TRN (Tax Registration Number) is the identification number given to every person registered under UAE VAT. It is mandatory that only persons having a valid TRN should charge VAT on supplies. In such a scenario, it is helpful for registered businesses to ensure that they receive supplies from a registered person, so that they can recover the input tax on the supply fearlessly. For unregistered persons and consumers also, it is essential to ensure that only a genuine registered person charges VAT on supplies to them. To assist this, the FTA has given the provision to verify whether the TRN mentioned on an invoice or quoted by a supplier is valid. Any person can use this tool to ensure that the TRN quoted by their supplier is genuine.

Steps to check whether a TRN is valid

- Visit the FTA Portal.

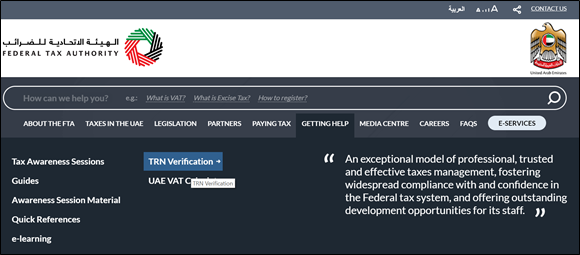

- Click 'Getting help'. Select TRN Verification from the options available

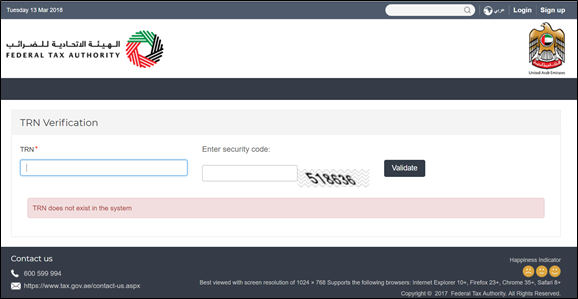

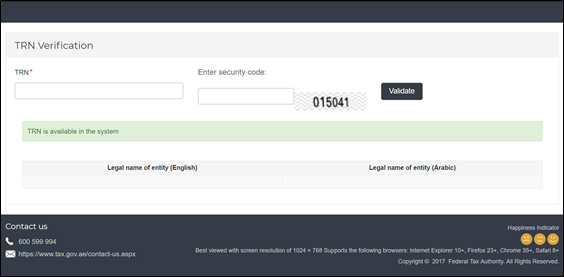

- Enter the TRN you want to check. Enter the security code displayed on the page.

- If the TRN is not valid, you will get the message shown below:

- If the TRN is valid, you will get the message shown below, with the legal name of the entity in English as well as Arabic:

Hence, this tool can be used by all persons in UAE to ensure that they pay VAT only to persons registered under VAT. Previously, only registered users on the FTA website were able to use this tool. However, the FTA has enhanced this tool recently, to ensure that even persons not registered on the FTA website can use this tool to easily verify a TRN.

Read more about VAT Registration

VAT Registration in UAE, How to Apply for VAT Registration in UAE, Online Amendment or Change in Registration Details in UAE VAT, Tax Registration Number (TRN), VAT Registration Deadlines in UAE, Who Should Register under VAT, How to de-register or amend a Tax Group under VAT in UAE, How to de-register under VAT in UAE, How to Register as a Tax Agent under UAE VAT, How to register as Tax Agency

UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Payment

VAT Payment in UAE, How to Make VAT Payment using GIBAN, How to make VAT Payment to FTA in UAE, VAT Payment on Import of Goods in UAE, VAT Payment through e-guarantee in UAE, VAT payment on commercial property in FTA Portal, VAT payment on import in FTA portal