The Federal Tax Authority’s (FTA) requirements for accrediting the tax accounting software truly reflects the commitment of the Authority to simplify the taxpayer's life in adhering to the VAT compliance. This also emphasises the importance of usage of accounting software in the journey of achieving 100 % compliance for businesses.

The prime objective which FTA wants to drive through the Tax accounting software requirements is that the automation of all tax-based responsibilities of a taxpayer such as keeping track of records, payments, file VAT returns, generating FAF (Audit File) etc.

In this article, we will discuss the key benefits of using FTA accredited software for businesses. Before we put down the list of benefits, let us understand the key functionalities a tax accounting software must have.

Key Functionalities of Tax Accounting Software

Among the various requirements, the three key functionalities that must be included in the accounting software is that the system should have the ability to automatically generate

- FTA Audit File (FAF)

- VAT return file

- VAT compliant tax invoices and credit/debit notes

To know more on tax accounting software requirements, please read 'FTA’s Tax Accounting Software Requirements'

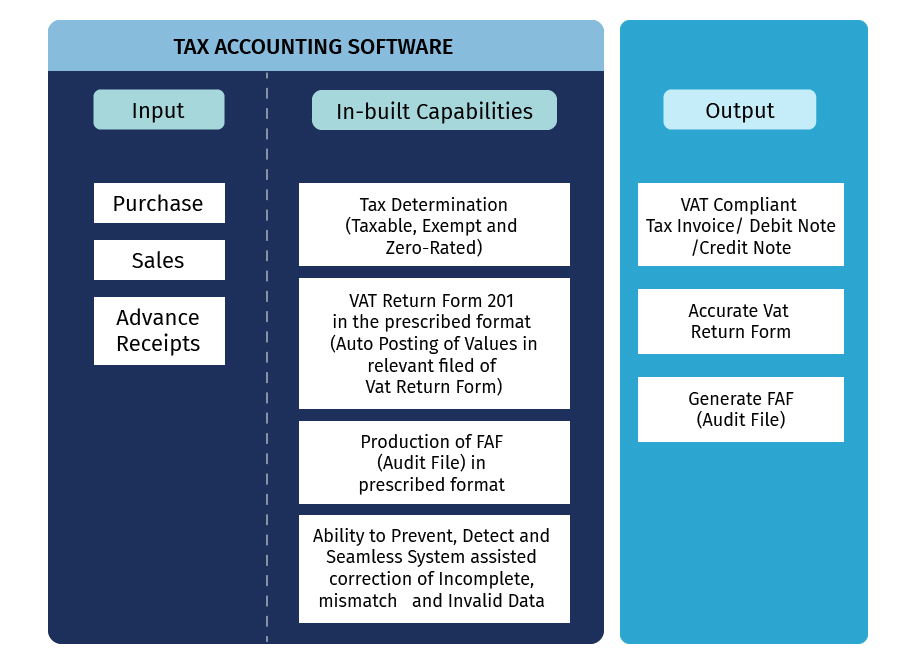

In the context of FTA, tax accounting software is one, which has, inbuilt capabilities to produce tax reporting from the accounting records. Let us understand this with pictorial graphics.

From the above illustration, it is clear that accounting software should produce the tax reporting from the accounting records i.e. the details of purchase and sales should automatically be reported into relevant VAT reports such as VAT return form and audit file. This will be possible only when the tax accounting software has the inbuilt capabilities to:

- Understand the VAT requirements, both at the transaction level and reporting level

- Determine the tax applicability at transactions level, based on the input available in the master (Ledgers, Stock Items etc.)

- Verify the tax calculation based on the configuration you had done

- Validate the transaction recorded in line VAT return format and FAF (Audit File) requirements and allows seamless system assisted correction

Benefits of FTA Accredited Tax Accounting Software

Tax accounting software is accredited by FTA after a strict verification of requirements that an accounting software has met. Once the accounting software is accredited by FTA, it is guaranteed to simplify the VAT compliance for businesses. The following are some of the key benefits of FTA Accredited Tax Accounting Software.

- Generating VAT compliant tax invoice, Debit note and Credit note

- Automatic generation of VAT return form (VAT 201) with zero or minimum efforts

- Auto-generation of FAF (Audit File) in the structure prescribed by the FTA with zero-efforts

- With the inbuilt capabilities to prevent, detect and system-assisted correction, you can be rest assured, VAT returns and audit file generated will be complete and error-free.

- On-Time filing of VAT returns since the VAT returns and audit file can be generated effortlessly

- Saves you from paying hefty penalties starting from AED 1000 to AED 50,000 which will be applicable for non-adherence for various compliance requirements

- Maintaining books and all other VAT records for a period of 5 years or 10 years as applicable.

- With the automation of all tax-based responsibilities, it helps in reducing the compliance cost for businesses

- While all the VAT reports are always ready (automated), it creates a platform which makes it easier for you as well as FTA to co-operate in areas such as audits.

- With all these benefits, it gives the business owner’s peace of mind and allows you to invest more time concentrating on your business growth rather than get stuck in the compliance grid.

All this sounds to be too good! Are there any other benefits of Tax Accounting software?

The answer is 'Yes'

A Tax Accounting Software is an integrated software that helps the businesses in managing their business needs such as managing books of accounts, Accounts payable, Accounts receivable, Billing, Financial reporting, Order management, inventory management, etc. and at the same time, helps you to be 100% VAT compliant.

You may be interested to read 'Simplified VAT Compliance with Tally.ERP 9 Release 6.3'

Read more about Federal Tax Authority (FTA)

e-guarantee Cancellation in FTA portal, Steps to Submit e-guarantee in FTA portal, Administrative Penalties under Tax Procedures Law by FTA in UAE, Change in business details to be notified to FTA, FTA Accredited Tax – Accounting Software Requirements

UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT, VAT on Exports & Imports, Import of goods in VAT Return Form 201

VAT Invoice

VAT Invoice in UAE, Simplified Tax Invoice under VAT in UAE, What Consumers Must Check in a Tax Invoice in UAE, Checklist for a Tax Invoice under VAT in UAE, Date of Supply, Value of Supply and Invoice for Deemed Supply in VAT, How to issue a Tax Invoice to unregistered customers, How to issue Tax Invoice to registered customers, Tax Invoice under VAT in UAE