss statement along with the statement of cash flows and the balance sheet show you an excellent snapshot of your business so you can make decisions and work on areas that need improvement.

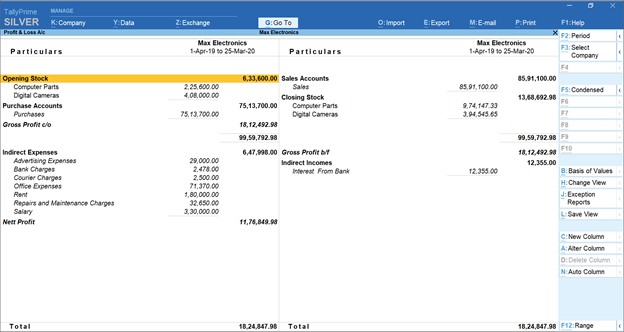

Monthly Comparative P&L A/c TallyPrime

Cash vs. Accrual basis

Before we get to analyzing the profit and loss statement, there is an important distinction to make. Do you use accrual or cash basis accounting? If you use the cash basis of accounting, it means that you are tracking when the movement of cash is actually done compared to when it was promised. For example, if you need to pay $100 to your supplier, you won’t account for it in your transactions until you actually make the payment through your bank. On an accrual basis of accounting, the transactions are recorded before the actual movement of money. That is, if you promised the supplier to pay $100 today, then you would record it today even though you did not send the money right away or even on the same day.

Analyzing a P&L statement

The profit and loss statement consists of many components that make up the statement as a whole. Each component has a separate section where the particular amounts are specified. To understand it, here are some of the major components explained along with what they mean for your business.

Net Sales

The net sales value is the total revenue of a business after selling goods. A sale is made when a product is sold from the company to the customer. In the income statement, the transaction is recorded when the goods are transferred to the customer and not when the customer pays for them. Let us say Ruby bought an item in June 2021 but she is paying for it a month later in July 2021. When recording the transaction, the income statement will report the sale in June 2021 which is when she bought it rather than when she actually paid for the product. Usually, sales are called the operating revenues for those businesses which sell goods.

Cost of goods sold

An important component of a profit and loss statement is the cost of goods sold which is also known as the cost of sales and cost of products sold. Cost of goods sold is the cost incurred by your business to sell the product during a period of time. For a retailer, the cost of goods sold is the cost paid to the vendor plus the cost of storage until the sale was made. For a manufacturer, the cost of sales consists of the total cost of manufacturing the goods sold such as labor costs, raw materials, and other components. The cost of goods sold must be computed correctly because its accuracy will ensure the precision of other calculations in the income statement.

Gross margin

The gross margin is also called the gross profit percentage. Gross profit is calculated by calculating the net sales and subtracting it from the cost of sales. When the gross profit is higher than the SG&A and non-operating expenses combined, the business is said to be profitable. To compute gross profit percentage or gross margin, simply divide gross profit by net sales. Many businesses prefer to compute gross margin so they can easily compare it to other businesses operating in the same industry. Another use of the gross margin is to see whether the business was able to maintain its level of profits over time.

Selling, general and administrative expenses

The selling, general and administrative expenses or SG&A are expenses that are incurred due to the seller’s primary activities and these are a part of the income statement. For instance, SG&A expenses include advertisements, utilities, salaries, insurance, and rent for retailers. You can say that the selling, general and administrative expenses are those which are incurred during the production phase and sale of the products for both manufacturers and retailers. For the manufacturer, the selling, general, and administrative expenses and cost of sales are grouped under the operating expenses. As for secondary activities such as interest expense and so on, they are not included in the SG&A.

Operating income

The operating income is computed by subtracting the operating expenses from the operating revenues. In this formula, the operating revenue refers to how much is earned from the core activities such as the net sales. This applies to both the retailers and manufacturers. For a service business, the operating revenues are those which are associated with activities used to provide its services. The operating expenses are those which are incurred when operations are being maintained. For service businesses, the cost of providing the services along with SG&A expenses are included in operating expenses. For manufacturers and retailers, the SG&A expenses along with the cost of sales make up the operating expenses.

Net income

The net income is also called net earnings. This is the amount that you get after subtracting the income tax expense. The income tax expense on your income statement isn’t exactly what you pay as income tax that year. The income tax expense is a part of the profit and loss statement and it is connected to what is included in the statement. The actual income tax that your business pays will be reflected in the statement of cash flows. Net income is also the same as the bottom line as it signifies how well your business has done over a course of time.

Business management software for effective accounting

Using business management software can make the generation of a profit and loss statement a whole lot easier and faster. In fact, it makes the generation of any financial statement quicker and simpler. You don’t need to wait until the closing of the books to know what your business earnings are during a certain period of time. Using a solution such as TallyPrime can save you hours of effort and headaches. TallyPrime gives you the power to generate profit and loss statements when you need to see how profitable your business is and it gives you the option to generate other statements to get a complete overview of your business. This gives you time to proactively take action.

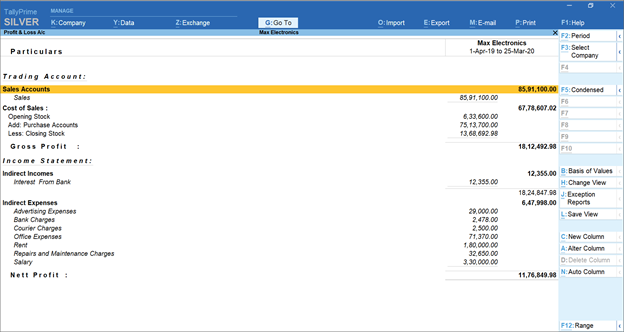

Vertical P&L A/c in TallyPrime

The main reason why financial statements are so helpful is that they not only showcase the current business situation but act as indicators of what the future might look like for the business. This enables you to get insights before you are deep in debt, have a low cash flow, or spend more than you earn. It gives you a roadmap to make amends before it is too late. This enables you to think of new ideas so you can grow. TallyPrime encourages you to get insights from real data so every decision you make is an informed one thereby pushing you to take your business to the heights you always dreamed of. TallyPrime is the ERP software suite to manage your business in the best way imaginable.