- Definition of Credit Memo

- Difference Between Credit Memo and Refund Memo

- When do you Issue a Credit Memo?

- Components and Format of Credit Memo

- Credit Memo Vs. Debit Memo

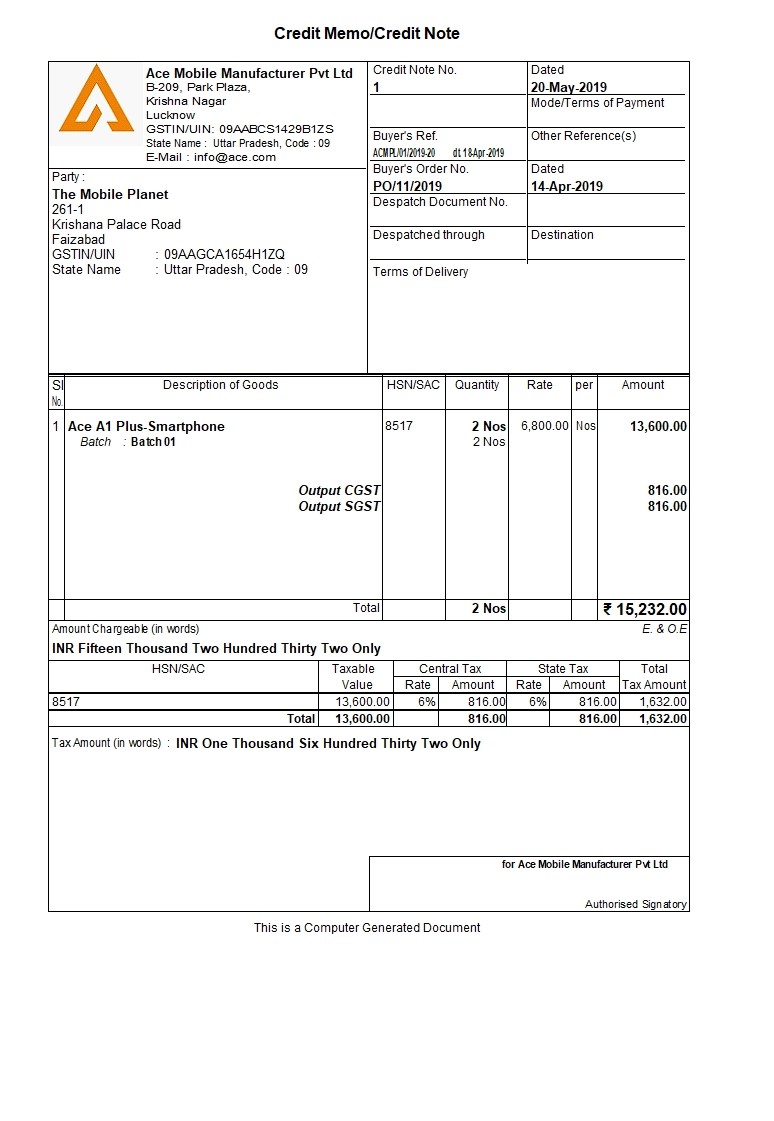

- Credit Memo Example

- How to Prepare a Credit Memo?

You went to a store to return or exchange the product you had brought from them and the officer who is at the counter issues a slip with the details of the product returned and the amount. The slip here is called a credit memo.

Definition of Credit Memo

A credit memo is a commercial document issued by a supplier to the customer notifying the reduction of the amount that a customer owes to the seller. If it is a cash sale, it implies the amount of benefit that the supplier owes to the customer.

A credit memo is called Credit Memorandum and more popularly known as ‘Credit Note’.

Often, credit memo and refund memo are used interchangeably but the question here is that whether both convey the same?

Let’s figure it out.

Difference Between Credit Memo and Refund Memo

A credit memo is totally different from a refund. When a seller issues a credit memo, it's put towards the existing balance on a buyer's account to reduce the total or he owes some benefit to the customer to whom the credit memo is issued.

On the other hand, refund memo notifies the actual money a supplier pays to the customer.

When do you Issue a Credit Memo?

There are several scenarios under which the seller may issue a credit memo to the buyer and some of the most common scenarios are mentioned below:

- The buyer returned the goods or rejected the services for some reason.

- Damaged or defective goods delivered

- Errors, mostly of clerical nature were made in the price on the original invoice.

- Customer overpaid the original invoice.

Components and Format of Credit Memo

A credit memo usually holds several pieces of important information. Most credit memos feature the purchase order number, as well as the terms of payment and billing.

Name and address, a list of items, prices, quantities, and the date of purchase are other significant pieces of data found on a credit memo.

All of this information helps a seller to keep track of inventory. It also includes the reason for issuing the credit memo.

Credit Memo Vs. Debit Memo

|

Basis of Comparison |

Credit Memo |

Debit Memo |

|

Meaning |

A Credit note is a written document stating sales return, where the seller intimates the buyer that the money for which the debit note is sent is being returned or adjusted. |

Debit note is a written document stating purchase return, where the buyer intimates the seller that they’re returning some goods that they have bought and mentioned the reasons behind it. |

|

Reasons |

Sales return of goods. |

Purchase return of goods. |

|

Which accounts book is updated on issuance? |

Sales return book or sales return register. |

Purchase return book or purchase return register. |

|

Accounting Entry |

In the seller’s account, sales account is debited, and the customer account is credited. |

In the buyer's account, suppliers account is debited, and the purchase is credited. |

|

Effect of transaction |

Sales account is reduced. |

Purchase account is reduced. |

Credit Memo Example

Priya Ltd sells goods worth INR. 1,00,000 /- to Rajesh Enterprises. Rajesh enterprises found INR. 10,000 /- worth of goods were found damaged & this is notified to Priya Ltd at the time of actual delivery through Debit Note or Memo.

Priya Ltd (seller) issues a credit note for INR. 10,000 /- in the name of Rajesh Enterprises Ltd (buyer). This reduces the receivables of the seller by INR. 10,000 /- and the buyer is only required to pay 90,000.

How to Prepare a Credit Memo?

Today, most of the businesses are using accounting software to account and issue sales invoices as well as credit memo/ credit note. Accounting software has benefited business by providing the complete tracking of order to invoice till issuing of credit memo and more importantly, auto-update on the accounts and bill’s receivables.

In most countries, the indirect tax mandates the seller to issue the credit note and also prescribes the mandatory details to be mentioned in the credit note. GST in India, VAT in UAE, VAT in Kenya, Bahrain VAT etc. are some of the examples of the tax system which mandates the supplier to issue a tax compliant credit memo.

Wanted to know about credit memo in different countries? Read GST Credit Note, VAT Credit Note in UAE, and Credit Note in Saudi VAT

Read more on Billing and Invoicing: