- Introduction

- What is a Tax Agency?

- What are the conditions for registering as a Tax Agency?

- What is the process for applying for registration as a tax agency?

Introduction

In our article 'Tax Agent under UAE VAT', we have learnt about tax agents. Tax agents are qualified and licensed persons who assist taxable persons in their compliance activities under VAT. Tax agents are registered with the FTA and taxable persons can appoint them to assist in fulfilling their tax obligations.

A tax agency is a firm of tax agents who register as an organisation to assist taxpayers in their compliance activities. A tax agency will consist of multiple tax agents. Note that all such tax agent firms have to register as tax agency with the FTA in order to be licensed to assist taxpayers in compliance. This is in addition to the individual tax agent license that the members of the firm may hold. In order to register as tax agency, the firm should have at least 1 tax agent linked to it.

Let us understand how to register as a tax agency under UAE VAT.

What is a Tax Agency?

A tax agency is a legal entity which is licensed to operate as a tax agency and has taken a tax agency registration with the FTA.

What are the conditions for registering as a Tax Agency?

The conditions to be fulfilled for tax agency registration are:

- Hold a business or trade license that allows the applicant to operate as a tax agency (usually issued by the Department of Economic Development), and

- Have professional indemnity insurance in respect of the tax agency business

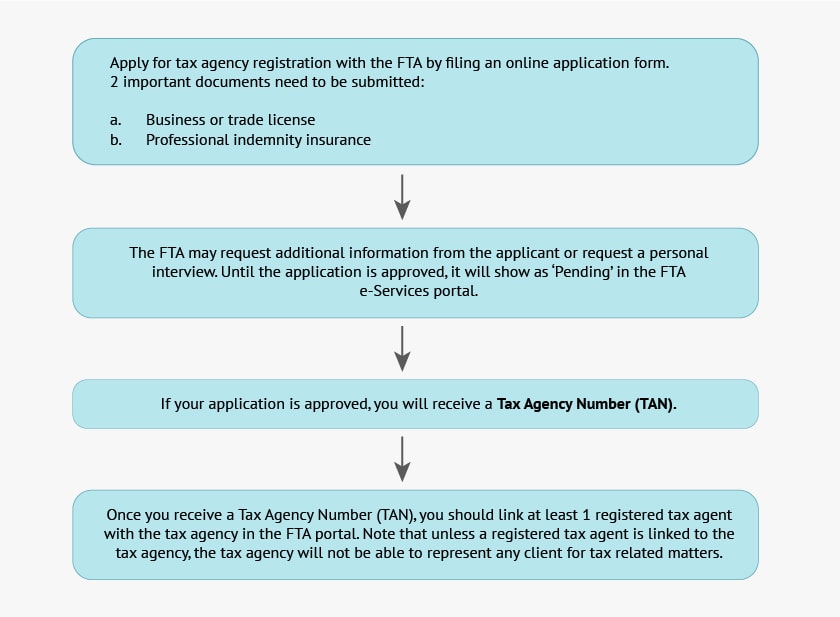

What is the process for applying for registration as a tax agency?

Hence, every firm of tax agents should register as a tax agency with the FTA in order to be able to assist taxable persons in compliance activities under VAT. A unique identification number (TAN) will be granted to every registered tax agency under VAT. This guide on how to become a tax agency in UAE will be useful to such persons.