- What are consolidated financial statements?

- Reason to prepare consolidated financial statements

- Example and format of consolidated financial statement

- Benefits and limitations of consolidated financial statements

- How businesses prepare consolidated financial statements?

What are consolidated financial statements?

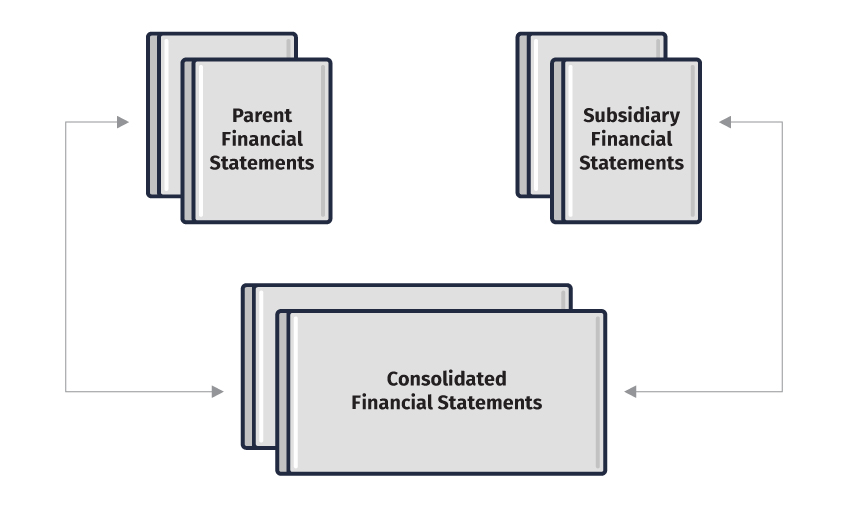

Consolidated financial statements also known as CFS, presents the financial position and results of operations for a parent and one or more subsidiaries as if they were a single company.

In simple words, the accounts of different companies belonging to the same management or owners are consolidated to present the financial position of the group as a whole.

Reason to prepare consolidated financial statements

- In many countries, it is mandatory to consolidate group company accounts.

- The shareholders want to know the performance of the entire business group and later the performance of individual constituent companies.

- Consolidation of financial statements is required when a corporation owns a majority of another corporation’s outstanding common stock.

- When a parent company acquire a subsidiary in a very different industry from its own as a means of diversifying its overall business risk.

- There are also legal reasons for maintaining separate entities mostly for tax-related purposes.

Example and format of consolidated financial statement

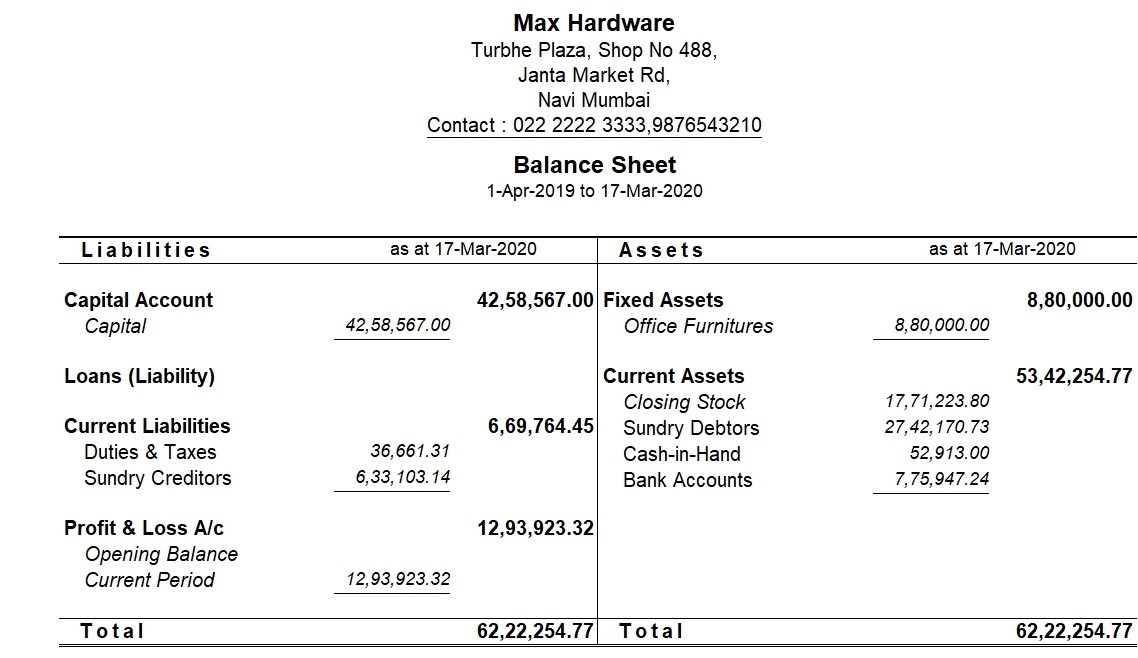

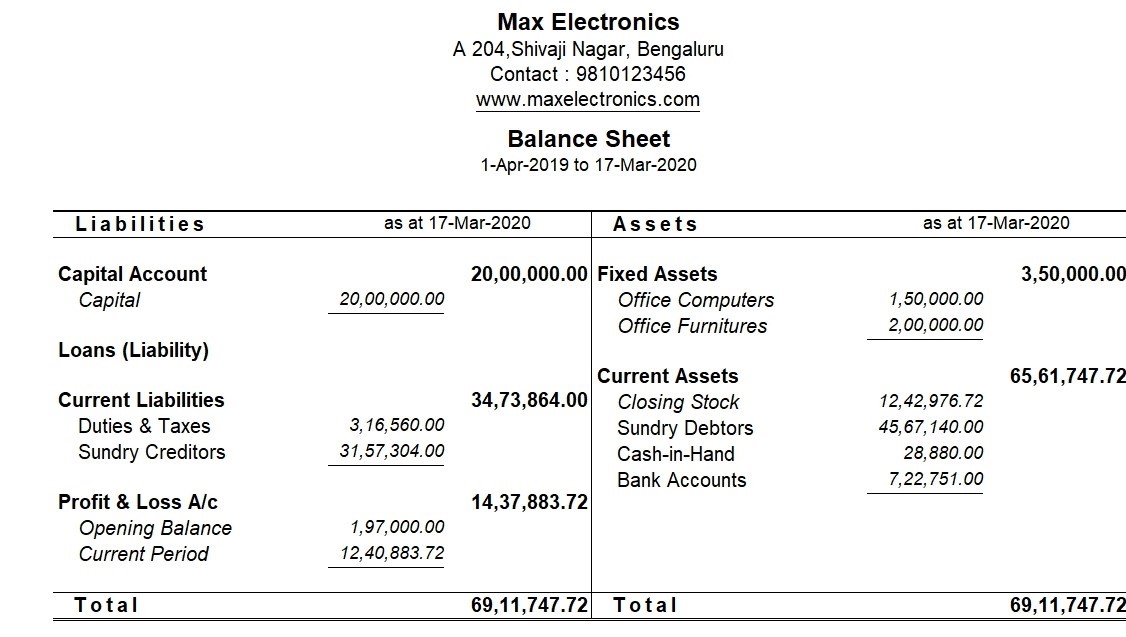

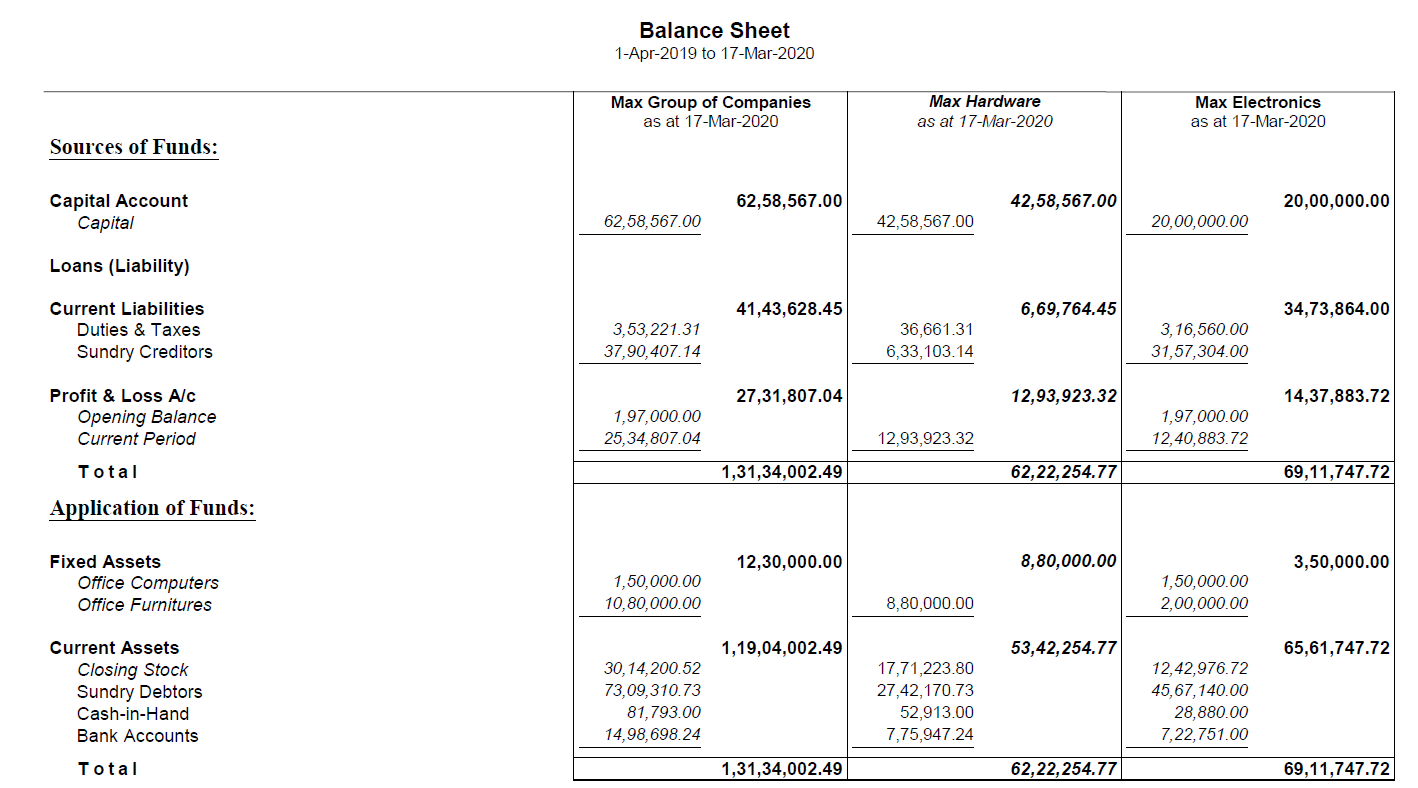

Max Hardware and Max Electronics are owned by Mr Max. As these are separate entries, Mr Max would like to prepare the consolidated financial statements and evaluate the financial position of the group.

Balance Sheet of Max Hardware

Balance sheet of Max Electronics

Benefits of consolidated financial statements

If your business consists of branches, subsidiaries, or sister companies, it can become difficult to monitor the health of your business group. You might have questions like how your business is doing overall, or how your different branches are performing. Creating consolidated financial statements will help you find answers to all these questions and more.

If you are one who is having a long-run interest in the parent company (parent’s shareholders or creditors), consolidated financial statements are vital to you. This is simply because these financial statements present a clear picture of the total resources of the combined entity.

Limitations of consolidated financial statements

Any piece of information could be lost when time data sets are aggregated. This is particularly true when the information involves an aggregation across companies that have substantially different operating characteristics.

As subsidiaries are legally separate from their parents, the creditors and stockholders of a subsidiary generally have no claim on the parent, and the stockholders of the subsidiary do not share in the profits of the parent.

Thereby, the consolidated financial statements usually are of little use to those interested in obtaining information about the assets, capital, or income of individual subsidiaries.

How businesses prepare consolidated financial statements?

Creating a consolidated financial manually is a nightmare. Not just efforts but potential risk of incorrect details due to omissions, errors etc. during data consolidation. This is why most businesses have started using accounting software that allows you to manage the business efficiently and generate all the reports including consolidated financial statements automatically.

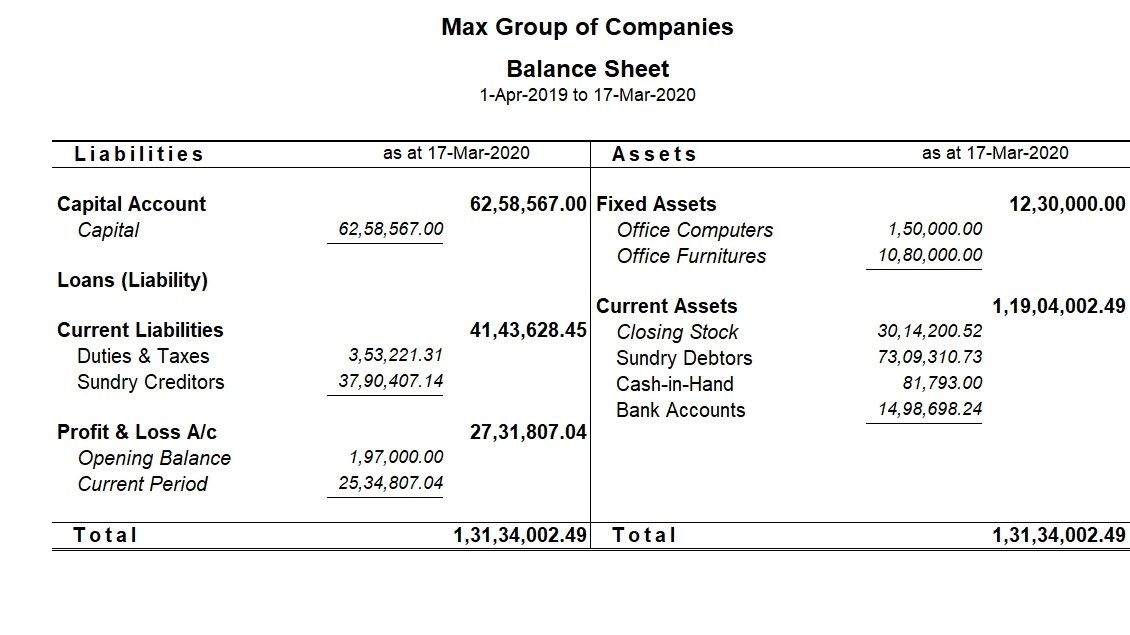

If you are using TallyPrime, consolidation of financial statements is an easy task at all times. Not just financial statement, you can consolidate complete books of accounts using the group company feature. The concept is simple yet powerful that allows you to consolidate the accounts of any number of companies at any time and maintain them separately. All this in a few mins.

You can view the consolidated balance sheet, profit & loss a/c, stock summary, ratio analysis, trial balance, cash/funds flow and much more.

You can also compare the individual member companies with the consolidated statement as shown below.

What is the purpose of consolidated financial statements?

Consolidated financial statements deliver a genuine and fair idea of a company's economic health across all divisions and subsidiaries. It is usually needed when an entity owns more than 50% of the outstanding common voting stock of another company.

What is the difference between consolidated financial statement and Stand Alone Financial statement

The primary distinction between standalone and consolidated financial statements is the fact that consolidated financial statement consists of reports for all activities of a company and its subsidiaries as a combined entity. Whereas, standalone financial statements report these findings as an independent entity.

When are consolidated financial statements required?

Consolidated financial statements are usually needed when an entity owns more than 50% of the outstanding common voting stock of another company