- What is accounting information system (AIS)?

- Benefits of accounting information system

- What are the functions of AIS?

- Types of accounting information system

- How is an accounting information system (AIS) used?

What is accounting information system (AIS)?

When it comes to running a business, what is the first thing that pops in your head? The finances, right? For any business, irrespective of its size, to run smoothly, it requires optimum cash flow and proper flow of reports and information across channels. A systematic process of collecting, storing, and processing financial and accounting data is used by internal users to report information to investors, creditors, and tax authorities. This process is called an accounting information system aka AIS. This system disseminates the company-related information to respective stakeholders, which is extremely crucial for faster decision making.

It is considered as one of the key responsibilities of an accountant, to work in-depth with AIS, ensuring perfect accuracy in a company's financial transactions and record-keeping. This information should also be readily available and accessible to users who need to refer them as and when required.

Benefits of accounting information system

Since an accounting information system provides a seamless flow of crucial and relevant data across the organization, it has several benefits that help a business manage its operations even better. Let us take a look at these benefits:

Better interdepartmental communication

A solid AIS paves way for the proper flow of information across various departments within the organisation. Let’s say the sales department has just uploaded the sales budget. This information is vital for the inventory department for better inventory planning and stock management. Now once the inventory is purchased based on the sales department’s inputs and analysis, this information is shared with the accounts payable department whenever a new inventory is purchased for an invoice to be raised. In a nutshell, an AIS ensures complete visibility of the company’s transactions within various functions for better business planning and forecasting.

Data access controls

An AIS will allow users to define various security configurations based on the requirements. It is obvious that not all departments need information about everything that is going on in the organisation, right? Well, that’s what AIS does. It ensures that only the relevant information is disseminated to a specific user by providing controlled data access. With various levels of security authorisations requiring approvals to access information, and AIS limits the information based on the permissions given by the main authority.

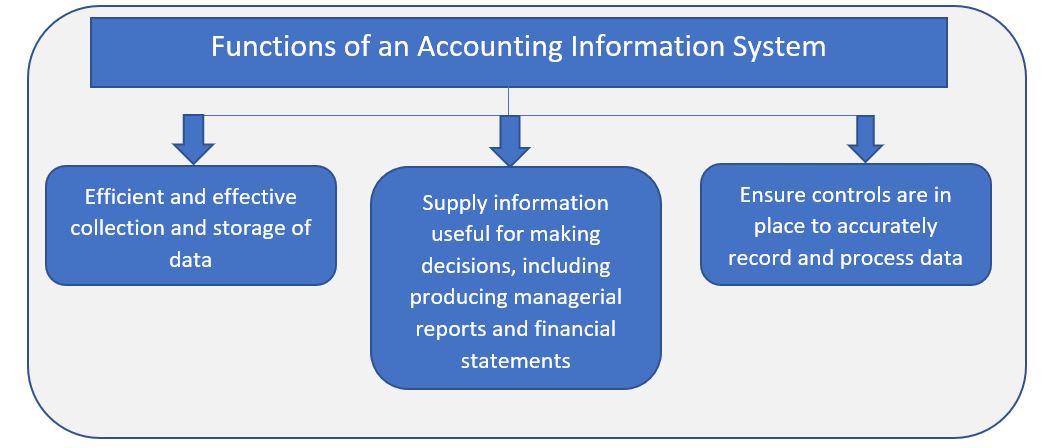

What are the functions of AIS?

An accounting information system helps the different departments within a company work together. Here are three basic functions of AIS:

Types of accounting information system:

An accounting information system comes in three types – Manual, Legacy and Modern/Integrated systems.

- Manual systems are primarily used by smaller organisations where the entire system is manual, with no technological integration. Because of the business size, the AIS need not be too complex, and all records can be maintained manually. However, a manual system would require, source documents, general ledger, general journal, and special journals or subsidiary journals for more accurate bookkeeping

- Legacy systems have been prevalent before the advent of high-end technology. While it does have some benefits of knowing the historical data of your firm and the ease of use, but it definitely lacks the flexibility and reliability that modern technology can offer

- Modern/Integrated systems are windows-based technologies that are considered to be much more user-friendly than legacy accounting systems. They generally cost less than legacy systems, can be quickly implemented, and have fewer bugs.

How is an accounting information system (AIS) used?

An Accounting Information System is a broad structure of an organisation that deals in collecting, storing and processing financial and accounting data that are used by decision makers. It forms a centralised system where the financial information is stored by authorised personnel, and this information is then disseminated to various stakeholders in the organisation. Important data like revenue, purchases, employee, customer, tax, etc are stored in AIS.

An accounting information system has a database structure to store information. This database structure is typically programmed with a query language that allows for table and data manipulation. Since AIS has numerous fields that require necessary inputs (whether new or old), it is crucial that the security is extremely strong to prevent any malicious virus attacks.

An accounting software such as TallyPrime allows you to handle multiple verticals of a business. Apart from just storing the data, it gives you the freedom to generate the most crucial financial reports, manage inventory, be tax compliant, seamlessly.

Read more about accounting:

Accounting Software, POS Software, Business Management Software for Start-ups, How To Choose Best Account Management Software For SMEs, Why Small Business Needs an Accounting Software, Effective Ways of Using a Payroll System Software, How Can Accounting System Analysis Assist in Business Growth, Best Practices to Evaluate, Purchase & Implement Business Accounting Software, How Accounting Software Can Save Small Business