- What is outsourced bookkeeping?

- What tasks can an outsourced bookkeeping service handle?

- How does outsourced bookkeeping work?

- Costs of outsourcing your bookkeeping

- Should you outsource bookkeeping?

What is outsourced bookkeeping?

Outsourced bookkeeping is hiring an outsourced bookkeeper to perform all the bookkeeping tasks for your business. You can simply hire an outsourced bookkeeper and have them work with the software you work with or completely outsource the task which is they use their software and all you have to do is pay for the service. Outsourced bookkeeping takes the stress out of managing a bookkeeper in-house and it saves money on investing in a software solution for performing bookkeeping and accounting tasks. Outsourced bookkeeping has gained traction in the past few years as many businesses wish to focus on other aspects of their business rather than worry about bookkeeping.

What tasks can an outsourced bookkeeping service handle?

Outsourced bookkeeping services can range from performing simple tasks to complicated ones such as generating financial statements and reports. Many firms still use bookkeeping and accounting synonymously which is why it is best to look into the services that an outsourced company offers rather than assuming them. When you feel like you are interested in an outsourced firm offering these services, ask them exactly which tasks the bookkeeper will be performing. Going by the standard definition of what a bookkeeper does, the following are some of the services that are handled by an outsourced bookkeeping service.

Integrate financial data

An outsourced bookkeeper is responsible for integrating your financial data with the software if you are choosing the software package along with an expert bookkeeper. That is, he will import all the financial information so that he can work on it on your behalf. He can get this information from invoices, credit card statements, bank statements, and so on. In certain cases, the process of importing is automatic as the accounts are connected to the software that the bookkeeper works on. If you are solely choosing an outsourced bookkeeper, then the bookkeeper will get used to the software that you use so that he can continue working on that platform and help ensure the accuracy of your transactions.

| Analysing Business Reports Just Got Easier with TallyPrime | How Does Accounting Information Help in Decision Making? The Employer’s Guide |

Reconciliation

An outsourced bookkeeping service often includes bank reconciliation. This process involves reconciling your business bookkeeping records with those on the bank statement or your business bank account. Bank reconciliation is crucial for every business because it protects you from fraud, lets you balance your records, makes it easy during audits, and spots discrepancies. Bookkeeping services will only perform bank reconciliation in the case that you use an accrual method of accounting. This is the case because it ensures that the bank transactions that you recorded in your books were actually performed at a later date.

Tracking

The outsourced bookkeeping service also ensures tracking is performed. This means tracking bills that have been generated and need to be accounted for. Did you pay your supplier at the time you promised you would? Did your customer make the payment by their credit card on the stipulated date after receiving the service? As a business, you must ensure everything you owe others is paid for on time and that you are also paid for your goods and services on time. An outsourced bookkeeper can ensure that your accounts receivable and accounts payable are managed so there are no leftover payments.

Ensuring accuracy of data

A bookkeeper’s main job is to ensure all the transactions have been entered accurately. An outsourced bookkeeper is also given the responsibility of that task as he ensures there are no errors. If he does find any errors, then he reports the same to you as soon as he finds one. He also ensures your books are always up-to-date so that if you need to pull out any data, you can do so with confidence without having to worry about accurate data. The bookkeeper does this on a regular basis to ensure every transaction that has been recorded is precise.

Generating financial reports on a schedule

The outsourced bookkeeping service will ensure you receive all the financial reports of your business on time. For example, the bookkeeper will send you statements such as the statement of cash flows, profit and loss statement, and balance sheet as these are the three main reports required to understand your business position thoroughly. The statement of cash flows shows you actual cash and your liquidity. The profit and loss statement shows how profitable your business is and how much you are making over a period of time. The balance sheet shows you the financial position as it throws light on the assets, liabilities, and equity.

Enabling you to understand your financial standing

If you are a small business or a startup then you are probably not sure what all the various reports mean. The outsourced bookkeeper will explain what each report means so you can then base your business decisions upon that. The bookkeeper will go into detail so that you can understand your business’s current position and whether you need to change some things to ensure it does better than it is doing right now. The outsourcing service will also provide support so that you can ask them in case of any confusion.

How does outsourced bookkeeping work?

The steps involved in an Outsourced bookkeeping service will vary depending on what the requirements of your business are. Moreover, the entire process will vary depending on the type of service you choose. For example, if you hire a professional bookkeeper then the process of bookkeeping will be different than if you chose a hybrid option which is a popular choice of many businesses. Here is an example of the process that occurs when you choose an outsourced bookkeeper.

Step 1: Understanding your existing systems

The first step the bookkeeper will do is to understand what you are already working with. That is, he takes time to understand the software and tools that you currently use for recording and storing your financial transactions. He will then go to setting up integrations so that he can continue working on the systems that you use and handle all the bookkeeping tasks on your behalf.

Step 2: Recording and reconciliation process

In the next step of the process, the bookkeeper will take charge and start to work with the software they connected with in the first step. He will record your financial transactions and then categorize them in an organized fashion. He will then also perform a reconciliation process to ensure it all balances and there are zero discrepancies.

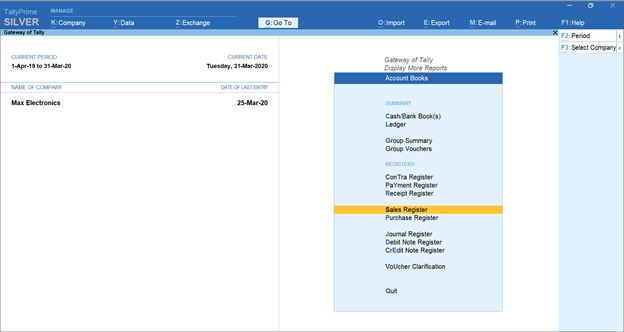

Accounting Reports and Registers in TallyPrime

Step 3: Updates and financial statements

The bookkeeper will keep you updated by sending you financial statements as often as you would like. For instance, he can send financial statements to you every month so you know where your business stands compared to where it should be. The bookkeeper will ensure the accuracy of the transactions and therefore the important financial statements as well.

If you have any questions or doubts regarding bookkeeping, then the bookkeeper is available to you. This helps you work alongside the bookkeeper so you, your team, and the bookkeeper are on the same page.

Costs of outsourcing your bookkeeping

The cost of outsourced bookkeeping can vary depending on various factors and so it is difficult to give an exact estimation. According to experts, the cost of outsourcing bookkeeping generally starts at $500 and can go as high as $2,500 per month which means anywhere from $6,000 to $30,000 per year for a business. But the cost depends on whether you also want a software package along with a bookkeeper or if you want to hire a bookkeeper only. If you want to receive financial reports on a regular basis, then the cost of outsourced bookkeeping can be higher compared to if you need it at only certain times.

The type of accounting you use can also dictate the bookkeeping charges such as whether you use the accrual-basis or cash-basis bookkeeping. The volume of transactions also varies by business and these directly affect the price of the bookkeeping service. If you want an experienced bookkeeper then the price will be higher. You can expect a steeper price if you want the support too. If you are a large corporation and your business has a complex model, then the charges will probably be much higher than those of a small business. If you need features such as inventory management and other accounting tasks to be done by the bookkeeper then extra charges will be levied.

Should you outsource bookkeeping?

Outsourcing bookkeeping is generally the path chosen by those businesses which either don’t want to invest in a bookkeeper, software, or both. Being on top of your bookkeeping is essential even if you are a startup because they aid in making some crucial business decisions. However, the hassle can be too much to handle which is when you might be tempted to try outsourced bookkeeping. Outsourced bookkeeping is better left as a last resort when you have tried the other methods like using an accounting software or hiring an in-house bookkeeper. While outsourced bookkeeping can be great, it does carry a risk because your transactions are being handled and managed by someone else.

What if there is a bookkeeping software solution that is so simple that you can learn it from scratch? TallyPrime is a business management software that can take care of all the accounting needs of your business. It is easy to use, simple to set up, and grows with your business ensuring accuracy all the way. It automates many important processes such as reconciliation, generates more than 400 reports, and gives you more control of your accounting. TallyPrime makes managing a business easy and helps you in other tasks such as managing inventory, credit management, creating invoices, and so on. TallyPrime is the one-stop solution for accounting and bookkeeping.

Read more:

Explore More Products