- Types of balance sheet format

- How to do balance sheet reconciliation

- Balance sheet reconciliation format

- Examples of balance sheet reconciliation

- How business management software can help?

Balance sheet reconciliation can be defined as a process of verifying the accuracy of information presented in the balance sheet. It includes cross-checking the closing balance of all the components of the balance sheet.

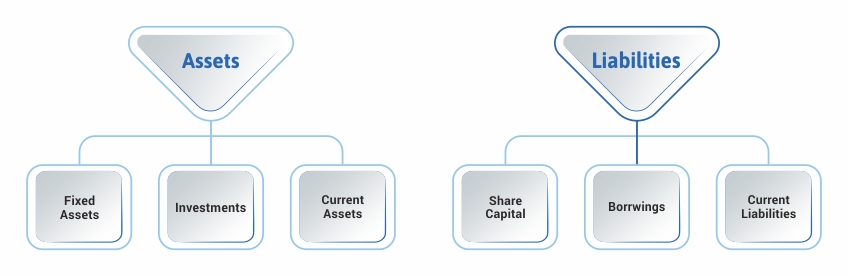

In the process of balance sheet reconciliation, the components of balance sheet such as fixed assets, current assets, current liabilities etc. are verified to ensure that the posting of entries into respective ledger accounts are accurately done. The components of the balance sheet are given below:

Read Balance Sheet Components to know more about the elements that a balance sheet comprises of

Types of balance sheet format

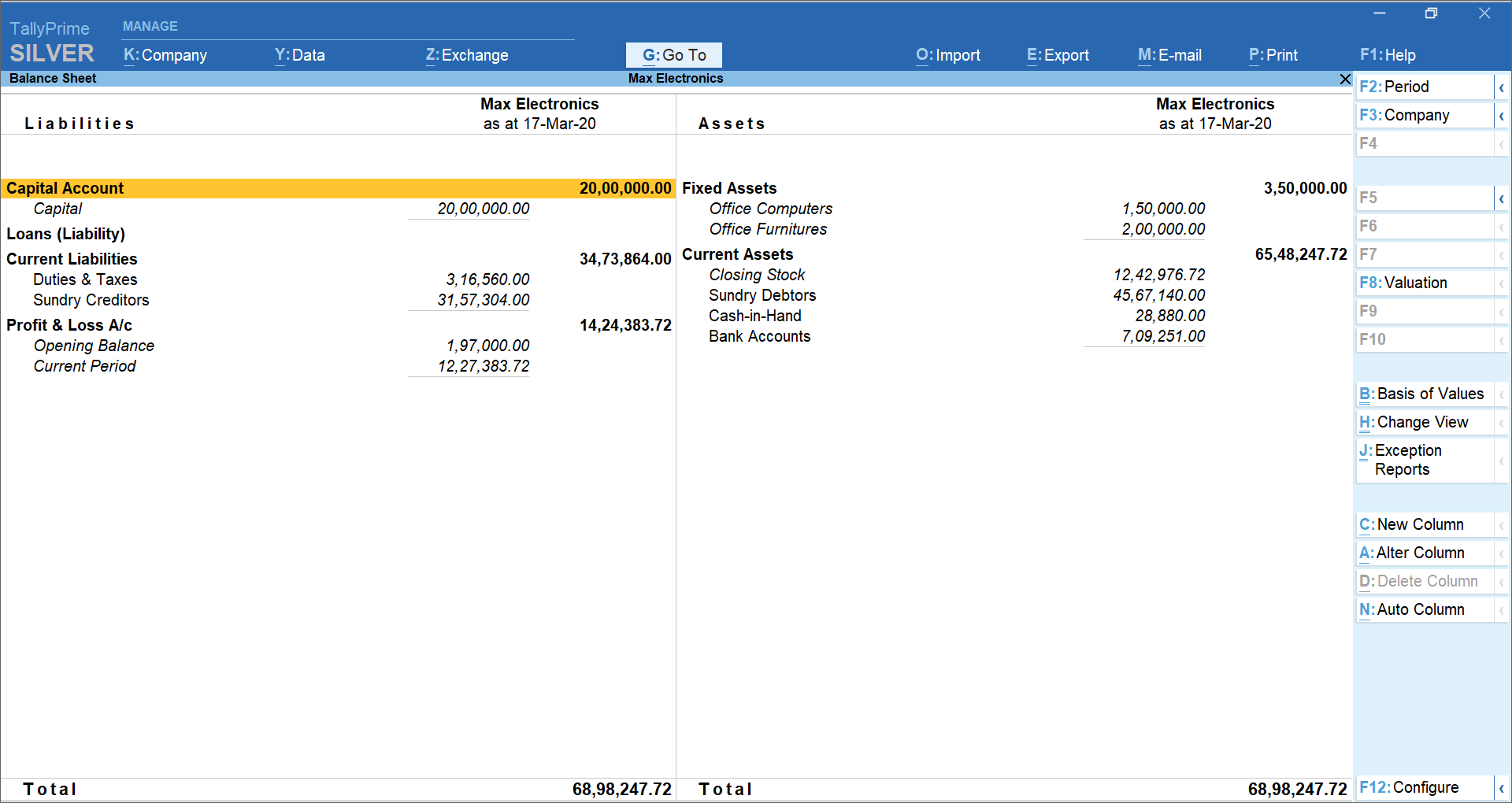

The information in the balance sheet can be presented in two different formats – ‘T’ format or horizontal format and vertical format. In both the formats, the information remains the same and only the style or the way the information is presented changes.

- ‘T’ format or horizontal format

In ‘T’ or horizontal format, all the assets are shown on the right side and the components of liabilities are shown on the left side of the balance sheet. The sample format of ‘T’ format balance sheet is shown below:

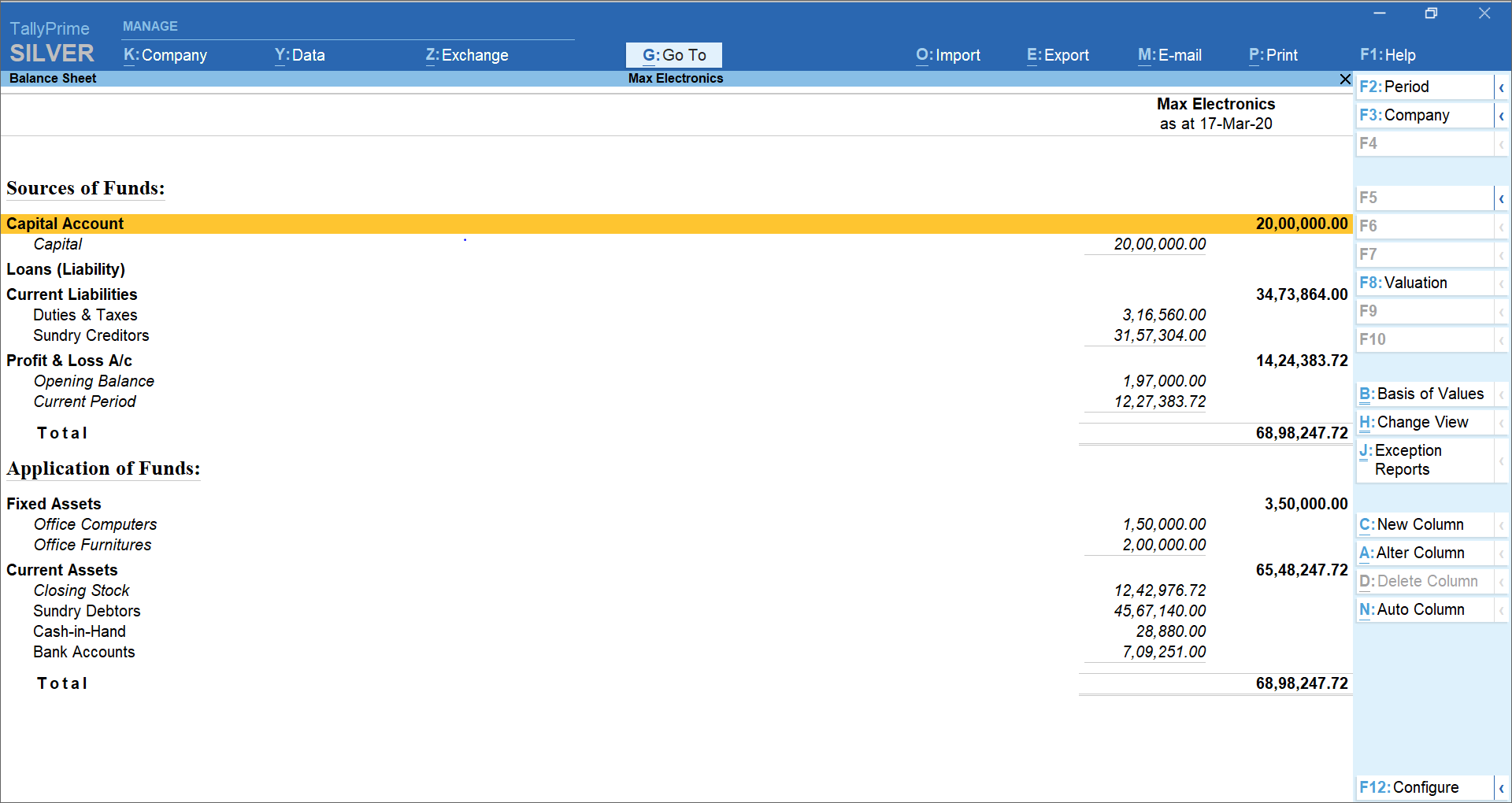

- Vertical balance sheet format

As the name suggests, the details in the balance sheet are presented vertically. In simple words, the components are shown one below the other. The sample format of the vertical balance sheet is given below:

How to do balance sheet reconciliation

To do a balance sheet reconciliation, first, the closing balance of all the assets and liabilities needs to be determined. Next, the net balance of all the assets and liabilities is determined. The last step is to match the net balance of asset with the net balance of liabilities. If both the values match, then it is believed that values are accurate. If not, some errors have occurred either while recording the transactions or general ledger posting, that needs to be identified and corrected.

Balance Sheet reconciliation format

|

Particulars |

Amount |

Amount |

|

Assets |

|

|

|

Net Fixed Assets |

XXXXX |

|

|

Net Current Assets |

XXXXXX |

|

|

Net Investments |

XXXXXXXX |

|

|

Total Assets (A) |

|

XXXXXXXX |

|

Liabilities |

|

|

|

Share capital |

XXXXX |

|

|

Borrowings |

XXXXXX |

|

|

Net Current Liabilities |

XXXXXXXX |

|

|

Total Liabilities (B) |

|

XXXXXXXX |

|

Both A and B should Match |

|

|

Examples of Balance sheet reconciliation

The trial balance of Max Electronics for the financial year 2019-2020 is given below.

|

Particulars |

Debit |

Credit |

|

Capital |

|

20,00,000 |

|

Secured Loans |

|

1,50,000 |

|

Duties & Taxes |

|

6,86,778 |

|

Sundry Creditors |

|

36,08,753 |

|

Office Computers |

1,50,000 |

|

|

Office Furnitures |

6,00,000 |

|

|

Closing Stock |

1143631 |

|

|

Sundry Debtors |

34,74,090 |

|

|

Cash-in-Hand |

72,810 |

|

|

Bank Accounts |

10,05,000 |

|

Using this info, let’s do a balance sheet reconciliation for Max Electronics

|

Particulars |

Amount |

Amount |

|

Assets |

|

|

|

Net Fixed Assets |

7,50,000 |

|

|

Net current Assets |

56,95,531 |

|

|

Net Investments |

--- |

|

|

Total Assets (A) |

|

64,45,531 |

|

Liabilities |

|

|

|

Share capital |

20,00,000 |

|

|

Borrowings |

1,50,000 |

|

|

Net Current Liabilities |

42,95,531 |

|

|

Total Liabilities (B) |

|

64,45,531 |

As you can see, the total assets and total liabilities match indicating the values are accurate. If there is a difference, you need to identify the errors and fix them. Read Errors in Trial Balance and Procedure to Locate Errors to know more about errors that may affect the trial balance

How business management software can help?

With the automation of transactions posting and report generation in business management software, the balance sheet reconciliation task looks redundant. Using the information of transactions that have been entered, the business management software automatically posts the values into relevant reports and ensures that the values you see in financial reports are always accurate.

With TallyPrime, the powerful business management software, you just need to record day-to-day entries and all the reports including the balance sheet are auto-generated. You also get the comfort of a wide variety of reports with numerous views, giving you powerful insights to run your business better.

Try TallyPrime and get amazed with a wide variety of business reports for confident decisions.